by Chris Black

What everybody will be watching for this week is of course what the Fed will deliver at Wednesday’s FOMC.

Recent talk of a “skip” has gotten the market hopeful that the Fed believes they have hiked too far, too fast and are prepared to cut in November. In reality, this may be a modern iteration of “Fed Speak (https://www.investopedia.com/terms/f/fed-speak.asp),” and integral to equity disinflation (jargon for lower stock prices).

The Fed is coming around to the fact that inflation is more persistent than expected (https://t.me/marketfeed/410753).

Part of their inflation fight, of course, includes financial asset wealth — a large portion of which is held in equities.

Recall that part of the reason stocks have yet to aggressively sell off is because the market has been conservatively bearish all year.

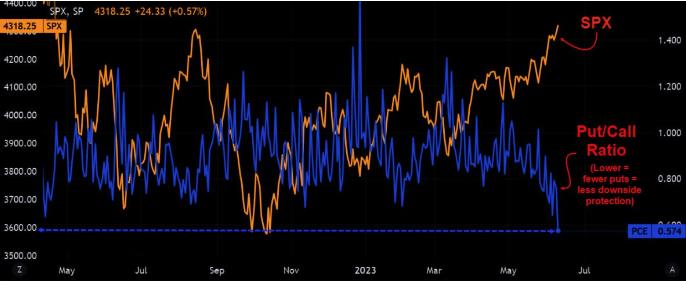

With this bearish outlook, traders buy downside hedges, often in the form of put options (“puts”), as protection against selloffs.

The market can’t move much lower if the short trade is crowded.

Traders need to be trapped in the wrong direction to propel a market.

But since “skip June FOMC” hit Wall Street’s consciousness, the time & real value of said protective hedges has eroded and the sentiment has flipped, leading stocks to rally across the board.

Similar to the dynamics at play when in Feb we suggested that put option values would erode if Powell failed to walk-back his dovish press conference days before, leading to a short squeeze in the dealer community.

To recap: A quick collapse in the value of puts leads to their rapid liquidation, in turn forcing the dealer community to cover their delta hedges (they remain position-neutral (http://tradewithmarketmoves.com/delta-neutral-option-strategy) selling puts by also shorting the underlying to a specific extent (https://seekingalpha.com/article/4468397-gamma-options#gamma-hedging)) and aggressively bid up markets in a short squeeze.

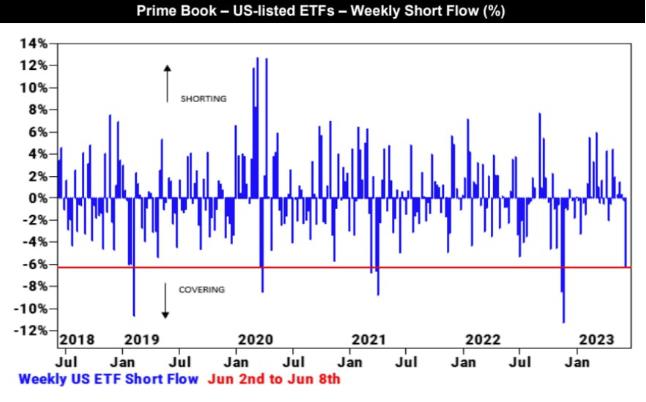

Goldman’s weekly Prime report (pic related) shows that this is exactly what’s happening.

Also, the skip idea is completely unfounded: May job openings (https://t.me/marketfeed/412428) suggest the real economy is strong enough to sustain another 25bp hike, and the May PCE (https://t.me/marketfeed/411103) (which ticked higher) tells that inflation is hot enough to justify it.

The PCE (put-to-call ratio in equities) is at its lowest since April 2022, as downside protection erodes away and sentiment reverses. More evidence that the downside risk is greater as the crowd becomes more bullish. In April 2022, when the PCE ratio was last where it is today, the market sold off 20% over the following 40 trading days.

Goldman’s Mike Nocerino notes (https://t.me/DTpapers/83) “the crowd has managed buying puts at local market lows and puking (selling) puts at local market highs. Is this time different, or…”

In any case, be it hike or skip, the pain trade on Wednesday is clearly to the downside.

There’s no steam left to this rally.

A hike would be punishing, however, and would aggressively achieve some much-needed asset disinflation.

Maybe that’s the Fed’s goal.

With QT (–$100bln/month) and the TGA refill (–$1.2trn) expected to drain up to a combined $1.5trn (https://t.me/DTpapers/80) in liquidity over the summer, they must be aware of what they’re doing.

It would allow them to disinflate in detail, so to speak.