via Mike Shedlock:

Fed Chair Jerome Powell says the “Federal Reserve is not and will not be a ‘climate policymaker.’” Actions prove otherwise.

The Fed’s New Climate-Change Mandate

Please consider the Fed’s New Climate-Change Mandate

The Federal Reserve, Federal Deposit Insurance Corp., and Comptroller of the Currency on Tuesday published guidance directing banks on how to manage putative climate risks. The agencies say they aren’t dictating how banks lend to accelerate the shift to a lower-carbon economy. But reading between the lines, that’s exactly what they’re doing.

The guidance says banks must manage their balance sheets for physical risks from climate change, such as flooding or drought, as well as the “stresses to institutions or sectors arising from the shifts in policy, consumer and business sentiment, or technologies associated with the changes that would be part of a transition to a lower carbon economy.”

In other words, banks will need to consider their lending priorities with the climate lobby’s preferred policies and predictions in mind, whether or not those predictions are likely to happen. That would mean reducing exposure to fossil fuels because President Biden has set a goal of eliminating carbon emissions from the power grid by 2035 and achieving a “net-zero” economy by 2050.

The guidance also says management should set “lending limits related to material climate-related financial risks” and consider “the evolving legal and regulatory landscape.”

Fed Chair Jerome Powell, who voted for the guidance, in a statement said “it is not the Fed’s role to tell banks which businesses they can and cannot lend to, and this guidance is not intended to do so,” adding the “Federal Reserve is not and will not be a ‘climate policymaker.’”

An Official Denial

“Never believe anything until it’s officially denied,” is a phrase of uncertain origin but most often attributed to Otto Von Bismarck.

Joint Proclamation

The Fed says it will not be a climate policymaker but that is exactly what the Fed, FDIC, and the Comptroller of the Currency (US Treasury Department) are doing with their Joint Proclamation.

Summary: The OCC, Board, and FDIC (together, the agencies) are jointly issuing principles that provide a high-level framework for the safe and sound management of exposures to climate related financial risks (principles). Although all financial institutions, regardless of size, may have material exposures to climate-related financial risks, these principles are intended for the largest financial institutions, those with over $100 billion in total consolidated assets. The principles are intended to support efforts by large financial institutions to focus on key aspects of climate-related financial risk management.

Click on the above link for the 23-page document.

Beyond Absurd

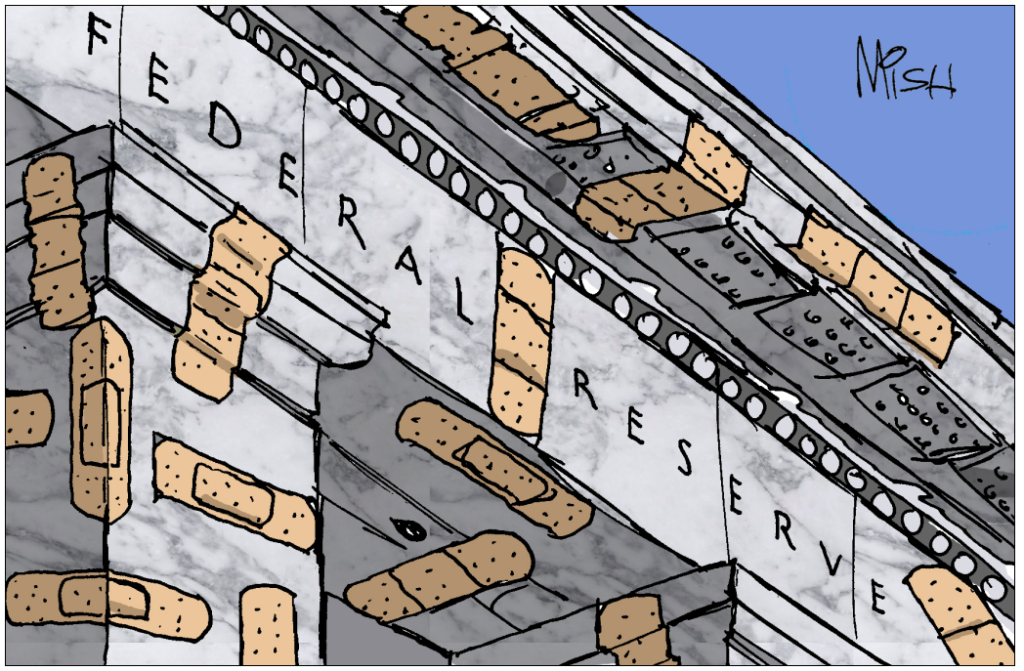

The Fed blew three consecutive economic bubbles, was clueless about the inflationary impacts of QE and fiscal stimulus, was asleep at the wheel when Silicon Valley Bank blew up, has never spotted a recession in advance, but wants banks to plan for climate change risk that could be decades away if ever.

Hello Jerome Powell, your pathetic official denial is fully transparent. This is stupid, and you know it.

Powell Discusses What the Fed Could Have Done to Prevent Inflation Rise

On October 20, I commented Powell Discusses What the Fed Could Have Done to Prevent Inflation Rise

Powell Clips

- No precision in understanding monetary policy lags.

- Markets have been front running Fed policy changes.

- Household savings are higher, spending has been higher.

- We should be seeing effects of monetary policy arriving

- Fed has slowed on rates to give policy time to work.

- There is a lot of uncertainty on lags

- It is very hard to know how economy can grow with higher rates

- By any reckoning, neutral rates ebbed over recent decades, unsure where it is now

- Models useful but have to look at what the economy is telling us

- With hindsight possible Fed could have done less during pandemic

- Bond yield rise doesn’t seem to be about expectations of Fed doing more on rates

- Is unclear if bond yield rise will be persistent, markets are volatile.

- We will let market yield rise play out, Fed will watch it.

Powell says the Fed “could have” done something when it’s damn clear the Fed has no idea what it’s doing at all.

How the Fed Destroyed the Housing Market

Also see How the Fed Destroyed the Housing Market and Created Inflation in Pictures

The longer the Fed holds rates high, the longer the housing transaction crash lasts. But cutting rates will further expand the housing bubble, asset bubbles in general. And bubbles are destabilizing.

This is the Fed’s tightrope dilemma, of its own making, foolishly hoping to make up for lack of enough inflation, calculated by not factoring in home prices or asset bubbles.

Does the Fed ever get anything right?

On top of it all, the Fed effectively has just undertaken climate change as an unofficial mandate.

What a hoot.