The great Will Rogers once said he never met a man he didn’t like. US President Joe Biden and Democrats have never met a spending opportunity they didn’t like (except for US border security, of course).

Under “Deficit Joe” Biden, Federal budget deficits have soared! And deficits are projected to grow!

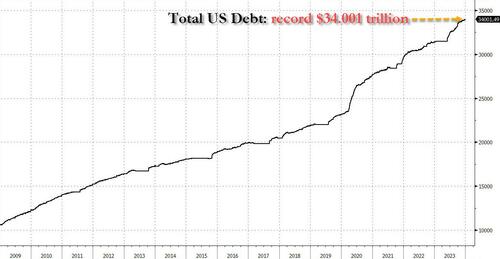

Over the past year, we have been closely watching the staggering acceleration in the growth of both US debt (the chart below which is just one month old is already woefully outdated, as total US debt just hit $34.191 trillion on the first day of February)…

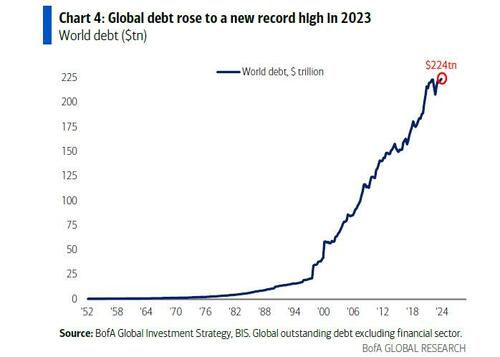

… and global debt.

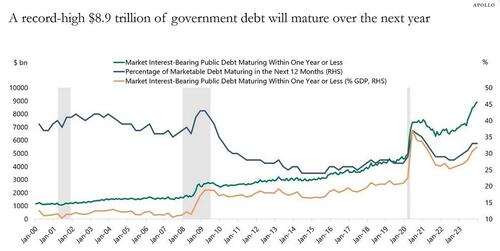

The problem, as Apollo’s gloomy chief strategist Torsten Slok points out, is that this feverish pace will only accelerate further, as a record $8.9 trillion of government debt will mature over the next year.

Meanwhile, the government budget deficit in 2024 will be $1.4 trillion according to the CBO (realistically expect this number to hit $2.0 trillion), and the Fed has been running down its balance sheet by $60 billion per month.

The bottom line is that someone will need to buy more than $10 trillion in US government bonds in 2024. That is more than one-third of US government debt outstanding. And more than one-third of US GDP.

This may be a particular challenge when the biggest holders of US Treasuries, namely foreigners, continue to shrink their share.

More fundamentally, Slok muses, “interest rate-sensitive balance sheets such as households, pension, and insurance have been the biggest buyers of Treasuries in 2023, and the question is whether they will continue to buy once the Fed starts cutting rates.”

(Spoiler alert: no… but that’s what QE is for, and sooner or later, it’s coming back).

Apollo’s latest updated outlook on Treasury demand is below (pdf link).

And don’t forget about $212.5 TRILLION in unfunded liabilities (Social Security, Medicare, etc).