via brownstone.org:

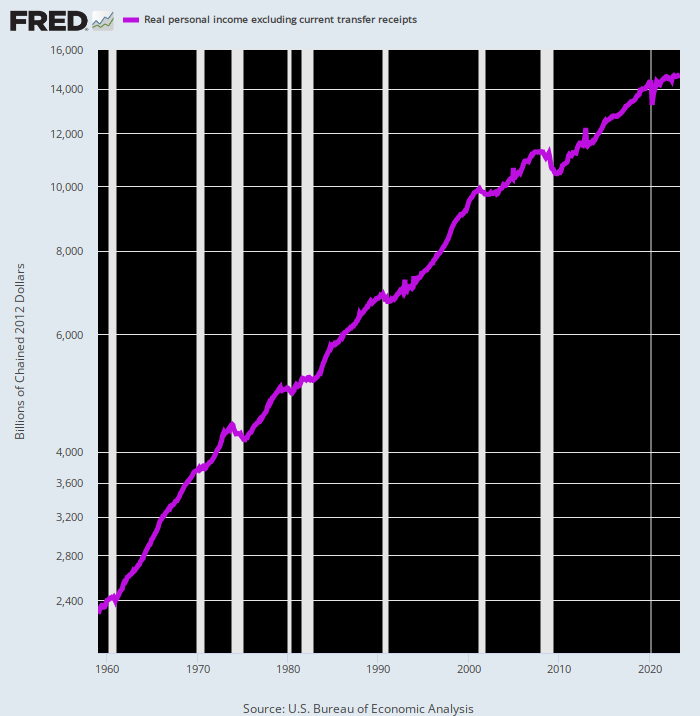

Here is a large caliber smoking gun. The BEA series for real personal income less transfer payments is a pretty serviceable proxy for private market output before the impact of Washington stimmies and distortions caused by transfer payments and government borrowing. After all, earned income – wages, salaries, bonuses, profits, interest and dividends – is the payment to factors of production for output and therefore its reciprocal.

The long-term trend is slouching definitively southward. Since the pre-lockdown peak in February 2020, in fact, the growth rate has slowed to just 17 percent 0f its pre-2000 average.

Per Annum Growth of Real Personal Income Less Transfer Payments:

- Feb. 1960 to Feb 2000: +3.62 percent;

- Feb. 2000 to Feb. 2020: +2.08 percent;

- Feb. 2020 to May 2023: +0.61 percent.

It doesn’t take a lot of cogitation to explain this dismal trend. The US economy is freighted down with debt and it is also short of labor, riddled with non-productive speculation and financial engineering and starved for productive investment. Taken together, those malign forces were more than enough to slow the underlying growth of the US economy to a crawl.

To be sure, the government reports slightly higher real GDP growth than the tepid 0.61 percent figure displayed above. During the equivalent 3.25 year period between Q4 2019 and Q1 2023, in fact, the per annum growth of real GDP posted at 1.61 percent. That’s still nothing to write home about, but it is considerably better than the pittance of gain private producers have produced and earned since the pre-Covid peak.

The difference, of course, is owing to the wonders of GDP accounting. That is, huge transfer payments from producers to non-producers and massive Federal spending and borrowing and its monetization at the Fed’s printing presses do give rise to additional GDP in an accounting sense and for the time being.

Alas, heavily taxing producers today and threatening even more future taxation to service the ballooning public debt isn’t a source of sustainable growth. It simply steals economic resources from the future.

…

54 views