via Mike Shedlock:

Health insurers dramatically mark up prices of generics and pharmacies are in on the scheme.

Generic Drugs Should Be Cheap But Sometimes They Aren’t

The Wall Street Journal reports Generic Drugs Should Be Cheap, but Insurers Are Charging Thousands of Dollars for Them

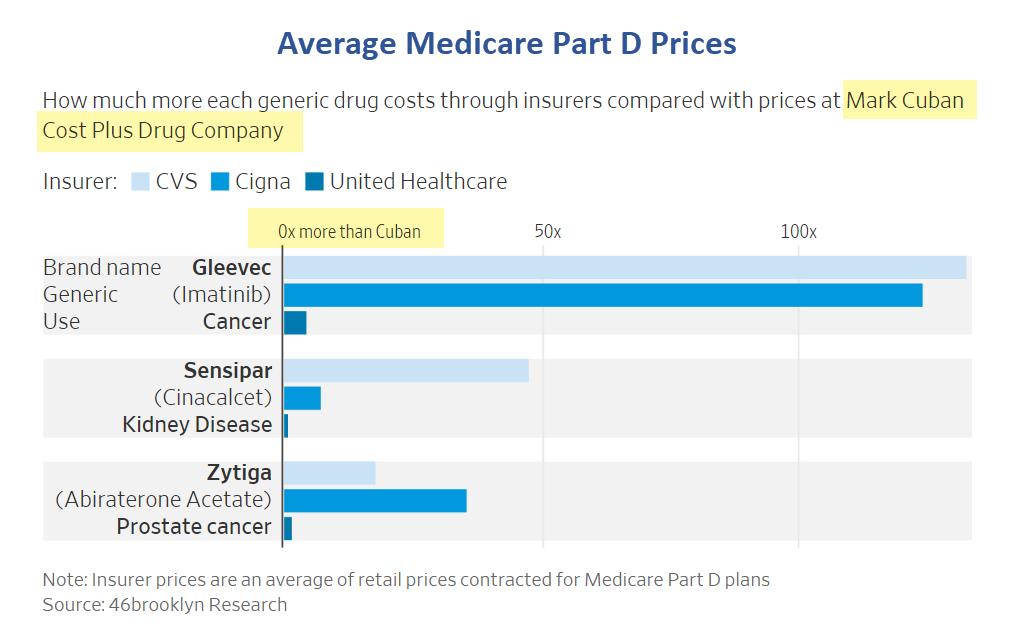

The cancer drug Gleevec went generic in 2016 and can be bought today for as little as $55 a month. But many patients’ insurance plans are paying more than 100 times that.

CVS Health and Cigna can charge $6,600 a month or more for Gleevec prescriptions, a Wall Street Journal analysis of pricing data found. They are able to do that because they set the prices with pharmacies, which they sometimes own.

Across a selection of these so-called specialty generic drugs, Cigna and CVS’s prices were at least 24 times higher on average than roughly what the medicines’ manufacturers charge, the Journal found.

The prices at UnitedHealth Group, which also owns a large health insurer, were 3.5 times as much, according to the analysis of data compiled by 46brooklyn Research, a nonprofit drug-pricing analytics group.

Price Gap

- Cigna’s prices were 27.4 times higher than Cuban’s on average for 19 generic drugs.

- CVS’s prices were 24.2 times higher on average for 17 generic drugs.

- UnitedHealth’s prices were 3.5 times higher than Cuban’s on average for 19 generic drugs.

- Cigna can charge roughly $6,610 a month for Gleevec, the Journal’s analysis found. CVS Health can charge more than $7,000 a month. United Health can charge $218.

- A prescription for generic Tecfidera, a multiple-sclerosis therapy, costs $54 a month through the Cuban pharmacy, compared with nearly $1,215 through UnitedHealth. (Cigna and CVS didn’t submit prices for the drug to Medicare.)

- A monthly prescription for prostate-cancer drug Zytiga costs about $118 on Cuban’s website, compared with $4,195 through Cigna, $2,056 through CVS and $205 through UnitedHealth.

Kudos to Mark Cuban for Increasing Competition

On August 22, I wrote Kudos to Mark Cuban for Lower Priced Drugs and Increasing Health Care Competition

Big Win For Consumers

Fortune called it a big win for Cuban. I suggest it’s a big win for everyone.

It also strikes at the heart of precisely what is wrong with Medicare for all and single payer setups. When government picks up the entire tab, there is no incentive for consumers to shop around for better deals.

Those without health care coverage and those on high deductible plans are the biggest winners.

Just a Start

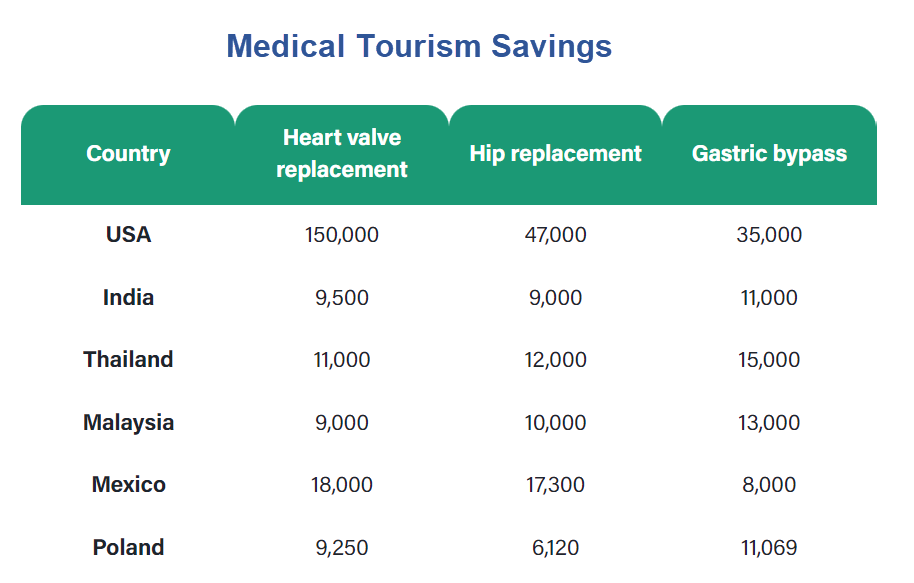

We need to go far beyond drug pricing into health care services.

Each year, millions of US residents travel to another country for medical care because of cost. The practice is called medical tourism.

Congress Investigates How Pharma Middlemen Affect Drug Prices

The WSJ reports Congress Investigates How Pharma Middlemen Affect Drug Prices

House Republicans have launched an investigation into the companies that manage drug benefits, dialing up the scrutiny of the middlemen who play an important role in how much medicines cost.

The House Oversight and Accountability Committee said Wednesday that it has sent letters to CVS Health Corp.’s CVS Caremark, Cigna Group’s Express Scripts and UnitedHealth Group Inc.’s OptumRx—the largest pharmacy-benefit managers—seeking documents about the drug-price rebates they negotiate and fees they charge.

The committee also said it has sent requests to the Centers for Medicare and Medicaid Services and other federal agencies asking for their contracts with the PBMs.

Medicare for All Isn’t the Answer

Hello Bernie Sanders, socialists, and progressives, Medicare for all is not the answer.

Medicare, Medicaid, and Obamcare have fostered a system of collusion, graft and outright fraud.

Companies that are allegedly independent collude with each other to charge the most that they can. Everyone suffers but the companies in on the fraud.

No Skin in the Game

Customers who have already reached their max out of pocket deductibles have no skin in the game. And that’s a huge problem.

According to Medicare.Gov “No Medicare drug plan may have a deductible more than $505 in 2023. Some Medicare drug plans don’t have a deductible. In some plans that do have a deductible, drugs on some tiers are covered before the deductible.”

Once deductibles are reached, sometimes in one month, consumers have no incentive to shop around.

Other customers, unaware of cost differentials, fill prescriptions on the basis of convenience, that being the nearest pharmacy.

In my recent experience, a doctor warned me not to go to CVS or Walgreens but rather Costco to get a prescription filled. Not many doctors do that. The worst doctors are in bed with pharmacies or insurers to not use generics. Some receive illegal kickbacks and/or a steady flow of customers for their efforts.

As long as we are going to have Medicare, and no politician will ever get rid of it, It would behoove Medicare and insurers to require the cheapest cost alternative on all drugs. That would force competition and eliminate fraudulent collusion.

US consumers are subsidizing the rest of the world. I would put an end to that by allowing drug imports.

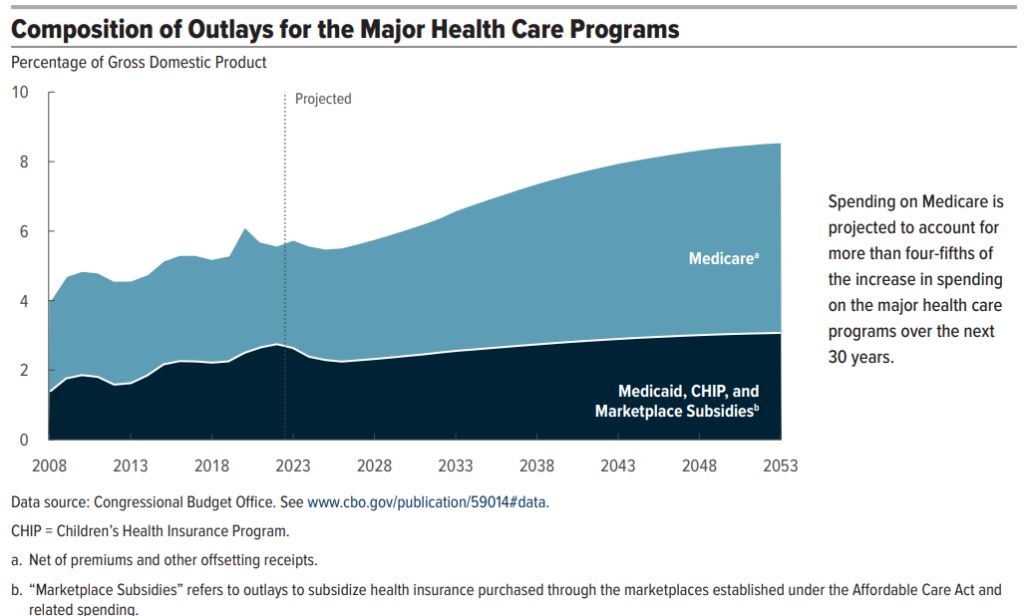

Composition of Outlays for Major Health Care

The nonpartisan Congressional Budget Office says “Spending on Medicare is projected to account for more than four-fifths of the increase in spending on the major health care programs over the next 30 years.”

What are we going to do about that?

The Right to Die

It’s an uncomfortable topic, where demagoguery about “death squads” abounds, but we need to have a talk about the right to die and how much money we spend prolonging a terminal patient’s life, in massive pain, for a few weeks or months.

I have made my wishes known. I do not want to be kept alive by heroic means if the quality of my life is expected to be grim. That’s a personal decision.

At the national level we must face this very uncomfortable question: Should we spend hundreds of thousands of dollars keeping someone alive whose life expectancy is 3 months? 6 months? a year?

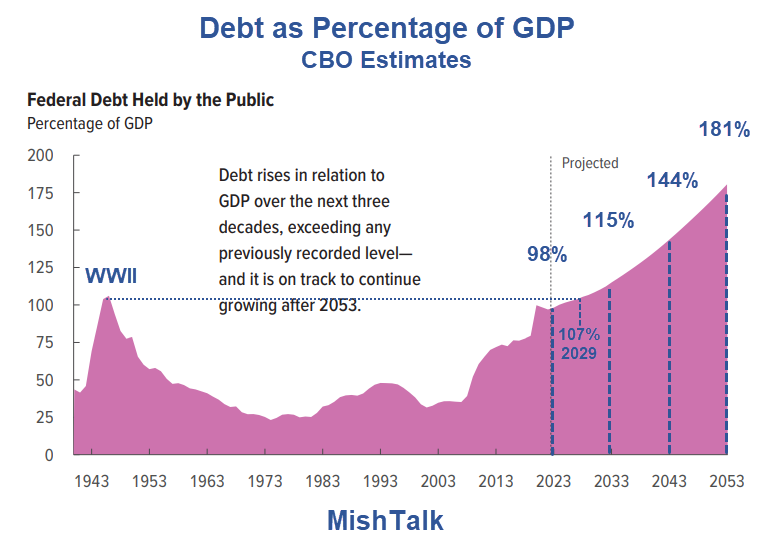

A review of US demographics, debt, and deficits puts a spotlight on those questions.

Debt to GDP Alarm Bells Ring, Neither Party Will Solve This

The CBO projects net interest will rise from 10 percent to 23 percent of total outlays.

Major Health Care programs, of which Medicare will comprise about 80 percent, will increase from 27 percent to 38 percent.

The total of Major Health Care and Interest is 23 percent + (38 percent * .77) = 52 percent.

Social Security is another 28 percent * .77 = 22 percent.

That makes the total of Major Health Care + Interest + Social Security 74 percent of total outlays, leaving 26 percent for everything else. Good luck with that.

For discussion, please see Debt to GDP Alarm Bells Ring, Neither Party Will Solve This

The solution to this mess is not politicians and certainly not Medicare for all.

Free market competition coupled with meaningful “skin in the game” individual actions is the only hope.