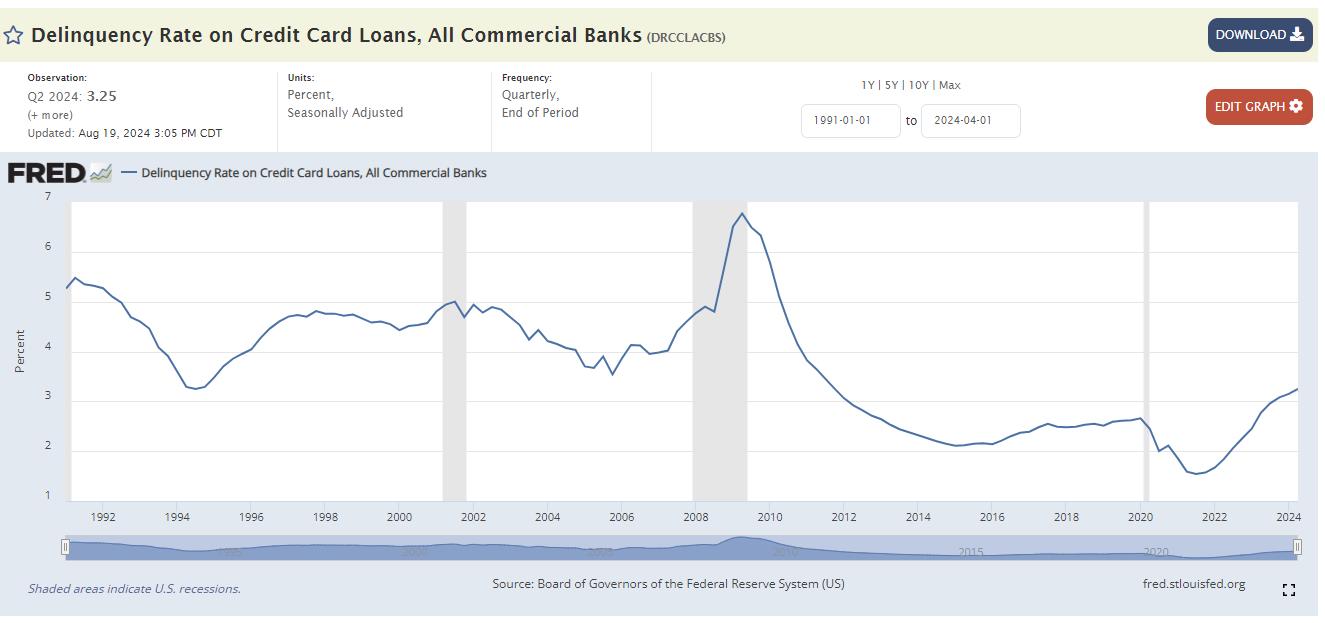

The American debt crisis is spiraling out of control, hitting the nation’s poorest communities with devastating force. The percentage of people with credit card delinquencies has surged over the past eight to eleven quarters, but nowhere is this increase more stark than in the most economically vulnerable ZIP codes. In these struggling areas, delinquency rates have jumped from 11% in Q2 2021 to a staggering 17.4% in Q1 2024—a shocking 58% rise. These numbers aren’t just statistics; they’re the harsh reality of everyday Americans teetering on the brink of financial ruin.

But the pain isn’t confined to the poorest ZIP codes. The Federal Reserve’s Eighth District and the nation as a whole are also hovering near historical peaks in delinquency rates, signaling that this crisis is spreading like wildfire. Even the wealthiest ZIP codes aren’t immune. Although they started from a lower base, the percentage of credit card debt in delinquency has climbed alarmingly. In the richest 10% of ZIP codes, delinquency rates have surged from 4.8% in Q2 2022 to 7.4% in Q1 2024, a 54% increase.

This rising tide of debt delinquency is not just a crisis for the individuals drowning in bills they can’t pay; it’s a ticking time bomb for lenders and the broader economy. The strain on lenders’ balance sheets is growing with each passing quarter, with the percentage of credit card debt in delinquency rising across all regions examined. As these delinquency rates soar, the financial system is being pushed closer to the edge, raising fears of a broader economic collapse.

This is more than just numbers on a balance sheet—it’s the slow unraveling of the American dream for millions of people. And unless something changes, this wave of delinquency could become a tsunami, crashing through the entire economy and leaving devastation in its wake.

2/ Americans saved around 10% of their income annually from 1940s to 1970s

But today, savings relative to income is contracting

People are now spending more than they earn pic.twitter.com/Kt2Wo4dsg4

— Game of Trades (@GameofTrades_) August 19, 2024

Sources:

https://fred.stlouisfed.org/series/DRCCLACBS

396 views