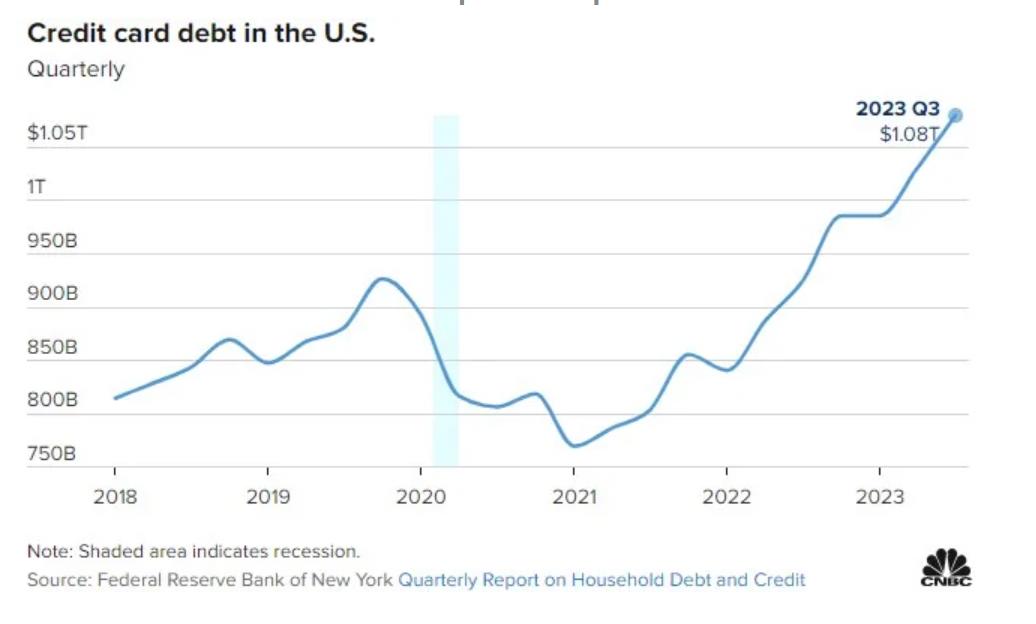

- Collectively, Americans now owe $1.08 trillion on their credit cards, according to a report from the Federal Reserve Bank of New York.

- Steadily, persistently higher prices have caused consumers to spend down their savings and increasingly turn to credit cards to make ends meet.

- At the same time, credit cards are one of the most expensive ways to borrow money.

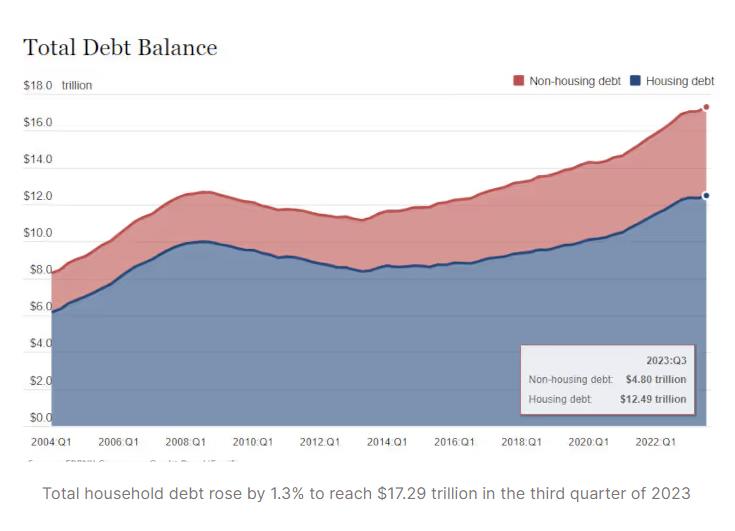

Household Debt and Credit Developments in 2023Q3:

- Aggregate household debt balances increased by $228 billion in the third quarter of 2023, a 1.3% rise from 2023Q2.

- Balances now stand at $17.29 trillion and have increased by $3.1 trillion since the end of 2019, just before the pandemic recession.

Balances:

- Mortgage balances shown on consumer credit reports increased by $126 billion during the third quarter of 2023 and stood at $12.14 trillion at the end of September.

- Balances on home equity lines of credit (HELOC) increased by $9 billion, and now stand at $349 billion in aggregate. Credit card balances, which are now at $1.08 trillion outstanding, increased by $48 billion (4.7%).

- Auto loan balances increased by $13 billion, continuing the upward trajectory that has been in place since 2011, and now stand at $1.6 trillion.

- Other balances, which include retail cards and other consumer loans, were effectively flat, with a $2 billion increase. Student loans balances grew by $30 billion and now stand at $1.6 trillion.

- In total, non-housing balances grew by $93 billion.

"Estimated annualized interest payments on the US government debt pile climbed past $1 trillion at the end of last month…That amount has doubled in the past 19 months, and is equivalent to 15.9% of the entire Federal budget for fiscal year 2022."@Ruth_Liew10 @Bloomberg pic.twitter.com/D6kVtZtVcj

— Daily Chartbook (@dailychartbook) November 8, 2023

h/t TonyLiberty