by TacticalHog

It’s absolutely absurd that the government is even considering this. Too-big-to-fail firms should be subject to stricter regulation, not given a free pass. This just goes to show how corrupt and out of touch our government is.

source is a month old pay-walled bloomberg article

kinda funny in the tab you can see the original article names BlackRock, then the updated article removed them from the title lmaoo

from link:

SEPTEMBER 22, 2023 • SILLA BRUSH, AUSTIN WEINSTEIN, KATANGA JOHNSON

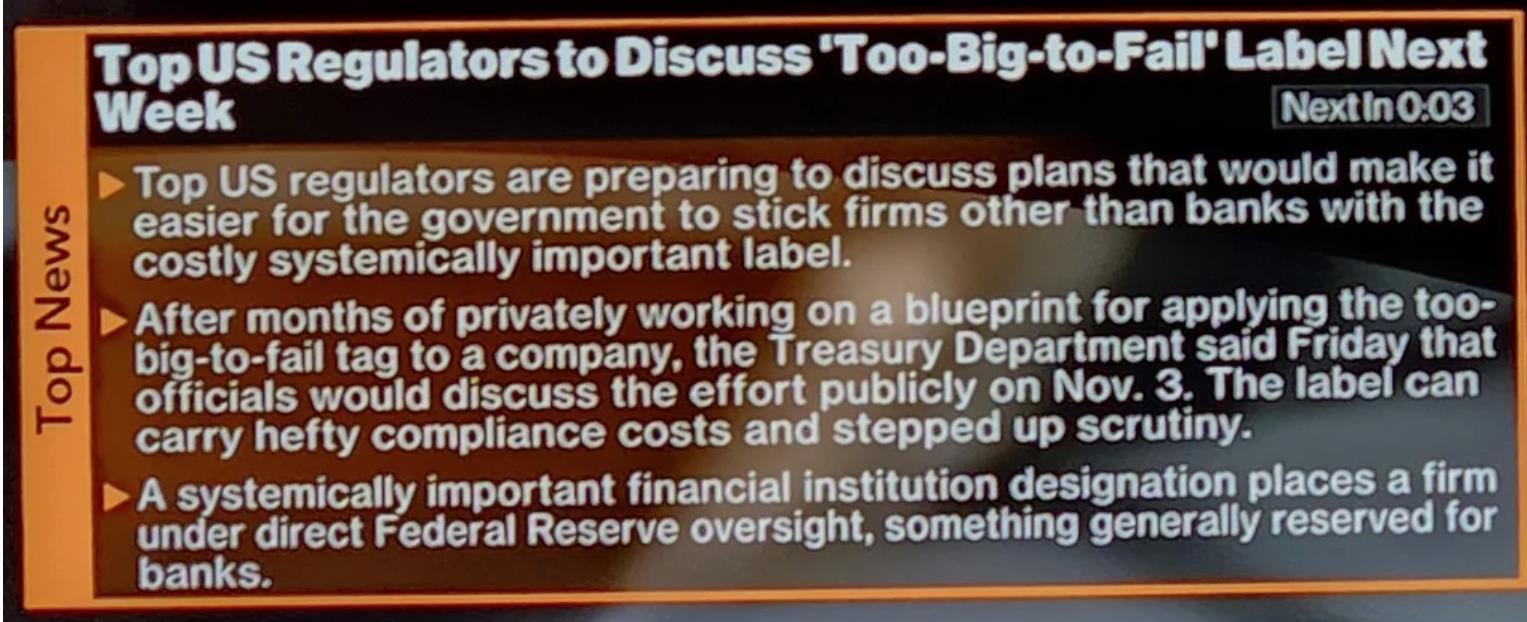

US officials led by Treasury Secretary Janet Yellen are seeking by year’s end to make it easier to stick firms other than banks with the systemically important label, according to people familiar with the matter.

Top American regulators are holding a closed-door meeting Friday to discuss the changes. The prospect of a reduced timeline — and greater discretion to make determinations — means that more companies could eventually wind up with the tag.

Financial titans are preparing for battle. The too-big-to-fail tag spells greater oversight and fresh compliance headaches, and long-simmering concerns about the threat are boiling over in Washington.

Leading trade groups like the Investment Company Institute, the Managed Funds Association and the Mortgage Bankers Association have been urging regulators to tread carefully. BlackRock Inc., Fidelity Investments, Vanguard Group Inc., and other big players in finance have also sent in comment letters, objecting to aspects of a proposal released in April.

The last time the Federal Reserve reduced the money supply like this it caused The Great Depression.

You can decide for yourself if "It's Different This Time" https://t.co/LWLr5J7RJD

— Financelot (@FinanceLancelot) October 29, 2023

When Yellen the Felon starts bloviating about “soft landings,” remember her track record for economic forecasting.

"The U.S. economy seems to be “on a glide path for the proverbial ‘soft landing.’” Janet Yellen January 22, 2007

No, really:https://t.co/Bm0WFK8pg6

— Sven Henrich (@NorthmanTrader) October 27, 2023