via mishtalk:

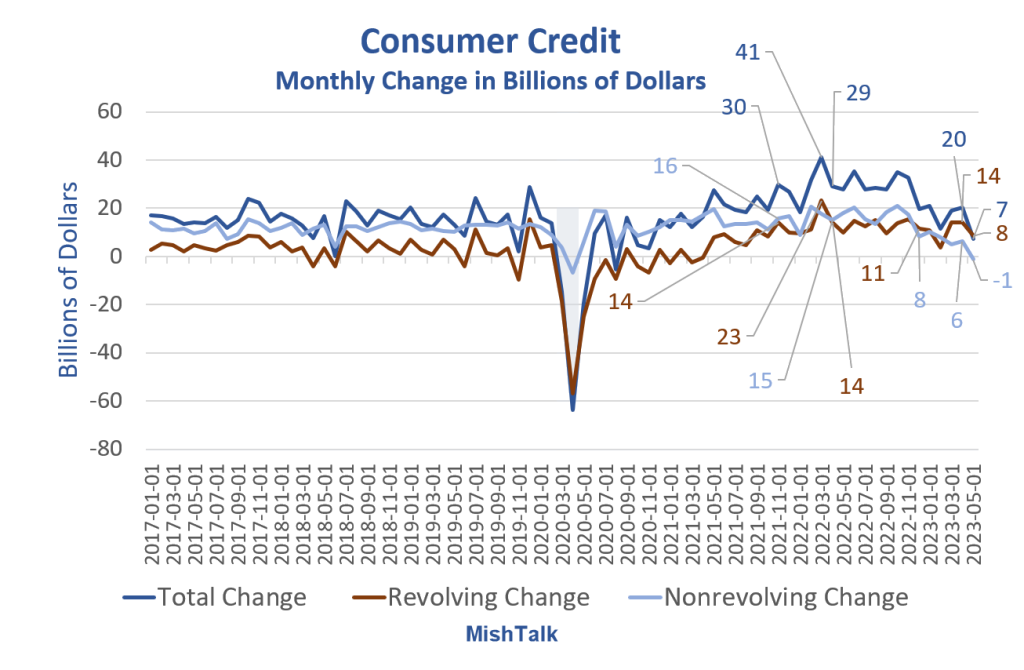

Nonrevolving credit posted its first negative reading since April of 2020. The net change is the lowest since November 2020. The Fed will be pleased with this report.

The Bloomberg Econoday consensus was for credit to rise by $20.0 billion.

Instead, the rise was $7.3 billion. In addition, the Fed revised May credit from $23.0 billion to $20.3 billion.

The consumer is clearly weakening as the lead chart shows.

Consumer Credit in Billions of Dollars

Those are nominal numbers. In nominal terms revolving credit, mainly credit cards, hit a new record high. Inflation adjusted numbers are much weaker.

Revolving Consumer Credit

Revolving consumer credit data from the Fed, Real (inflation adjusted) calculation and chart by Mish.

Resolving Consumer Credit Detail in Billions of Dollars

Adjusted for inflation, revolving credit is still less than the pre-pandemic high.

Real Consumer Credit

Real consumer credit is weakening, especially non-revolving. That reflects a slowdown in autos, housing, and student debt.

Heading Into Earnings Season, Let’s Discuss Actual Corporate Profits

54 views