via Mike Shedlock:

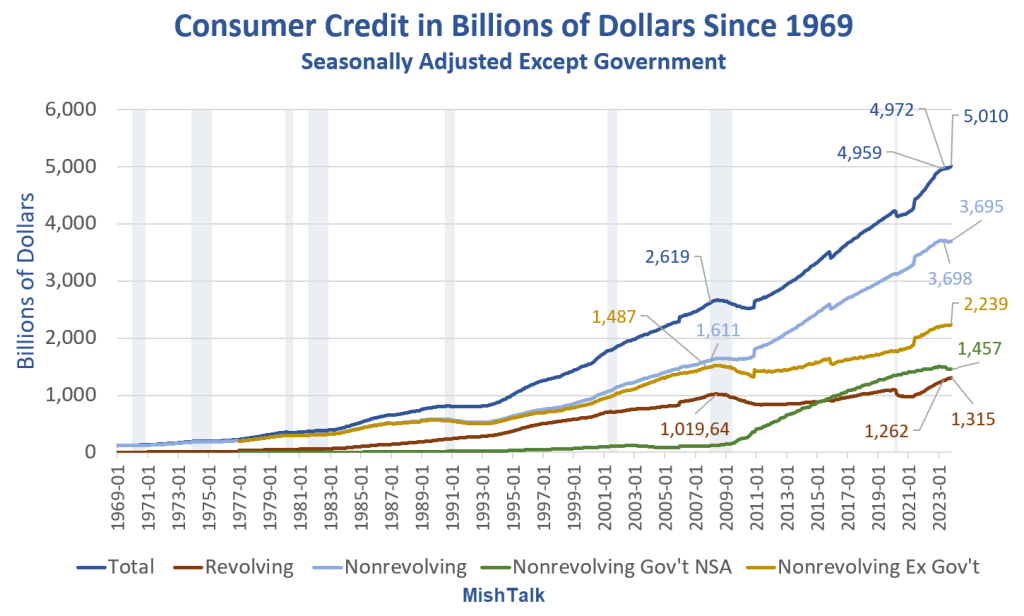

Total consumer credit, revolving credit, and credit card interest rates all hit new record highs in November.

Adjusted for inflation, revolving credit is approaching the record high hit during the Great Recession.

Revolving Consumer Credit in Billions of Dollars Nominal and Real

In real, inflation-adjusted terms revolving credit is approaching the peak hit during the great recession.

Credit Card Rates Record High

Another new all-time high for consumer credit card interest rates pic.twitter.com/BWeavhTbEO

— Liz Ann Sonders (@LizAnnSonders) January 10, 2024

For most of 2000-2020 credit card rates were between 12 percent and 14 percent.

The average rate is now 21.47 percent.

Records Galore

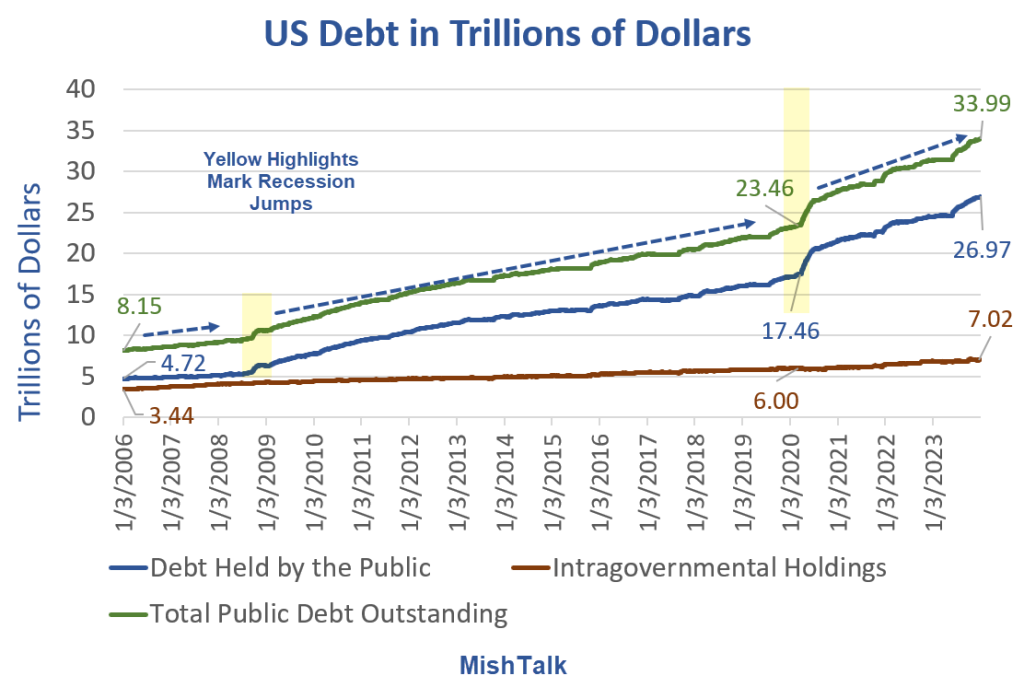

On January 4, I wrote Debt Jumps Past $34 Trillion, $1 Trillion Interest

A bipartisan majority wants more of this and more of that. So that is what you should expect.

The fallback position is not less of anything. Rather, it’s another clean continuing resolution.

Sure enough

Spending Deal Reached, the Republican Freedom Caucus Condemns It

On January 7, I noted Spending Deal Reached, the Republican Freedom Caucus Condemns It

The deal does not address the border at all!

To get any border funding (that Biden will try to find a way to not honor), Republicans will have to further cave in on both Ukraine and Israel.

The total funding will be well in excess of the deal that Kevin McCarthy once had on the table.

Party on dudes.

132 views