Bidenomics is terrible! Just a huge payoff to be big donors (the donor class) for green energy, Big Pharma and Big Defense. Now Biden is considering using ankle monitors to prevent illegal immigrants from leaving Texas and traveling to welfare-friendly blue states like California and New York rather than just enforcing the border. The middle class is truly wasting away with Bidenomics.

Let’s start with crashing mortgage refi demand as consumers load up on credit cards to afford rising prices thanks to Bidenomics.

Then we have consumer credit plunging with massive downward revisions.

The Fed reports dramatically weakening consumer credit with negative revisions too.

Consumer Credit Report Revisions

Revision Key Points

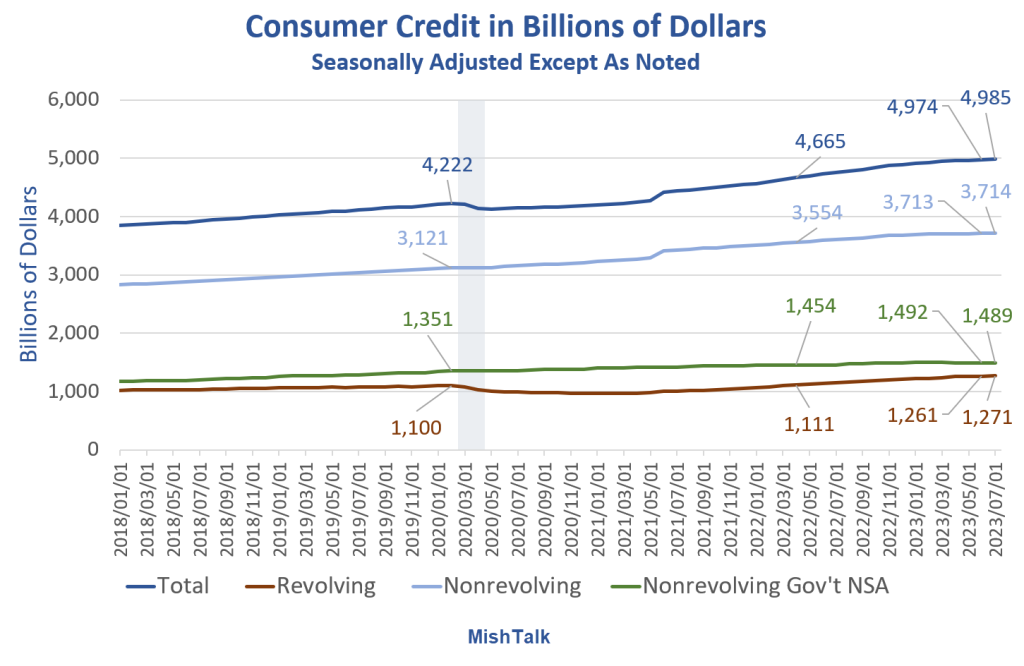

- Most of the revisions are in nonrevolving, but that impacts the totals.

- Nonrevolving credit rose $1 billion in July, from a negative $22 billion adjustment in June. The Fed revised a reported $3.735 trillion down to $3.713 trillion.

- In turn, nonrevolving impacted the totals.

- Total credit rose $11 billion in July, from a negative $23 billion adjustment in June. The Fed revised a reported $4.997 trillion in June down to $4.974 trillion.

Nonrevolving Consumer Credit in Billions of Dollars

Nonrevolving Credit Implications

Assuming the data is accurate (unlikely) or at least the revision direction is accurate (likely), mortgage and existing home sales data is suspect.

Real (inflation adjusted) nonrevolving credit peaked in June of 2021.

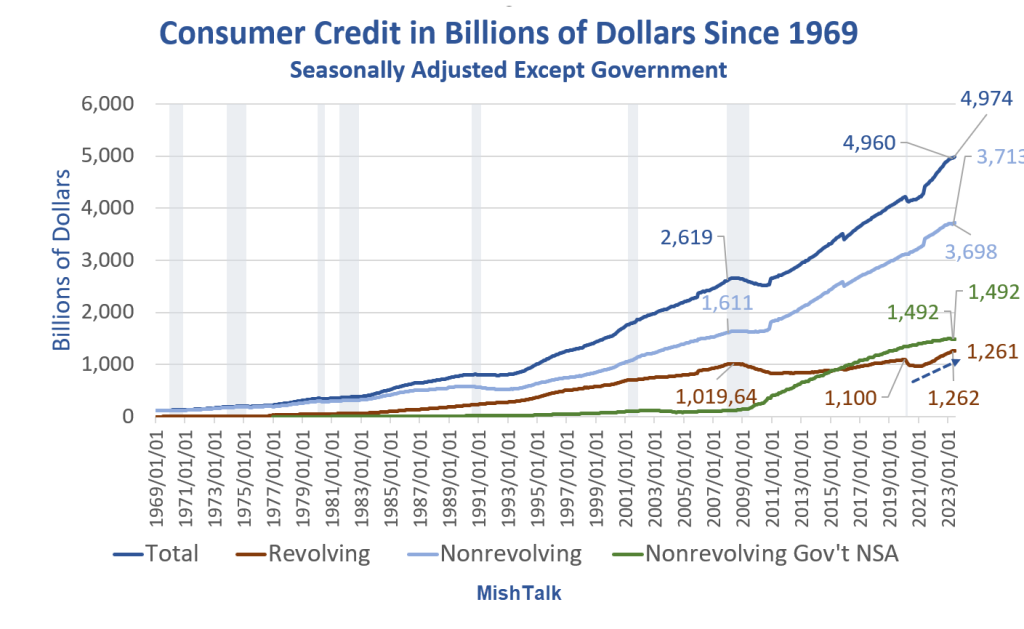

Consumer Credit in Billions of Dollars Since 1969

Consumers have generally done a pretty good job of avoiding credit card debt thanks to three rounds of fiscal stimulus.

However, inflation kicked in and the stimulus money has been spent. The result is the steep rise in credit card debt as noted by the blue arrow. Let’s hone in on that.

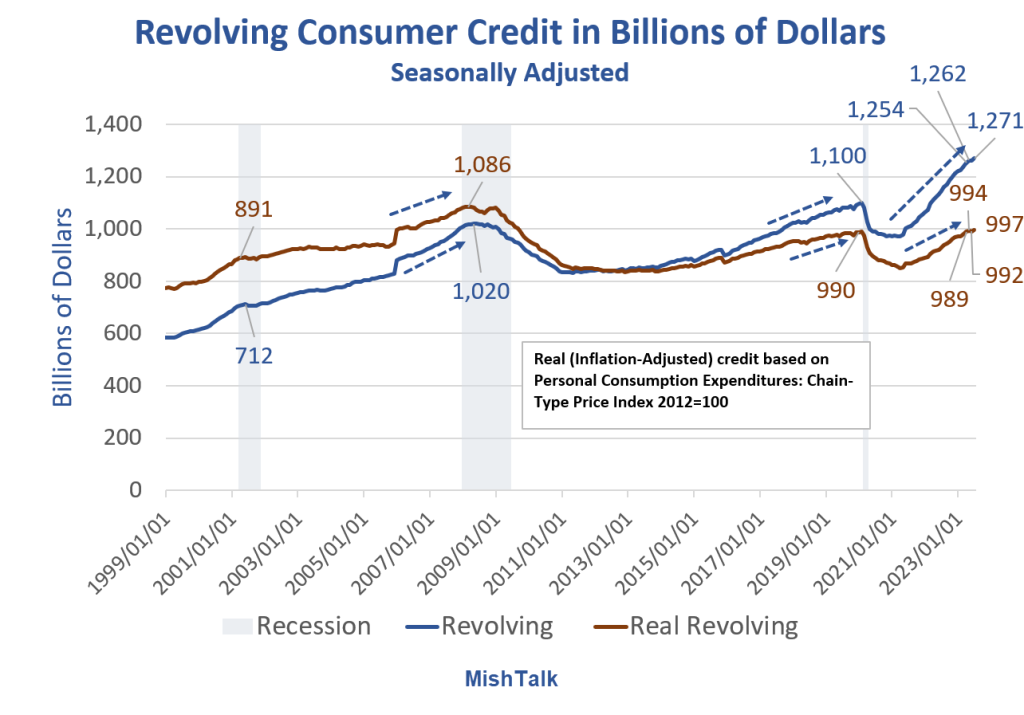

Revolving Consumer Credit in Billions of Dollars

Stunning Steepness in Credit Card Debt Accruals

The speed at which consumers are going into credit card debt is stunning.

It’s hard to maintain lifestyles with rising inflation unless wages keep up.

The BLS and Fed believe the rate of increase in inflation is falling. Assuming the data is correct, consumers are struggling anyway.

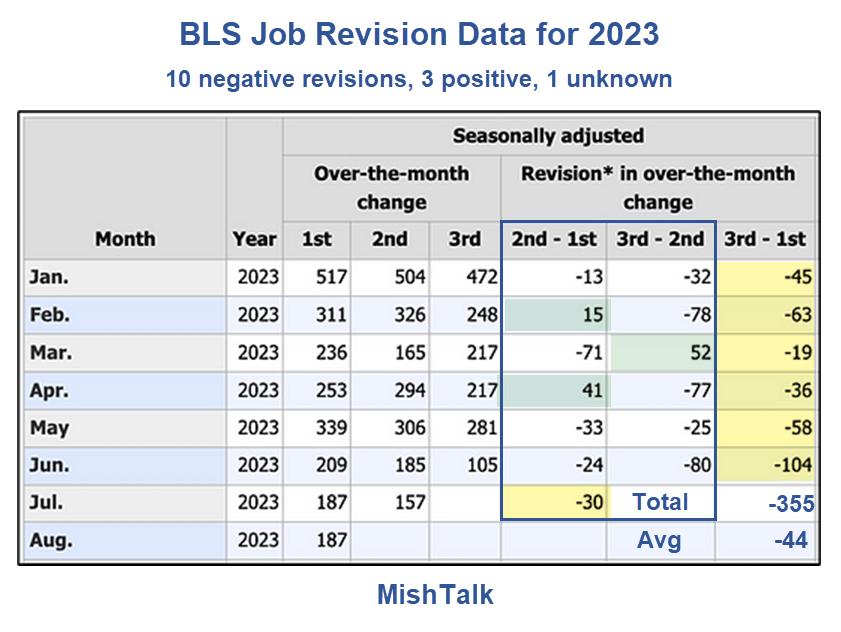

What Happens if Jobs Take a Dive?

That’s actually the wrong question. Job revisions (there’s that word again) have been steeply negative.

Jobs are still positive, assuming (there’s that word again) you believe the numbers and more negative revisions (there’s that word again) are not in the works.

As long as you are making assumptions, if you are rah-rah on the strength of the Biden economy, you may as well assume GDP numbers are correct as well.

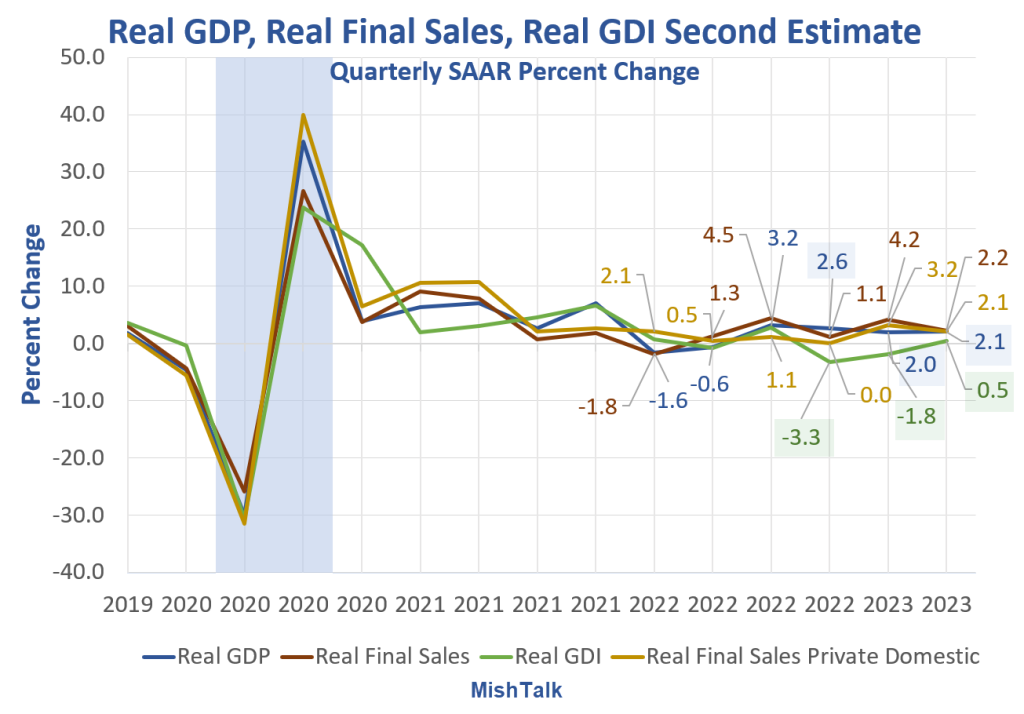

My assumption is GDP is flat out wrong and Gross Domestic Income (GDI) numbers are far more likely to be correct than GDP numbers. GDP and GDI are supposed to be the same but aren’t.

GDP vs GDI

On August 30, I commented Negative Revision to 2nd Quarter GDP, Huge Discrepancy with GDI Continues

If you are a GDP and Jobs believer you likely assume (there’s that word again) GDP is accurate. The last three quarters are +2.6%, 2.0%, and 2.1%.

In contrast, the last three measures of GDI are -3.3%, -1.8%, and +0.5% with the more recent quarter the most likely to be the most revised.

The Fed Is Making Decisions on Poor, Untimely Data, Frequently Revised

I tied many of the ideas in this post together, in far more detail (absent the credit card revisions), in my previous post The Fed Is Making Decisions on Poor, Untimely Data, Frequently Revised

Please give it a look. Meanwhile, damn the revisions, full belief ahead.

All this despite M1 Money exploding.

For those of you in Columbus Ohio, I cannot recommend Fyzical Therapy and Balance Center in Upper Arlington more highly. Ask for Carmen Soranno!