via naturalnews:

For Wolf Richter, publisher of finance and econ site Wolf Street, the long-term treasury market is finally waking up from its delusion that the Fed is going to gradually cool inflation to its target of two percent.

It is also finally admitting it cannot normalize interest rates after having spent 18 months believing in the hype about a Fed pivot and rate cuts to something like zero percent that would be forced on the Fed by a steep recession, with lots of forever-quantitative easing (QE) to follow.

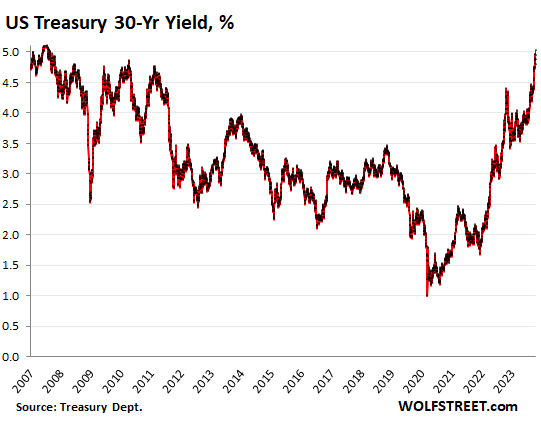

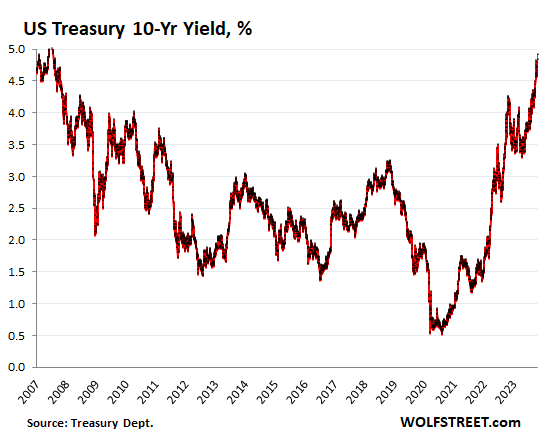

The latest retail report reflected high increases in retail sales that were in good part due to high increases in inflation. Richter called the occurrence a “bond bloodbath.” “Today, it is the 30-year treasury yield that pierced the five percent line. It currently trades at 5.02 percent, the highest since August 2007,” Richter wrote in his October 18 article. “The 10-year yield jumped to 4.92 percent at the moment, the highest since July 2007, edging within easy reach of the magic five percent line.”

These long-term yields above five percent only indicate that a form of normalcy is gradually being forced upon the bond market by the resurgence of inflation, and by the belated realization that this inflation isn’t just going away on its own somehow. “This is a huge regime change after years of the Fed’s QE and interest rate repression, and all prior assumptions are out the window,” he further pointed out.

The Daily Doom‘s David Haggith agreed with Richter’s sentiments and commented: “Delusion ends hard when the denial breaks up, and the Fed’s financial demolition is accomplishing that destruction now. If it doesn’t, inflation will do the job for it.” His forecasts include: as the Fed tightens into a steep recession, the slide into the second plunge since last year’s dip will be steep as it will not likely come until the Fed tightens hard enough and long enough to break the “Everything Bubble” – an expression referring to the correlated impact of monetary easing by the Fed on asset prices in most asset classes, such as equities, housing, bonds, many commodities and even exotic assets such as cryptocurrencies and special purpose acquisition companies (SPACs).

This will send the American economy rapidly into recession in an all-out panic because people who have been investing based on such enormous delusions panic when they finally realize that they’ve run out past the edge of a mighty high cliff, he said, adding that the Big Bond Bubble crash would be inevitable because of the Fed’s quantitative tightening and its raising of interest rates. The government’s massive addiction to endless and enormous deficits, requiring massive new bond issuances, could also contribute to the collapse, he further noted.

“This deficit-spending by the government has to be funded by piling enormous amounts of Treasury securities on the market that need to find buyers. Yield solves all demand problems by rising until demand emerges. And that’s in part what we’re seeing now. All of this is happening as the Fed is unloading its balance sheet at a record pace, having already shed over $1 trillion in securities in a little over a year,” a separate Wolf Street feature indicated.

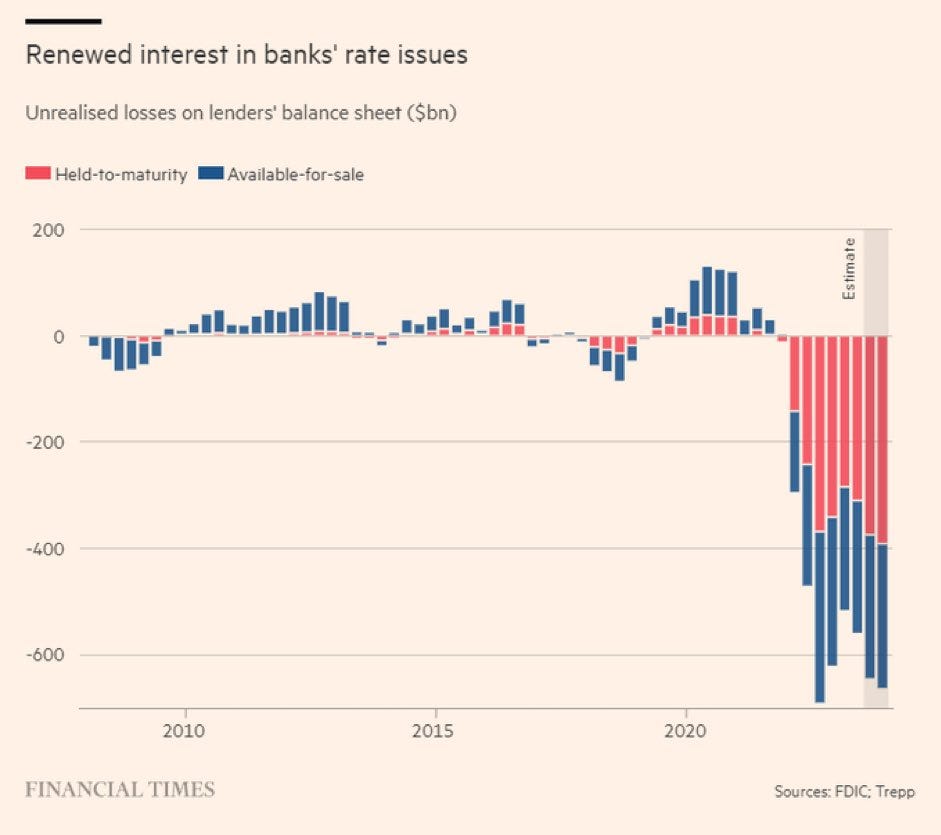

Losses in Treasury bonds far worse than mortgage losses in 2008

Meanwhile, banks are in shambles as losses in Treasury bonds were found to be far worse than mortgage losses in 2008.

According to Haggith, the losses become realized losses if banks actually have to sell the bonds in their reserves to fund any flow out of the bank, as we saw last spring. Now, Wall Street bond investors are reportedly worried about the burgeoning U.S. federal debt because the trend in deficits is a strongly established fact and the Fed faces potential policy pitfalls ahead as it wrestles with how to respond to investor angst about the U.S. government’s humongous $33.5 trillion government debt.

As the Fed considers postponing plans for another interest-rate increase, they might be waiting to see if the bond vigilantes are doing their work for it now and pricing bond yields up, whether the Fed raises rates or not.

“At this point, the Fed will merely be running to catch up to what the free market is already doing just so it can appear to still be in control,” Haggith further predicted. “The Fed cannot help the government finance those massive deficits without spraying new gasoline directly into the inflation inferno it has already fueled, and the government cannot seem to stop itself from runaway spending. Even if it does manage to stop itself, the Fed’s roll-off of more Treasuries that have to be refinanced will continue to worsen the picture for bonds. So, will the rising of inflation, a major fear factor now that it is starting [to be] seen by investors, be back on the move?”

What is unfortunate is that until now, the bond market still foolishly believed the Fed would cave in on the inflation fight and go back to QE and/or it foolishly believed that the Fed’s inflation fight would be easily won. “This week’s economic news shined a bright light on the fact that all of that was fantasy. Realization about the inflation fight that remains is repricing everything,” he said hoping that the realization finally wakes the market fully now. (Related: Alarming study: 60% of Americans are still living paycheck to paycheck amid soaring inflation and rising interest rates.)

Visit DebtCollapse.com to read related news on the collapsing state of the U.S. economy.