by welp007

$C stock dropped 60% just last week, announcing it may fire an additional 24,000 employees. Yet it gives no fux making a $20 million dollar annual installment of its 20-year commitment to the New York Mets Citi Field.

By Pam Martens and Russ Martens: November 7, 2023 ~

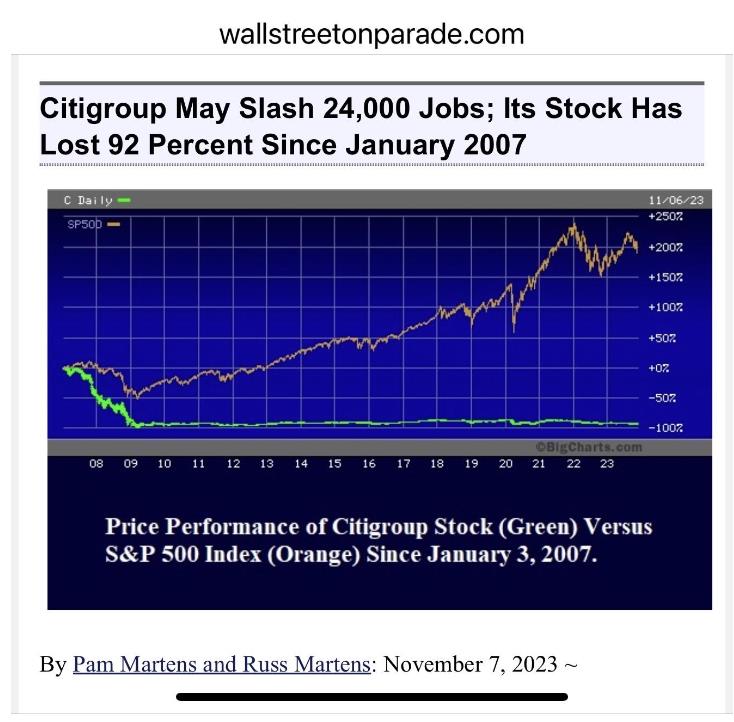

On the first day of trading in January 2007 (the year prior to the Wall Street financial crisis in 2008 that saw century-old iconic financial firms explode one after another), Citigroup closed the trading day at $55.25. Yesterday, Citigroup’s common stock closed at an effective share price of $4.20.

Citigroup did a 1-for-10 reverse stock split on May 9, 2011. That means that investors holding 100 shares of Citigroup back in January 2007 saw their position shrink to 10 shares after May 9, 2011. So yesterday’s closing price of $42.04 for Citigroup is effectively $4.20 for long-term shareholders, adjusting it for the reverse stock split.

To put that in even starker terms, investors who have held onto this dog for almost 17 years have watched 92 percent of its share price vanish.

More dire news on Citigroup came yesterday with a report at CNBC indicating that Citigroup may cut as many as 24,000 employees, or 10 percent of its workforce of 240,000.

To put that in even starker terms, investors who have held onto this dog for almost 17 years have watched 92 percent of its share price vanish.

READ MORE: