Earlier today, Goldman’s head of hedge fund sales Tony Pasquariello observed that “to this point in the sequence, I’d argue the slowdown in China had been a net positive for US equities — with specific regard to the disinflationary impulse and the flow of capital. That said, coming out of a week that featured another disappointing set of data — and another dose of CNH weakness — it now feels like China growth fears can provoke a more global risk-off dynamic.”

Well, if Tony is right, then watch out below, because the bad news out of China has become a firehose that is only getting more powerful with every passing day, especially if one ignores the fake official data and looks at the truth beneath the surface.

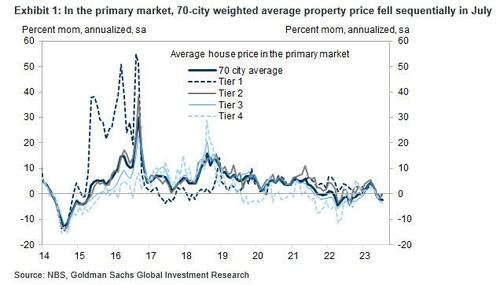

Consider China’s official housing market statistics, which despite falling sequentially for the first time in 2023 in July, have first been remarkably resilient in the face of tepid economic growth and record defaults by developers. New-home prices have slipped just 2.4% from a high in August 2021, government figures show, while those for existing homes have dropped 6%.

Of course, China’s official data is almost as credible as that of the Biden Department of Labor; and indeed, the picture emerging from property agents and private data providers is far more dire.

As Bloomberg notes, these figures show existing-home prices falling at least 15% in prime neighborhoods of major metropolitan areas like Shanghai and Shenzhen, as well as in more than half of China’s tier-2 and tier-3 cities.

-

Existing homes near Alibaba’s headquarters in Hangzhou have dropped about 25% from late 2021 highs, according to local agents.

-

In Lianyang, a downtown area popular with expats and financiers in Shanghai, residential prices have slid 15% to 20% from record highs in mid-2021.

Now, the secretive shadow banking giant has become the latest symbol of financial fragility in an $18 trillion economy where confidence among investors, businesses and consumers is rapidly dwindling.

The privately owned manager of more than 1 trillion yuan ($137 billion) and its trust-company affiliates are under intense scrutiny after halting payments to thousands of customers. Underlining Zhongzhi’s importance, regulators have formed a task force as they seek to prevent contagion. Behind the scenes the firm has hired KPMG to carry out what is likely to be a protracted restructuring process. Potential asset sales threaten to weigh on broader markets.

“The U.S. economy remains strong, while China continues disappointing at the margin and global investors are becoming increasingly concerned,” Claudio Irigoyen, an economist at Bank of America, wrote in a report. This “decoupling” could eventually “contaminate sentiment” enough to precipitate a sharper fall in global markets, he added.

h/t Simian_Stacker