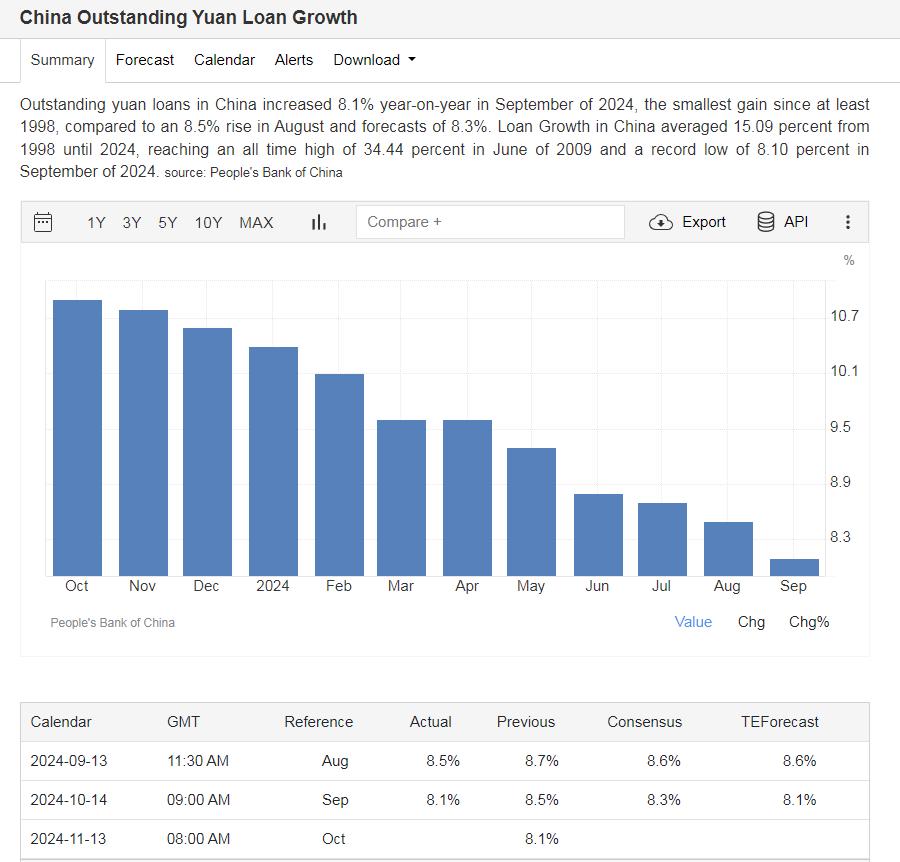

China’s desperation is becoming increasingly blatant, yet some overseas investors still eye the Chinese stock market as a haven for their money. Recent moves by Beijing highlight the growing instability: the government is reportedly planning to tax its ultra-rich citizens overseas—those who have invested in foreign real estate or reaped large profits from overseas investments. This is a desperate measure, signaling an economy struggling to retain wealth within its borders. With China’s credit growth continuing to slow and the government projected to miss its 2024 growth target of 4.8%, one has to wonder: why are investors ignoring these glaring red flags?

The financial strain is mounting, and China’s attempts to curb its economic troubles are unsettling. Reports suggest that Chinese banks are mulling over cutting deposit rates as early as this week—a move designed to encourage consumer spending but one that could further destabilize the banking sector. Even more worrying, the government is considering an $853 billion debt swap to rescue local governments drowning in debt. This reflects a broader issue: zombie companies, kept alive by new debt, can no longer rely on endless credit. As Beijing forbids banks from issuing more loans to these sinking entities, the entire economy teeters on the brink of a credit collapse.

The writing is on the wall. With credit growth drying up, local governments in crisis, and desperate measures targeting the wealthy, China’s economic woes are far from over. The question is: will investors wake up before it’s too late, or will they continue to pour money into a system that seems poised for collapse? The risks are growing by the day, and the time for blind optimism is over. Investors must start acknowledging the cracks in China’s economic facade before they find themselves caught in the fallout.

Sources:

🇨🇳 #China Banks Mull Cutting Deposit Rates as Early as This Week – Bloomberghttps://t.co/Oai359APeJ pic.twitter.com/LLQpf0Rvvy

— Christophe Barraud🛢🐳 (@C_Barraud) October 15, 2024

Chinese #GDP 📉 👀https://t.co/QmKx2eXsQQ

— Invariant Perspective (@InvariantPersp1) October 15, 2024

Chinese Money Supply 📉 ☠️https://t.co/A6U4hM9avR pic.twitter.com/RuZKD9CZQ4

— Invariant Perspective (@InvariantPersp1) October 15, 2024

🇨🇳 #China Weighs $853 Billion Debt Swap to Rescue Local Governments – Bloomberghttps://t.co/2T19AH6QgD pic.twitter.com/nFHVaFLP6e

— Christophe Barraud🛢🐳 (@C_Barraud) October 15, 2024

https://tradingeconomics.com/china/loan-growth

https://uk.finance.yahoo.com/news/china-weighs-853-billion-debt-065814659.html