by waitingonawait

Friend thinks this will be a nuke to the economy.

HONG KONG, Oct 9 (Reuters) – China’s Country Garden (2007.HK) may announce a restructuring plan for its offshore debt soon, local media reported on Monday, as the country’s largest private property developer faced another looming debt deadline.

The developer, which missed two dollar interest payments last month, has two coupons totalling $66.8 million coming due on Monday.

Country Garden declined to comment on the report by media outlet Cailianshe and whether it has made any payments.

HONG KONG: Chinese property developer Country Garden, which missed two dollar interest payments last month, faces another deadline on Monday (Oct 9) with two coupons totalling US$66.8 million coming due.

The coupons due on Monday are tied to Country Garden’s 6.5 per cent April 2024 and 7.25 per cent April 2026 bonds.

The payments have a 30-day grace period, but the developer faces a big test later this month when its entire offshore debt could be deemed in default if it fails to pay a US$15 million September coupon by Oct 17.

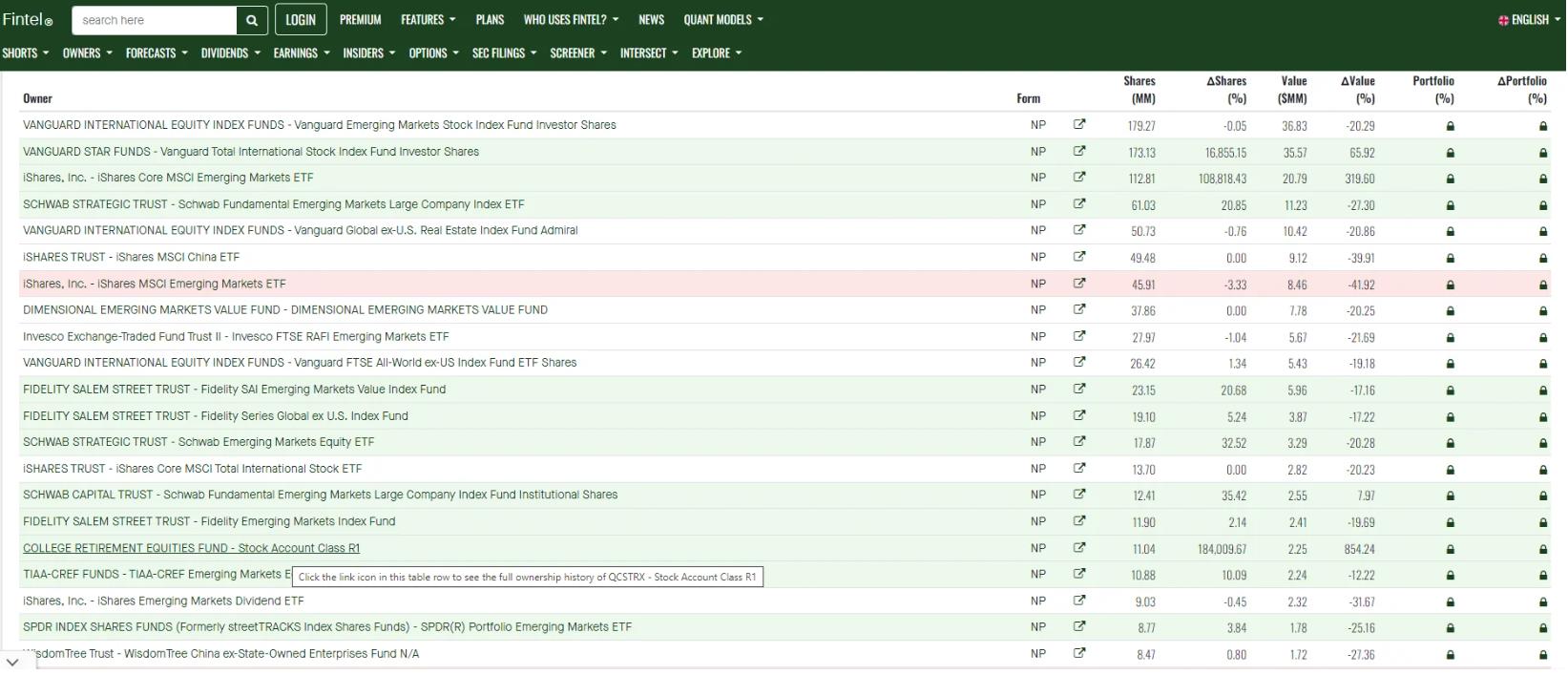

China’s largest private developer has US$10.96 billion offshore bonds and 42.4 billion yuan (US$5.81 billion) worth of loans not denominated in yuan. If it defaults, these debts will need to be restructured, and the company or its assets also risk liquidation by creditors.

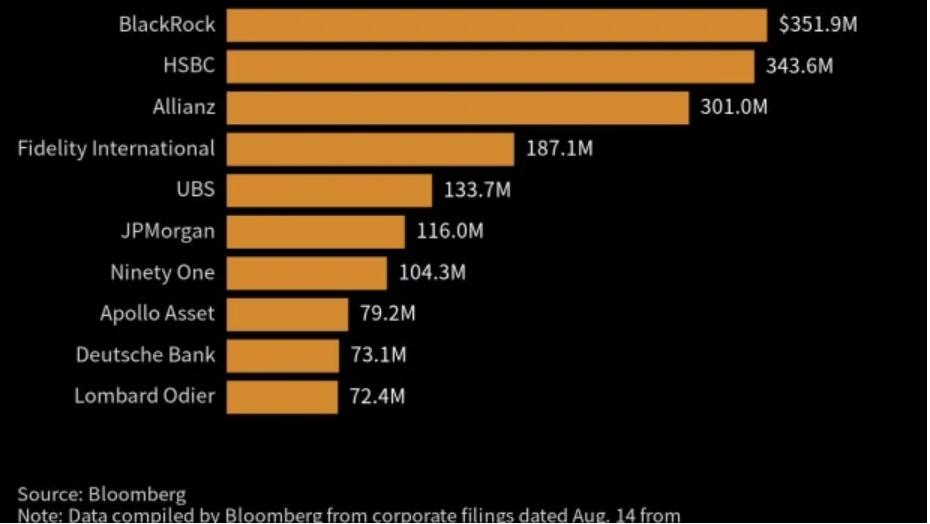

China’s property sector has been hit by a debt crisis since 2021. Companies accounting for 40 per cent of Chinese home sales – mostly private property developers – have defaulted on debt obligations, leaving many homes unfinished.

More than two years on, the crisis has deepened as confidence in both housing and capital markets dried up, further squeezing developers’ liquidity.

Beijing has rolled out a range of support measures in recent months to revive the sector, which makes up about a quarter of the world’s second-largest economy.

Some analysts, however, say more measures are needed.

In a research note on Friday, UBS said property sales growth in major cities likely stayed weak in September, suggesting a limited rebound of sales despite more supportive measures to ease the property crisis.

The market is closely watching whether Country Garden, which owns projects across the country, can manage to dodge default again by making payments at the last minute.

In September, Country Garden won approval from its onshore creditors to extend yuan bond payments, and in the same month made coupon payments on the offshore markets in the last hours of the end of a grace period.

But the developer has not yet paid a US$15 million coupon due Sep 17 and another US$40 million coupon due on Sep 27, both of which have 30-day grace periods.

Edit:

Published: 8:00am, 17 Aug, 2023

The ripple effect from slumping home prices might be bigger than expected, triggering more defaults by developers, falling government revenues, declining wages for government and property sector workers, and weak consumption, Lu Ting, chief China economist at Nomura Holdings, said in a report on Tuesday.

Country Garden Holdings.

Global investors including BlackRock Inc. and Allianz SE may be key stakeholders to watch in Country Garden Holdings Co.’s debt crisis given their recent exposure to the embattled Chinese property developer’s dollar bonds.

Should put 351.9 Million doesn’t seem like a lot for Blackrock or very much tbh

#fx #forex $CNH $USDCNH 🥶https://t.co/xY1HUYPMGv pic.twitter.com/0dGTQl9RFH

— Invariant Perspective (@InvariantPersp1) October 9, 2023

This is probably one of the most important charts right now about the Chinese economy. To offset the collapse in the real estate sector, Beijing has managed to surge credit to the manufacturing sector, which has helped prevent a total collapse of domestic credit growth and demand pic.twitter.com/YPa0LQYYjZ

— Shanghai Macro Strategist (@ShanghaiMacro) October 9, 2023

Views: 136