As central banks rapidly raise rates, the yield curve is steepening from previously inverted levels, signaling potential economic downturn. The JPY’s movement suggests increased volatility, especially as the BOJ moves off the ZLB and the ECB contemplates rate cuts ahead of the Fed. Asynchronous moves among major central banks historically trigger heightened market volatility.

In a pivotal year, central banks plan to shift from aggressive interest-rate hikes to reducing borrowing costs. The timing of this pivot will be crucial in mitigating the impact of past tightening and avoiding a hard landing. Predictions indicate a potential rate cut by the Fed in Q1 2024, with stock prices expected to decline by 30-50%. Additionally, home prices might face a collapse reminiscent of the last housing market downturn, driven by the level of rates.

As economic uncertainties loom, 50% of CFOs anticipate a recession in 2024, with 20% expecting it in the first half and 30% in the second half, according to CNBC. The convergence of these factors sets the stage for a challenging and volatile economic landscape in the coming year.

Sources:

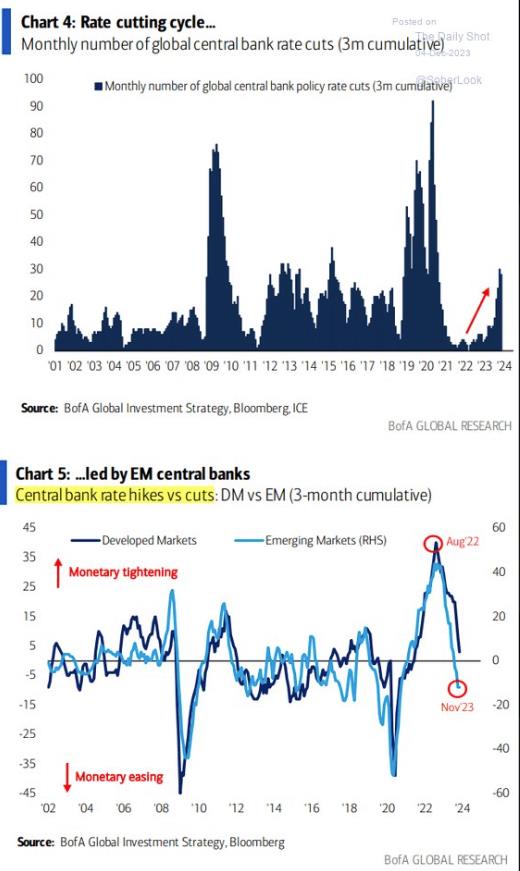

GLOBAL 🌎 RATE CUTS pic.twitter.com/CL2oaVwPTH

— Win Smart, CFA (@WinfieldSmart) December 11, 2023

The JPY move is starting….

Be prepared for extra volatility as #BOJ moves off the ZLB while the #ECB is likely to start cutting rates ahead of the Fed. Asynchronous moves among major Central banks has historically been a trigger for greater volatility. pic.twitter.com/vTA2YHOTnf— Constance L Hunter (@ConstanceHunter) December 7, 2023

WARNING: The yield curve is steepening rapidly from inverted levels

This brings the economy even closer to an economic downtrun

This won’t end well pic.twitter.com/oJqdTMo64A

— Game of Trades (@GameofTrades_) December 11, 2023

January 28, 2008 …

Does it sort of remind you of articles today?

🔥🔥🔥 pic.twitter.com/9sXDmosqBf— Wall Street Silver (@WallStreetSilv) December 11, 2023

Rate Cut Pivot Can’t Come Soon Enough for Debt-Strapped Companies

Shrinking maturities leave little breathing room for some businesses and also governments.

I too predict that the Fed will be cutting rates in the first quarter of 2024. Because stock prices will be -30% to -50% lower.

I also predict home prices will collapse. Because this is the level of rates that crushed the housing market last time. pic.twitter.com/zD4MLd7Ork

— Mac10 (@SuburbanDrone) December 11, 2023

50% of CFOs expect a recession next year – 20% in the first half of 2024, and 30% in the second half, per CNBC.

— unusual_whales (@unusual_whales) December 11, 2023