"Central banks are hoarding gold faster than we've ever seen." https://t.co/J9XZM6jxsg via @dailychartbook pic.twitter.com/Rg9zR1EhiT

— Jesse Felder (@jessefelder) August 17, 2024

Gold hits an ATH in US $…ever, and not a mention in the CNBC’s of the world. The US MSM has done a great diservice to its audience by never acknowledging the one asset class that has outperformed everything else the past 2 decades. Shame! https://t.co/Rb89Ec8YB1

— Frank Giustra (@Frank_Giustra) August 16, 2024

For the most part, US mainsteam Media chooses to ignore gold hoping it will just go away. Meanwhile the rest of the world is loading up at record numbers. A rising gold price is a threat to the narrative that all is ok with the fiat currency system. https://t.co/nlB499u3CA

— Frank Giustra (@Frank_Giustra) August 16, 2024

Jordan Roy-Byrne: Gold Mining & Junior Gold Stocks Approaching Major Resistance

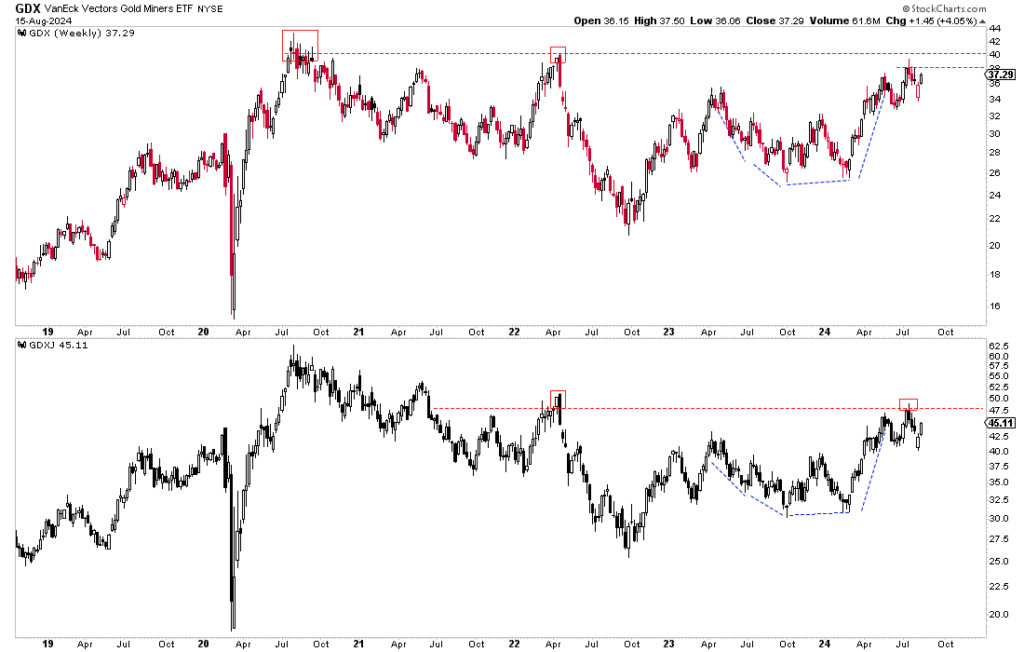

The recent sharp decline in the stock market pulled gold stocks lower. GDX declined 14%, and GDXJ declined 18% in only three weeks.

However, they have started to recover as Gold is now trying to pull away from its correction, which turned into a bullish consolidation.

GDX closed Thursday at $37.29, just below weekly resistance at $38 and $40. It has not made a weekly close above $41 since the end of 2012!

Technically, GDX formed an irregular but potentially bullish cup and handle. The measured upside target would be a minimum of $44, the 2020 high.

GDXJ closed Thursday at $45.11. It has closed above $47.50 for only one week since early 2021. Its potential cup and handle pattern projects above $55.