by TonyLiberty

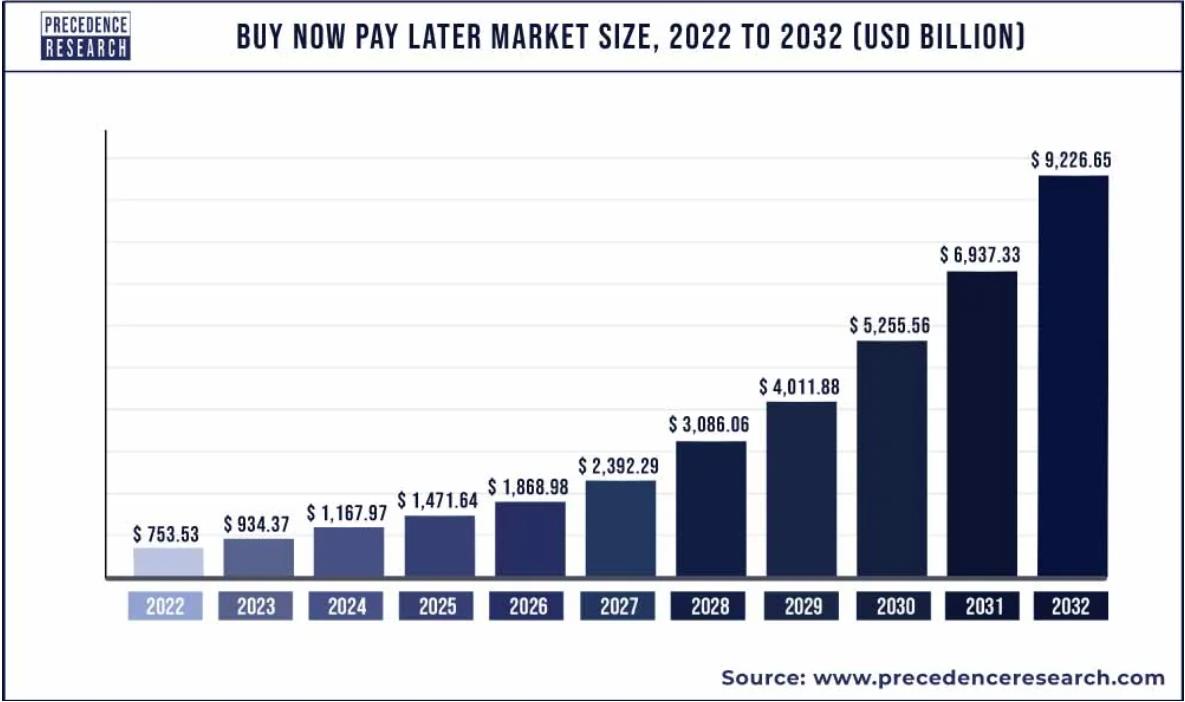

Buy Now, Pay Later is fueling a risky debt bubble — BNPL loans in the US have exploded from $2 Billion to $24 Billion from 2019 to 2021. And now, BNPL delinquency rates are surpassing those of credit cards, raising concerns about the financial stability of borrowers.

One of the biggest risks of Buy Now, Pay Later is the potential for overspending — When people use BNPL, they may be more likely to buy things they cannot afford because they do not have to pay for them all at once.

Buy Now, Pay Later is not regulated in the same way as credit cards. This means that there are fewer consumer protections available if you have a problem with a BNPL lender.

If you do not make your BNPL payments on time, you can end up with late fees and interest charges. This can quickly add up and make it difficult to afford your payments. Late payments can also hurt your credit score.

Buy Now, Pay Later is fueling a risky debt bubble.

Views: 76