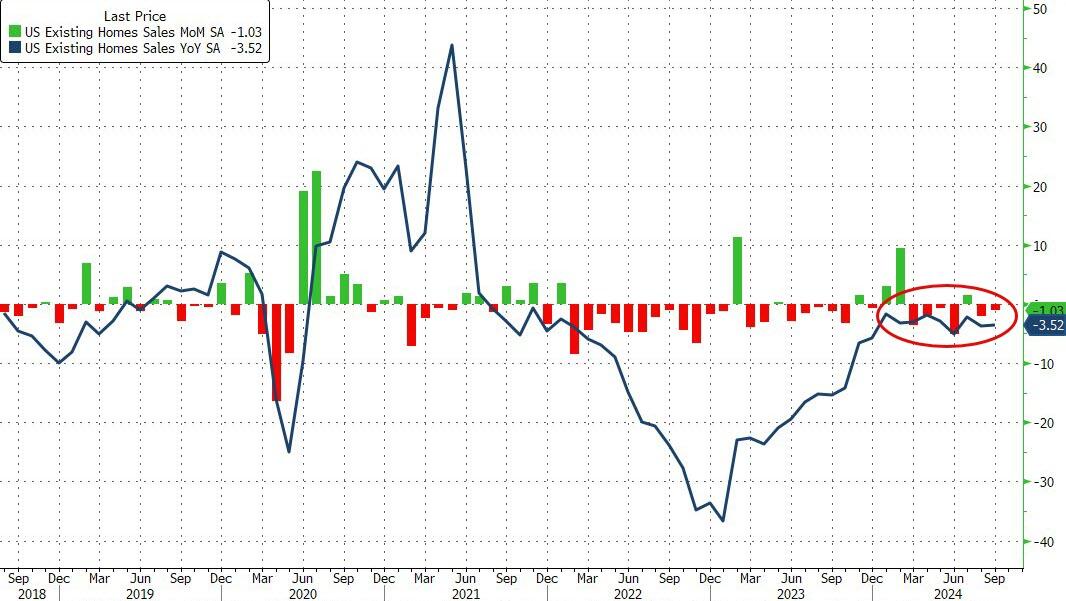

We are in the jungle. And its a bungle in the economic jungle.

Source: Bloomberg

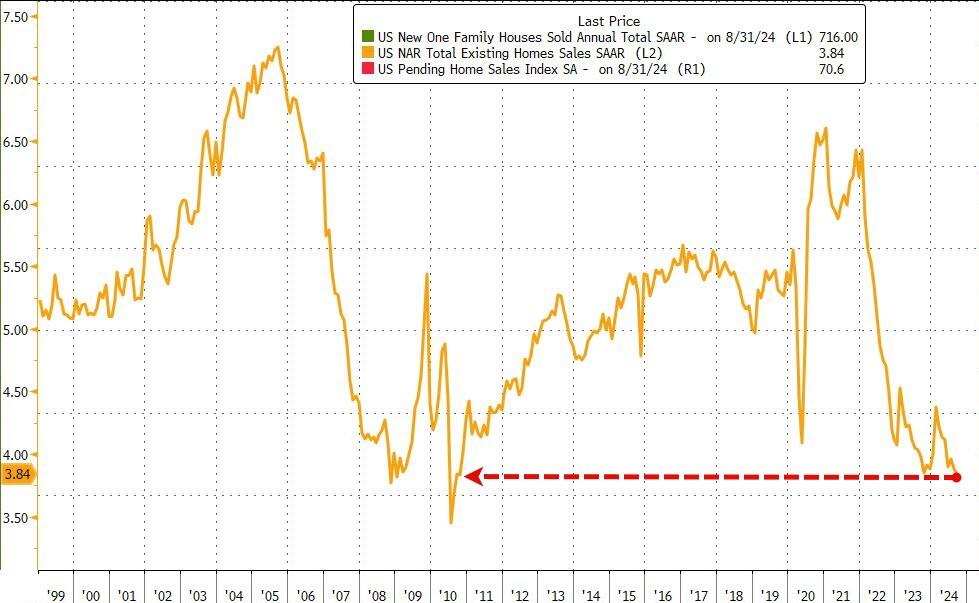

Total sales SAAR dropped to 3.84mm, the lowest since 2010…

Source: Bloomberg

Even with the weaker September sales figures, “factors usually associated with higher home sales are developing,” Lawrence Yun, NAR chief economist, said in his ubiquitously optimistic statement.

“There are more inventory choices for consumers, lower mortgage rates than a year ago and continued job additions to the economy.”

First-time buyers made up 26% of purchases, matching an all-time low.

Some 1.39 million homes were for sale in September, up 23% from a year earlier, the NAR report showed. The supply of homes still remains below pre-pandemic levels.

At the current sales pace, available inventory would last 4.3 months, the longest in more than four years.

The median sales price rose 3% in September from a year ago to $404,500.

Around the country, previously owned home sales dropped in three of four regions, including a 1.7% decline in the South to the slowest pace since the start of 2012.

Closings fell 2.2% in the Midwest to a 13-year low, and 4.2% in the Northeast. Sales rose 4.1% in the West, driven by California and Arizona.

While the short-term (lagged) may bring an improvement in existing home sales (based on the lagged impact of declining mortgage rates), as the chart below shows, since The Fed unleashed its rate0cutting cycle, mortgage rates have risen aggressively once again…

Source: Bloomberg

…not a good sign for the housing market’s affordability.

However, inventory problems could persist since “84 percent of mortgaged homes have a rate below 6%, so the number of sellers that would be financially incentivized to sell would remain limited,” Odeta Kushi, deputy chief economist at title insurance giant First American Financial Corp. said in the report.

Watch Harris laugh insanely if confronted with this news.