The yield on the all-important 10-Year U.S. Treasury is spiking again. As I write this, it’s about to take out its former highs.

There are no shortage of reasons.

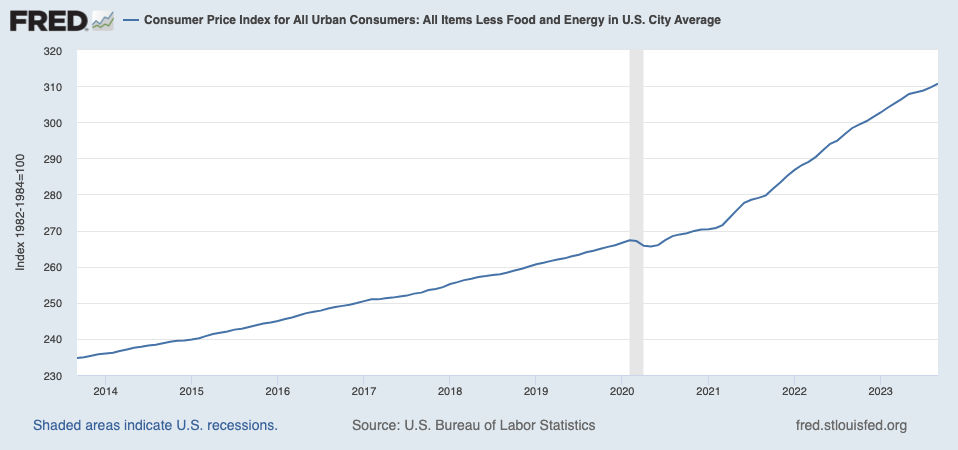

First and foremost, Inflation remains HOT.

Mainstream economists have been high-fiving one another because CPI is now 3.7%. Apparently the fact prices are still rising but at a slower pace is some kind of BIG WIN for the Fed. For those of us who live in the real world, the fact that prices are still rising by this much despite the Fed embarking on its most aggressive monetary tightening in decades is not a good thing.

And bond yields know it.

Bond trade based on many things including inflation expectations. In this light, the fact inflation is proving this difficult to slay is yet another reason bond yields are spiking higher: they know the Fed will have to do more.

The second reason why yields are spiking is that there is still too much excess liquidity in the financial system. Banks are still parking over $1.2 TRILLION at the Fed every night. This is a clear signal banks have too much extra capital/ liquidity lying around.

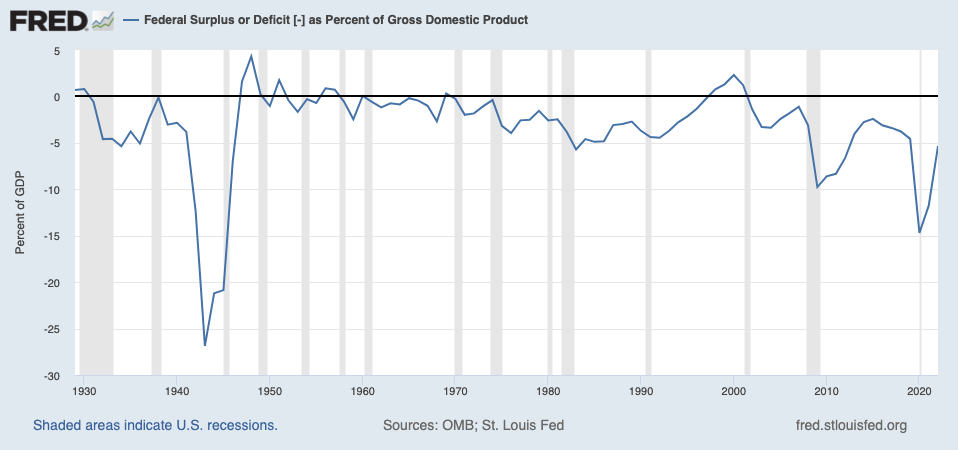

And finally, there’s the the ENORMOUS deficit that the Biden administration has been running since President Biden took office. Indeed, Bidenomics should be renamed SPEND-onomics as the federal government is running its largest deficit as a percentage of GDP outside of WWII.

All this spending requires the Treasury to issue massive amounts of debt. Basic economics tells us that the more of something there is, the less it’s worth. This is why U.S. Treasuries are worth less and hopefully won’t become worthless.

The below chart is truly horrifying. It tells us that the fuse is lit on a $33 trillion debt bomb.

The great debt crisis of our lifetimes is fast approaching.

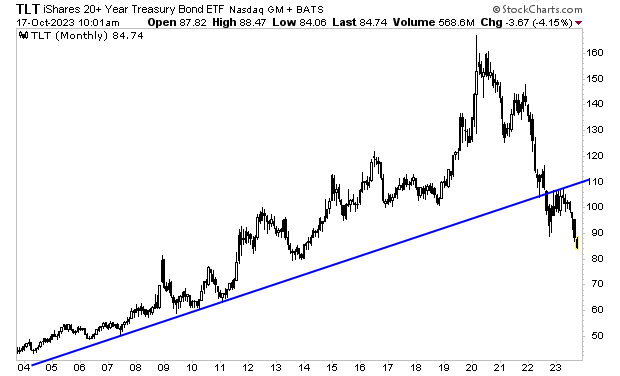

In 2000, the Tech Bubble burst.

In 2007, the Housing Bubble burst.

The U.S. Treasury bubble burst in 2022. And the crisis is now approaching.