What we are monitoring:

- Bank Term Funding Program (BTFP)

- Discount Window/Primary Credit

- “Other Credit Extensions”

I hope to shed light on the recent uptick in borrowing due to an attempt to offset the initial shrink in M2 and dip in deposits. Buckle up!

Bank Term Funding Program (BTFP):

https://www.federalreserve.gov/releases/h41/20230810/

https://fred.stlouisfed.org/series/H41RESPPALDKNWW

| Date | Bank Term Funding Program (BTFP) | Up from 3/15, 1st week of program ($ billion) |

|---|---|---|

| 3/15 | $11.943 billion | $0 billion |

| 3/22 | $53.669 billion | $41.723 billion |

| 3/29 | $64.403 billion | $52.460 billion |

| 3/31 | $64.595 billion | $52.652 billion |

| 4/5 | $79.021 billion | $67.258 billion |

| 4/12 | $71.837 billion | $59.894 billion |

| 4/19 | $73.982 billion | $62.039 billion |

| 4/26 | $81.327 billion | $69.384 billion |

| 5/3 | $75.778 billion | $63.935 billion |

| 5/10 | $83.101 billion | $71.158 billion |

| 5/17 | $87.006 billion | $75.063 billion |

| 5/24 | $91.907 billion | $79.964 billion |

| 5/31 | $93.615 billion | $81.672 billion |

| 6/7 | $100.161 billion | $88.218 billion |

| 6/14 | $101.969 billion | $90.026 billion |

| 6/21 | $102.735 billion | $90.792 billion |

| 6/28 | $103.081 billion | $91.138 billion |

| 7/5 | $101.959 billion | $90.016 billion |

| 7/12 | $102.305 billion | $90.362 billion |

| 7/19 | $102.927 billion | $90.984 billion |

| 7/26 | $105.078 billion | $93.155 billion |

| 8/2 | $105.684 billion | $93.741 billion |

| 8/9 | $106.864 billion | $94.921 billion |

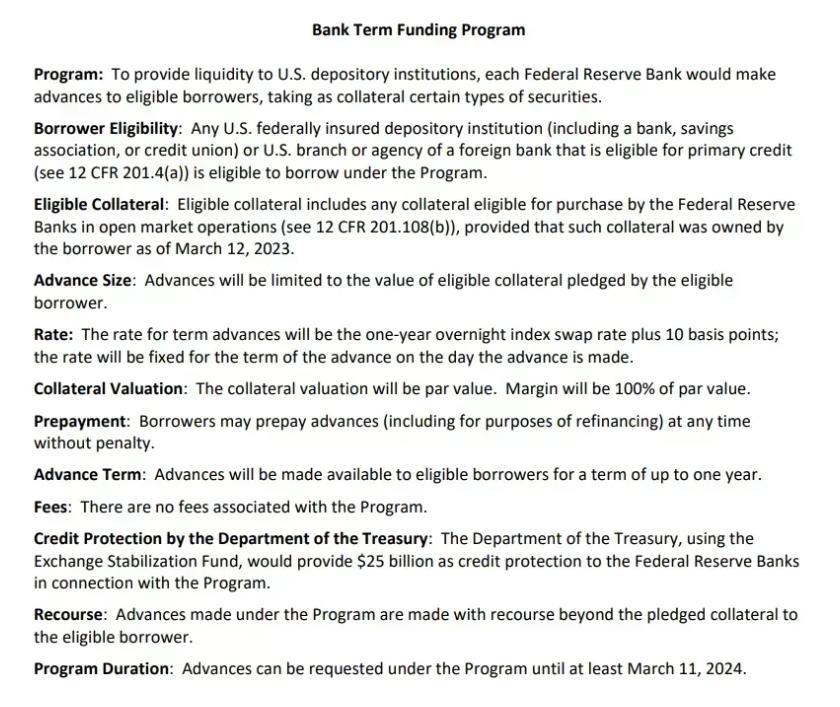

- Association, or credit union) or U.S. branch or agency of a foreign bank that is eligible for primary credit (see 12 CFR 201.4(a)) is eligible to borrow under the Program.

- Banks can borrow for up to one year, at a fixed rate for the term, pegged to the one-year overnight index swap rate plus 10 basis points.

- Banks have to post collateral (valued at par!).

- Any collateral has to be “owned by the borrower as of March 12, 2023.”

- Eligible collateral includes any collateral eligible for purchase by the Federal Reserve Banks in open market operations.