TLT is cracking lows not seen since 2011.

BREAKING: Bond tracking ETF, $TLT, falls below $90 for the first time since April 2011.

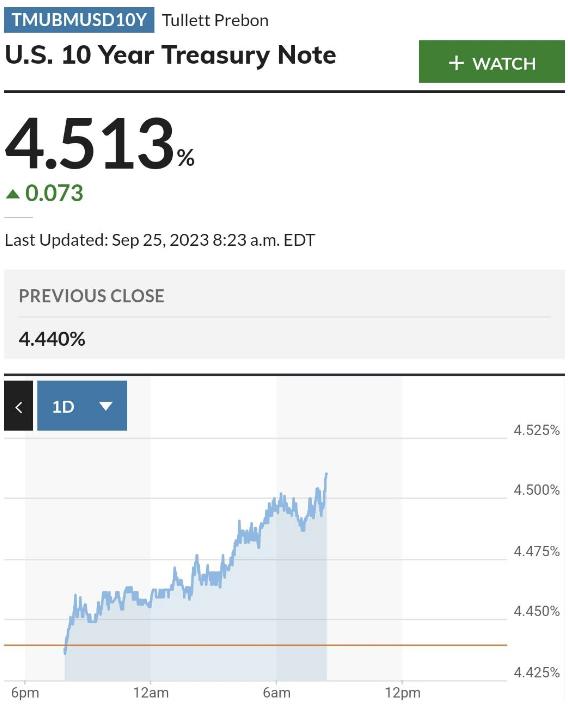

The 10-year note yield is now trading above 4.50% for the first time since 2007.

The 2-year note yield is now up a massive 500 basis points since September 2021.

Treasury yields are hitting… pic.twitter.com/RcHkFKdZ8e

— The Kobeissi Letter (@KobeissiLetter) September 25, 2023

5% Inflation could cause 15% of Junk Bonds to default. – Bank of America via Bloomberg

“That wave could bring cumulative high-yield defaults to 15%, according to Melentyev, a jump from current levels. In the last 12 months, about 2.5% of US high-yield debt defaulted, according to Fitch Ratings. A persistent 4% inflation rate could bring cumulative defaults to 10%, Melentyev wrote.”

Hedge funds are boosting bets against U.S. stocks as selloff continues, Goldman Sachs says

“Hedge funds have been ramping up bets against U.S. stocks amid the worst streak of losses for the S&P 500 since the collapse of Silicon Valley Bank, according to data from Goldman Sachs Group’s prime brokerage unit.

Goldman’s hedge fund clients increased short positions in single stocks, exchange-traded funds and equity index products through Friday for the third straight week, according to research shared by the bank with its clients.

Hedge funds have now increased their short positions during five of the last six weeks, with the bulk of the action occurring in single-name stocks. Shorting a stock involves borrowing the shares from a broker, like Goldman, and selling them, hoping to eventually buy them back and close the position at a lower price.”

Hedge funds are increasing short exposure to technology and semiconductors stocks.

Currently, nearly 40% of all shorts in semiconductor stocks are by hedge funds.

This is up sharply from ~33% just a few months ago.

Interestingly, these same funds were buying names like $NVDA… pic.twitter.com/EQ9bGb0CzV

— The Kobeissi Letter (@KobeissiLetter) September 25, 2023

h/t GlassHouse_101