Incredibly, ultra long-duration Treasury bonds have now lost more in % terms than stocks did during Great Financial Crisis.

The drawdown in extended duration Treasury ETF (🔻58.3%) now exceeds PEAK-TO-TROUGH losses in S&P 500 during stock market crash of 2007 – 2009 (🔻56.0%) pic.twitter.com/nlXZH5xOUY

— Jack Farley (@JackFarley96) October 2, 2023

Ok, think of it this way. You can get a low risk short-term cd for approximately six percent (didn’t check current rates so I’ll take your word on that).

The earnings yield on stock market is earnings / price of the market. That is around 4.0% today. The dividend is 1.6%. So the total “return” on that is 5.6%.

Therefore, the very low risk CD is paying better than a very risky stock market. In finance theory that is not supposed to ever happen because low risk should always pay less than higher risk. Therefore the CD investment “dominates” the stock investment under CAPM theory — which is assumed to be impossible.

Please note that the CD has risk in that the bank could choose to simply not pay it. In the past i would have said this is a nearly zero risk. I’m not so sure now because of the massive instability going on in the banks. A better choice is government t-bills.

I’m a MBA and a CFA and worked for 30 years in Corp. Finance for a very famous company.

#notinvestmentadvice

We are clearly going off the rails similar to the crash in the 80s.

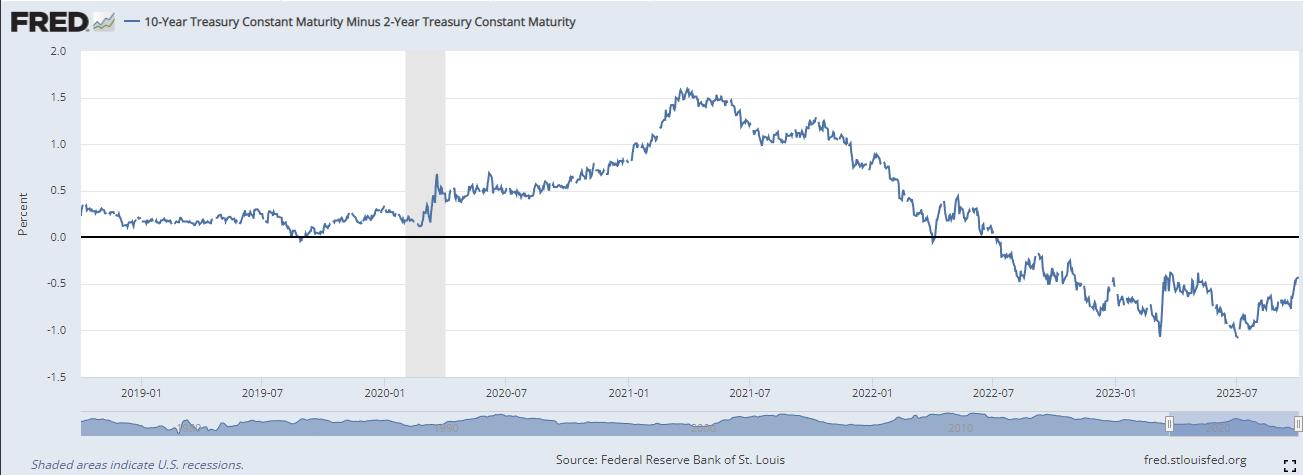

This is the yield curve inversion right now:

https://fred.stlouisfed.org/series/T10Y2Y/

The last time the yield curve was inverted this much, for this long, was way back then.

Somebody is eating huge losses in the bond market:

Stress in the financial system is rising: The value of global bonds dropped another $428bn this week as the interest rate world keeps repricing for a higher for longer. In past quarter, bonds lost ~$1.8tn in value and everyone is puzzling over who has the losses on their books. pic.twitter.com/fDk8AO7875

— Holger Zschaepitz (@Schuldensuehner) September 30, 2023

The US is not alone.

Germany's 10-year yield is also surging, now back to its 2011 debt crisis levels.

The unavoidable resolution of these imbalances is clear:

Ultimately, policymakers must restore a financially repressive environment. pic.twitter.com/O2FvVpnkeV

— Otavio (Tavi) Costa (@TaviCosta) October 3, 2023

Next bank failure will be in Japan https://t.co/51eCSNZeIh

— zerohedge (@zerohedge) October 3, 2023

Nominally (blue line), U.S. commercial banks own as much agency mortgage-backed securities (MBS) now as they did in January 2021.

But the same holdings give roughly 3 times as much interest rate exposure, or duration.

2/7 pic.twitter.com/zFyXVCPox9

— Jack Farley (@JackFarley96) October 3, 2023

VIX flirting with 20. Stocks no likey pic.twitter.com/cTQKNcwRGh

— Hedgeye (@Hedgeye) October 3, 2023

U.S treasury 30-year yield rises to 4.856%, highest since 2007

— Win Smart, CFA (@WinfieldSmart) October 3, 2023

Why a rout in government bonds is worrying

h/t Tonight We Ride!

197 views