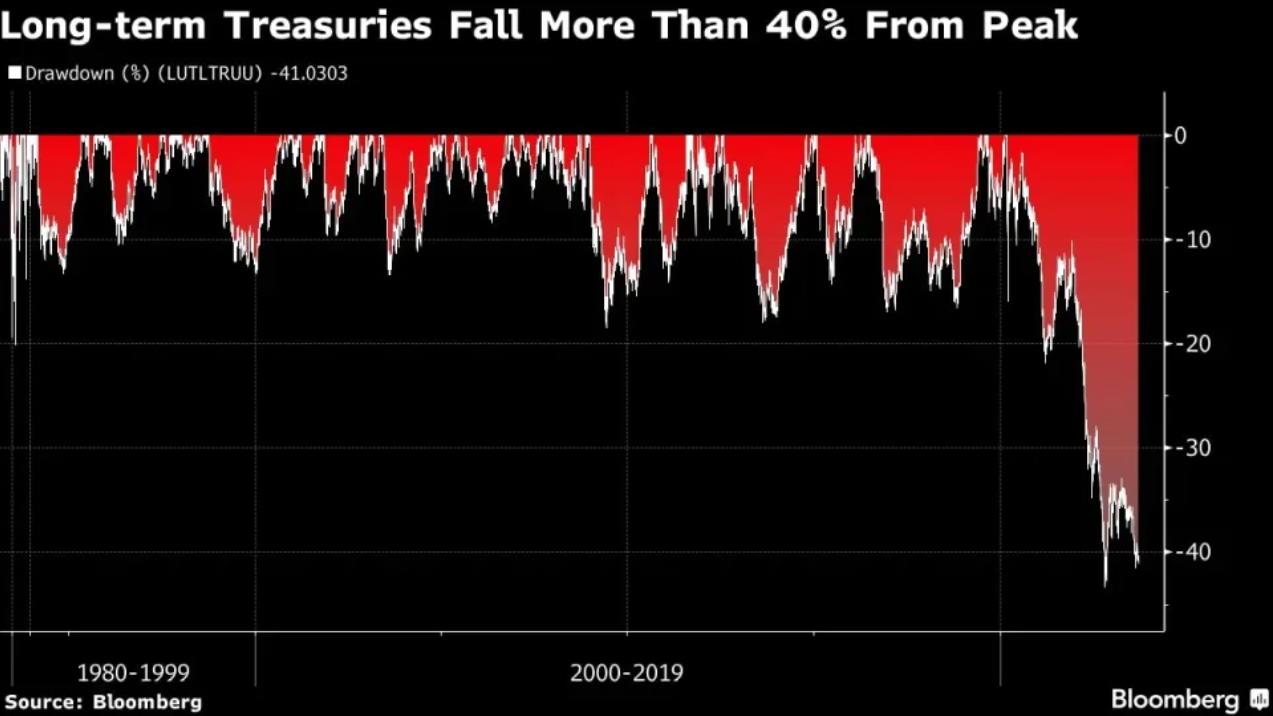

The recent turbulence in the bond market has sent shockwaves through the financial industry, raising concerns about the stability of the bond market and its potential impact on various stakeholders:

The 30-year Treasury bonds maturing in May 2050, initially offering a yield of 1.25%, have seen their value plummet by a staggering 50%. This sharp decline, with the bonds briefly trading at just 0.49%, represents a significant loss for investors who hold these assets.

Banks, traditionally major players in the bond market, are grappling with substantial losses on their Treasury holdings. The declining bond prices have put considerable pressure on their balance sheets and investment portfolios, posing challenges to their financial stability.

Hedge funds have taken increasingly bearish positions by shorting 2-year Treasury futures, reaching record levels in these bets. This trend suggests growing investor sentiment that Treasury yields may rise, resulting in lower bond prices.

Regulatory concerns have emerged as three regulators have sounded the alarm about the situation. The highly leveraged nature of these trades raises the risk of rapid liquidation if the market moves unfavorably. Forced selling in response to these leveraged positions could trigger a domino effect, potentially causing disruptions and instability in the bond market.

Conversely, money managers have taken record-long positions in 2-year Treasury securities, indicating a divergence in market sentiment. Some investors anticipate that yields will fall, driving up bond prices.

The bond market has become a battleground where investors are taking opposing positions on the direction of interest rates and bond prices. This volatility and uncertainty in the bond market could have broader implications, affecting financial markets and the overall economy.

In summary, the bond market’s recent upheaval highlights the complexity of factors at play, including expectations regarding interest rates, regulatory concerns, and varying investor outlooks. These developments underscore the heightened volatility and risks in financial markets, which have the potential to impact a wide range of market participants and the broader economic landscape.

Sources:

https://finance.yahoo.com/news/sub-50-cent-price-treasury-190103366.html

— Genevieve Roch-Decter, CFA (@GRDecter) September 19, 2023

Indeed ! pic.twitter.com/kvum9Zhfpq

— Genevieve Roch-Decter, CFA (@GRDecter) September 19, 2023

h/t betsharks0