If the government pretends the national debt isn’t a problem, does the problem go away? No, it doesn’t – it just grows until there’s absolutely nowhere safe from it…

From Peter Reagan for Birch Gold Group

Even if the national debt weren’t accumulating that fast right now, it has already reached unsustainable levels.

But it is still piling up fast. In fact, things have gotten much worse, much faster than it has in past decades.

A recent article revealed that the national debt has crossed yet another threshold. The discussion has also spilled out into the banking and finance sector:

The federal debt is now at $34.5 trillion, or about $11 trillion higher than where it stood in March 2020. As a portion of the total U.S. economy, it is now more than 120%.

Concern over such eye-popping numbers had been largely confined to partisan rancor on Capitol Hill as well as from watchdogs like the Committee for a Responsible Federal Budget. However, in recent days the chatter has spilled over into government and finance heavyweights, and even has one prominent firm wondering if costs associated with the debt pose a significant risk…

You can see just how fast the national debt has been piling up for yourself, on the official Treasury line graph below:

via Treasury Department Debt to the Penny, retrieved May 24, 2024

But perhaps the most alarming aspect of this recent development for older Americans, according to the same article, is the national debt’s burden smothering any meaningful action to solve problems with the Social Security trust fund:

However, the biggest issue with the budget is spending on Social Security and Medicare, and “under no scenario” regarding the election does reform on either program seem likely, Goldman said.

If nothing is done to help the trust before 2034-35, that would result in a 20% reduction in monthly benefit payments made to those Americans who have already paid taxes into the program for decades.

Sadly, there are also much bigger problems just starting to develop…

Debt service costs more than anything else

According to a recent Fox Business article, the U.S. could be reaching the end of the happy time when it’s possible to pretend that the national debt isn’t a crisis.

The article referenced official data and a report by the Committee for a Responsible Federal Budget, and summarized where the situation stands now:

In the first seven months of fiscal year 2024, which began in October, spending on net interest surged to $514 billion, surpassing spending on both national defense ($498 billion) and Medicare ($465 billion). In fact, interest costs have topped spending on veterans, education and transportation combined.

“Rising debt will continue to put upward pressure on interest rates,” the Committee for a Responsible Federal Budget (CRFB), a nonpartisan group that advocates for lowering the national deficit, said in a statement. “Without reforms to reduce the debt and interest, interest costs will keep rising, crowd out spending on other priorities and burden future generations.”

Put simply, the United States government is paying more to service the debt it’s racked up than for beneficial programs – you know, the kind that actually take care of and protect Americans.

Biden tried to hand-wave away his administration’s historic contribution to the debt:

“I might note parenthetically: In my first two years, I reduced the debt by $1.7 trillion. No president has ever done that,” Biden said recently.

Nonsense!

The President is confusing two totally different words.

The deficit is how much the government outspends its revenue in a single year.

The debt is the total of all deficits – from 1960 to the present day. (The last time the government spent less than its revenue was 2001.)

See the difference?

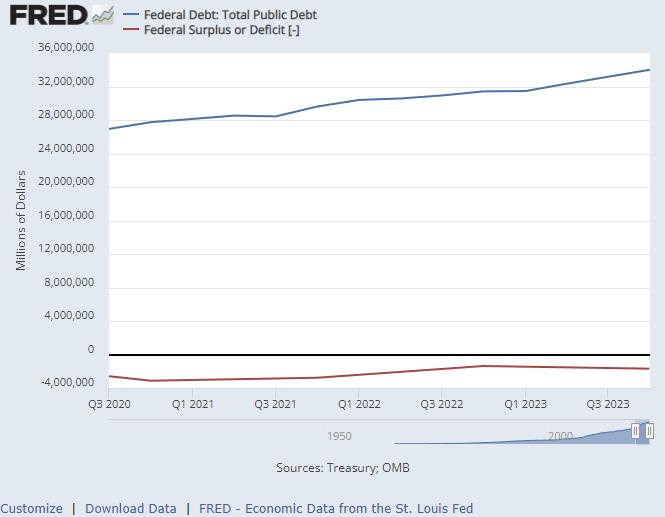

Take a look at the chart below. The red line shows the government’s annual deficit, the blue line total public debt:

Note: we’re using “total public debt” which excludes intragovernmental debt – IOUs the Treasury Department writes to other government entities:

Intragovernmental debt is debt that one part of the government owes to another part. In almost all cases, it is debt held in government trust funds, such as the Social Security trust funds. These debts represent assets to the part of the federal government that owns them (i.e., Social Security), but liabilities to the parts of the government that issue them (the Treasury Department). Therefore, they have no net effect on the government’s overall finances.

Frankly, it’s a little difficult to accept that there’s “no net effect on the government’s overall finances.” From an accounting perspective, maybe so. If you take a $20 bill out of your wallet and put it in your pocket, there’s “no net effect” on your overall finances. But that’s not what’s happening. (I don’t want to get sidetracked here – suffice to say that the Social Security trust fund’s assets are the Treasury’s liabilities… Then brush up on the concept of counterparty risk.)

So what the President is really bragging about isn’t reducing the debt (which, in fact, has grown $6.5 trillion since he was sworn in). He’s talking about reducing the deficit.

Reducing the deficit is easy! All you have to do is spend less money!

So how much longer can we pretend the national debt doesn’t matter?

The answer: Sooner than anyone thinks…

What economic impacts does the national debt have?

Let’s not mince words here, the debt situation in the United States is already bad, no matter how you want to look at it.

But according to the non-partisan Congressional Budget Office (CBO), it’s going from quite bad to much worse:

Debt held by the public rises each year in relation to the size of the economy, reaching 116 percent of GDP in 2034 – an amount greater than at any point in the nation’s history. From 2024 to 2034, increases in mandatory spending and interest costs outpace declines in discretionary spending and growth in revenues and the economy, driving up debt. That trend persists, pushing federal debt to 172 percent of GDP in 2054.

That first sentence – debt growing faster than the economy – is especially alarming. This means the total debt is outpacing our hypothetical ability to pay for it.

Historically, U.S. GDP has grown about 2.5% per year over the last six decades.

If the debt grows faster than 2.5% per year, that virtually guarantees it will be impossible to pay back without deliberate money-printing. “Inflating away the debt.”

That leaves us with a few questions:

- How much longer can lawmakers and officials pretend this isn’t a problem?

Answer: Not any longer.

Exhibit A: JP Morgan CEO Jamie Dimon’s recent interview with Sky News. Highlight:

“At one point it will cause a problem and why should you wait?” Dimon said. “The problem will be caused by the market and then you will be forced to deal with it and probably in a far more uncomfortable way than if you dealt with it to start.”

- Could we be looking at a future with both higher inflation and higher taxes?

Answer: The risks of both hyperinflation and for higher taxes exists, both to “inflate away” the debt, and pay it off faster.

Exhibit B: Not-so-fun fact: Government collects more revenue when inflation is higher. (Which means you’ll foot the bill, not just once, but twice!)

- Could even more nations around the world start dumping the dollar? Could the ones that are already dumping the dollar start doing so much faster than they are now?

Answer: Yes, both are not only possible, but increasingly likely as the Treasury Department continues refinancing old debts with new, more expensive debt.

Exhibit C: Janet Yellen’s difficult-to-understand debt management strategy currently focuses on refinancing with shorter-term IOUs that are actually more expensive than longer-term loans.

The last word: I’m not personally a great fan of the International Monetary Fund (IMF), but at least that international financial institution had the courage to point out an even bigger risk:

The high and rising level of US government debt risks driving up borrowing costs around the world and undermining global financial stability, the International Monetary Fund has warned.

“Loose fiscal policy in the United States exerts upward pressure on global interest rates,” Vitor Gaspar, director of the IMF’s fiscal affairs department, told reporters. “It pushes up funding costs in the rest of the world, thereby exacerbating existing fragilities and risks.”

Essentially, U.S. government debt is so out of control it’s putting the entire global financial system on shaky ground.

The federal government’s debts already look like a house of cards.

The IMF is worried that, when this precarious paper pile inevitably collapses, it won’t take down just the U.S. economy…

As J. Paul Getty famously said:

If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.

…and if you owe the entire world $34.5 trillion, wouldn’t that be everyone’s problem?

That’s an issue you and I can’t solve for the world. What we can do is solve it for ourselves…

Don’t be part of the problem – create your own solution

The global financial system is based on pieces of paper backed by nothing but the “full faith and credit of the U.S. government.”

Now, remember, thanks to the cozy relationship between the Federal Reserve and the Treasury Department, the U.S. government has infinite credit.

Faith, on the other hand, is not a renewable resource.

That’s one of the major reasons central banks worldwide bought record quantities of gold for the last 27 months. They see the writing on the wall.

So before things start getting really “interesting” in the financial world, take the time to shore up your defenses. How are you going to preserve your buying power and ensure your financial future?

For the last 6,000 years, physical gold and silver have been the safe haven store-of-value assets chosen by everyone during times of crisis.

But precious metals aren’t just for times of uncertainty and economic crisis. For example:

If you bought gold or silver during the past decade, you must feel pretty good right now. The price is up, and apparently heading higher.

Their performance is comparable to other types of financial assets:

Gold generates robust returns across economic cycles. Looking back over the past 50 years, gold prices increased by an average of nearly 11% per year…

Gold consistently outpaces inflation, too. In periods of high inflation – when consumer prices are increasing by 5% or more – gold prices on average have gained over 20%.

So I hope you’ll take a few minutes to learn more about the benefits of owning physical precious metals. Some might say it’s “risky” to diversify with physical gold and silver. Personally, I believe it’s much riskier not to.

178 views