by Michael

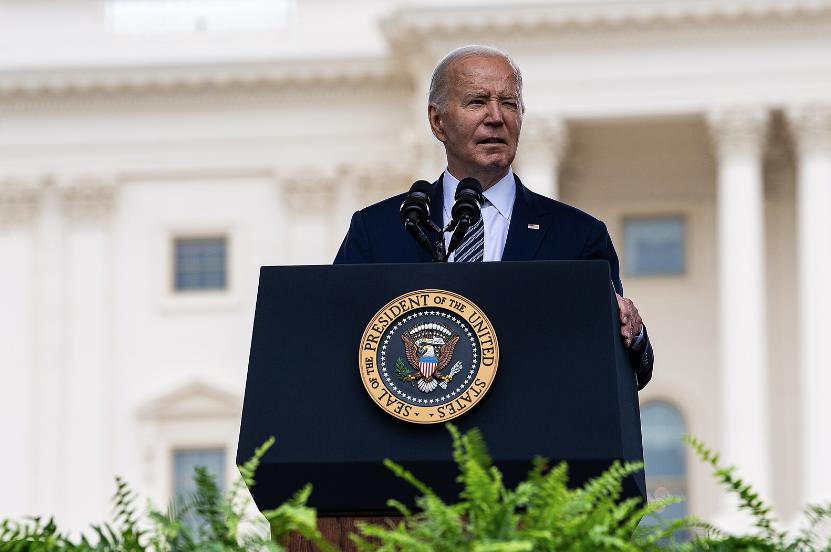

I have a great idea. Let’s wildly print money, let’s systematically destroy the reserve currency of the globe, let’s add a trillion dollars to the national debt every 100 days, let’s strangle the economy with all sorts of ridiculous regulations, let’s dramatically hike interest rates, let’s make things exceedingly difficult for our domestic energy industry, and let’s allow theft, violence, homelessness and migration to run wild. Then we’ll sit back and see what happens. What I have just described is essentially what we have witnessed over the last three years. Joe Biden and others in positions of power in Washington are running our economy into the ground. The system really is coming apart at the seams, and Bidenomics really is the beginning of the end for the U.S. economy.

Former Chrysler and Home Depot CEO Bob Nardelli is also sounding the alarm about the severe damage that Bidenomics is doing.

In fact, he just told Maria Bartiromo that the fault lines of our economy are “about ready to crack”…

Former Chrysler and Home Depot CEO Bob Nardelli warned that the fault lines of the economy are “about ready to crack” on Monday, adding that the Biden administration’s alleged policy missteps could leave a cumbersome mess for the next person who sits in the Oval Office to clean up.

“What I’ve seen over the past three-and-a-half years is that a series of debacles and missteps have created a tremendous pressure on the fault lines of our economy, and they’re about ready to crack,” he told FOX Business’ Maria Bartiromo.

He is right.

Our economy is steamrolling in the wrong direction, and the short-term outlook is extremely troubling.

One recent survey of small businesses found that nearly half of them believe that they will “definitely” or “probably” not survive another four years under Joe Biden…

In a new report from RedBalloon and PublicSquare, nearly half of the 80,000 small businesses surveyed said they “definitely” or “probably” will not survive another four years with Biden.

“There is nothing I can afford to do in addition to what I’m already doing. If things don’t change, I’ll be finished,” one business owner said in the report.

Already, businesses are making moves to preserve their cash flows. Four in 10 now said they are delaying paying bills while a whopping seven in 10 have put all staffing plans on hold, the survey found.

And a different survey discovered that a whopping 43 percent of all small business renters in the U.S. could not pay their rent in full last month…

A significant number of small businesses across the nation are struggling to pay rent due to skyrocketing costs, a recent study by business networking platform Alignable found.

The company’s latest Small Business Rent report, published on Friday, found that 43 percent of small business renters in the U.S. were unable to pay their rent in full and on time in the month of April. Such a high delinquency rate hasn’t been reported in the U.S. since March 2021, at the height of the COVID-19 pandemic, when it reached 49 percent.

More small businesses are going under with each passing day.

We really are in the midst of a “small business apocalypse”, and that is extremely bad news, because small businesses create most of the new jobs in this country.

Rising costs are one of the primary reasons why so many small businesses are now in hot water, and inflation is also crushing ordinary American families that are just trying to make it from month to month.

Earlier today, I was astounded to learn that the price of an order of medium fries at one McDonalds location in Los Angeles was $1.79 at the end of 2019, but now it has risen to $4.19.

Print more money. What could possibly go wrong. pic.twitter.com/TTRqGQLkIl

— Rothmus 🏴 (@Rothmus) May 20, 2024

When the Federal Reserve was pumping trillions of dollars into the system and our politicians were sending out free checks to everyone, I warned that this would happen.

Not too long ago, $648 was a fairly typical monthly mortgage payment on a nice home.

Today, it is the average monthly payment on a new vehicle in the United States…

More than 115 million people in the U.S. finance their automobile purchases, and if you do, you might want to hold on to your current vehicle for as long as you can. Buying a car is becoming more financially difficult than ever, with the average car payment in the U.S. at an all-time high — $648 for new cars and $503 for used vehicles.

The average sticker price on a new vehicle has risen to almost $50,000.

If you are old enough, you probably bought an entire house for less than that many years ago.

Speaking of home prices, they have risen by more than 47 percent since the beginning of this decade…

Home prices have surged 47.1% since the start of 2020, easily outstripping the gains seen in recent decades.

That’s according to a recent analysis by ResiClub of the Case-Shiller National Home Price Index, which showed that house prices in the 1990s and 2010s grew a respective 30.1% and 44.7%.

Today, most homeowners are stuck in their current homes because they literally cannot afford to move.

Without a doubt, the raging inflation that our leaders have created has done an immense amount of damage.

According to one recent survey, 65 percent of U.S. households are convinced that inflation is making their financial lives “worse”…

Inflation made the financial lives “worse” for 65% of US households, according to the report. Among those, 19% said it was “much worse.”

The findings were drawn from the Fed’s 11th annual Survey of Household Economics and Decisionmaking, which looks at American’s economic health across a variety of areas, including employment, income, banking and credit, housing, retirement planning, student loans, childcare and even Buy Now, Pay Later usage.

The longer Joe Biden is in the White House, the more intense the economic pain is going to become.

Many businesses that were once thriving are now going belly up. The latest iconic chain to file for bankruptcy is Red Lobster…

Red Lobster has filed for Chapter 11 bankruptcy protection days after shuttering nearly 100 restaurants across America.

The seafood chain, which has closed restaurants in 27 states, has been struggling with rising lease and labor costs in recent years and also promotions like its iconic all-you-can-eat shrimp deal that backfired.

Demand for one such recent promotion overwhelmed restaurants, reportedly contributing to hundreds of millions in losses.

If we really want to fix the economy, we should be like George Costanza and “do the opposite” of everything that Joe Biden and his minions have been doing.

But even if Joe Biden is voted out in November, the “experts” running the Federal Reserve will still be there.

And they have been doing an absolutely nightmarish job.

In addition, our Congress critters just continue to borrow and spend us into oblivion no matter who controls the White House.

Our leaders have been making really bad decisions for decades, and now we really have reached a breaking point.

Bidenomics has been an abject failure of historic proportions, and the pain that it is causing is getting worse with each passing day.