by OtaraMilclub

If banks were required to mark their assets to market, as they did prior to 2009, the entire banking industry, including the too big to fail wall street banks would be insolvent, along with the Federal Reserve. Does this seem sustainable to you?

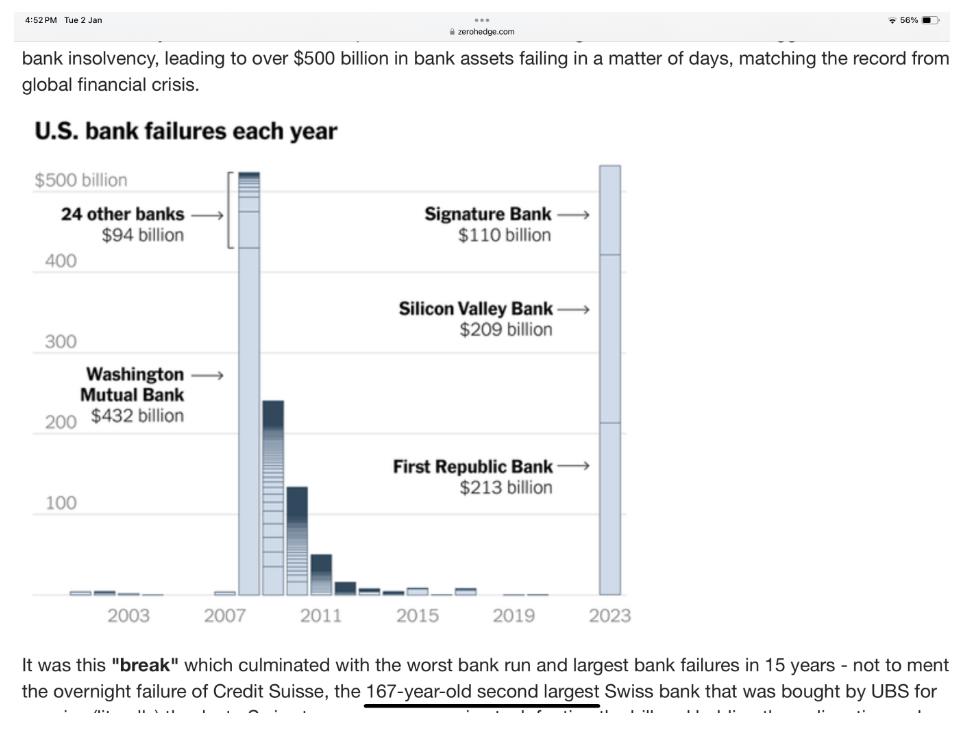

$500 billion wiped out in a matter of days and no one blinks an eye. We’re truly screwed as a society, never mind as humanity. The only people up in arms, I presume, were those with cash in those banks.

6. US Credit Card Delinquencies vs Liquid Assets (via @dailychartbook) pic.twitter.com/Jsb6mlCiwq

— Smartkarma (@smartkarma) January 2, 2024

Billions of commercial real estate debt mature this yr & owners will struggle to refinance at current rates.

Unlike US home loans, CRE debt is almost entirely interest-only. Borrowers tend to have low monthly payments but face a balloon payment equal to original loan on maturity pic.twitter.com/mZJ8Qlw2wC

— Daniel Baeza (@dbaeza13) January 1, 2024

1,064 views