via YAHOO:

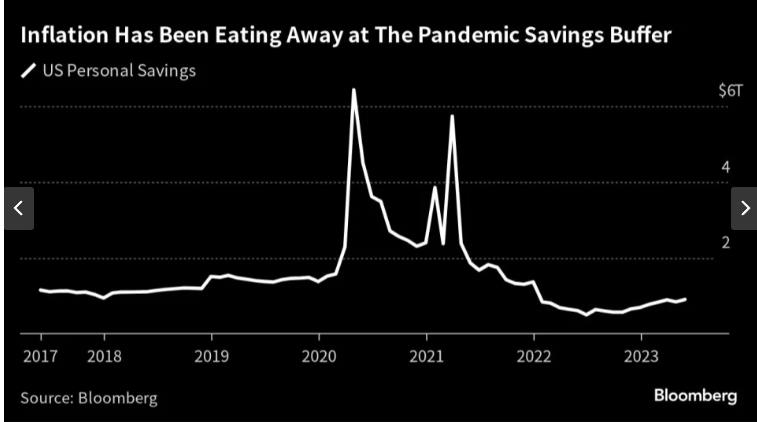

(Bloomberg) — US consumers, particularly those with lower incomes, are running into financial trouble as pandemic savings disappear, a headwind for lenders ranging from banks to asset-backed securities investors.

The credit outlook is expected to deteriorate later this year when almost 27 million borrowers have to resume making payments on student loans. Delinquencies for other forms of debt will likely rise, as people divert money away from servicing car loans and credit cards, according to Morgan Stanley economist Sarah Wolfe.

Consumer spending growth will likely also face pressure as debt servicing burdens rise. Bank of America Corp. Chief Executive Officer Brian Moynihan pointed out in the latest week that consumer spending patterns now are consistent with slowing growth in the economy.

Some are already suffering. Bloomberg Economics estimates that the average household in the bottom 40% of income distribution now has $1,200 less liquid assets than they did before the pandemic when adjusted for inflation.

Views: 29