How much could go wrong with banks and commercial real-estate loans this March compared to last?

Do the burgeoning bank troubles from commercial real estate loans gone bad plus the devaluation of bank reserves as a result of Fed tightening add up to dark days to come? Have banks done the hard work of saving themselves from a repeat of what we saw a year ago, last March?

CNBC reports today,

The forces that consumed three regional lenders in March 2023 have left hundreds of smaller banks wounded, as merger activity — a key potential lifeline — has slowed to a trickle.

That change, alone, means the problems could be worse. We already know that the Bank Term Funding Program just expired, which saved banks a year ago. We know that the cash banks had parked on the side at the Fed to the tune of $2.6-billion has wound down to almost nothing. Now add to that the fact that almost no one wants to merge with smaller banks that have been wounded when mergers are another major way banks save themselves in situations like this, and the safety nets have just about disappeared.

While many believed that, by now, the Fed would have reduced interest rates to where bank reserves held in the form of US Treasuries would not be as devalued, nothing has changed there either, nor is anything about to change anytime soon:

As the memory of last year’s regional banking crisis begins to fade, it’s easy to believe the industry is in the clear. But the high interest rates that caused the collapse of Silicon Valley Bank and its peers in 2023 are still at play….

As a result, hundreds of billions of dollars of unrealized losses on low-interest bonds and loans remain buried on banks’ balance sheets. That, combined with potential losses on commercial real estate, leaves swaths of the industry vulnerable.

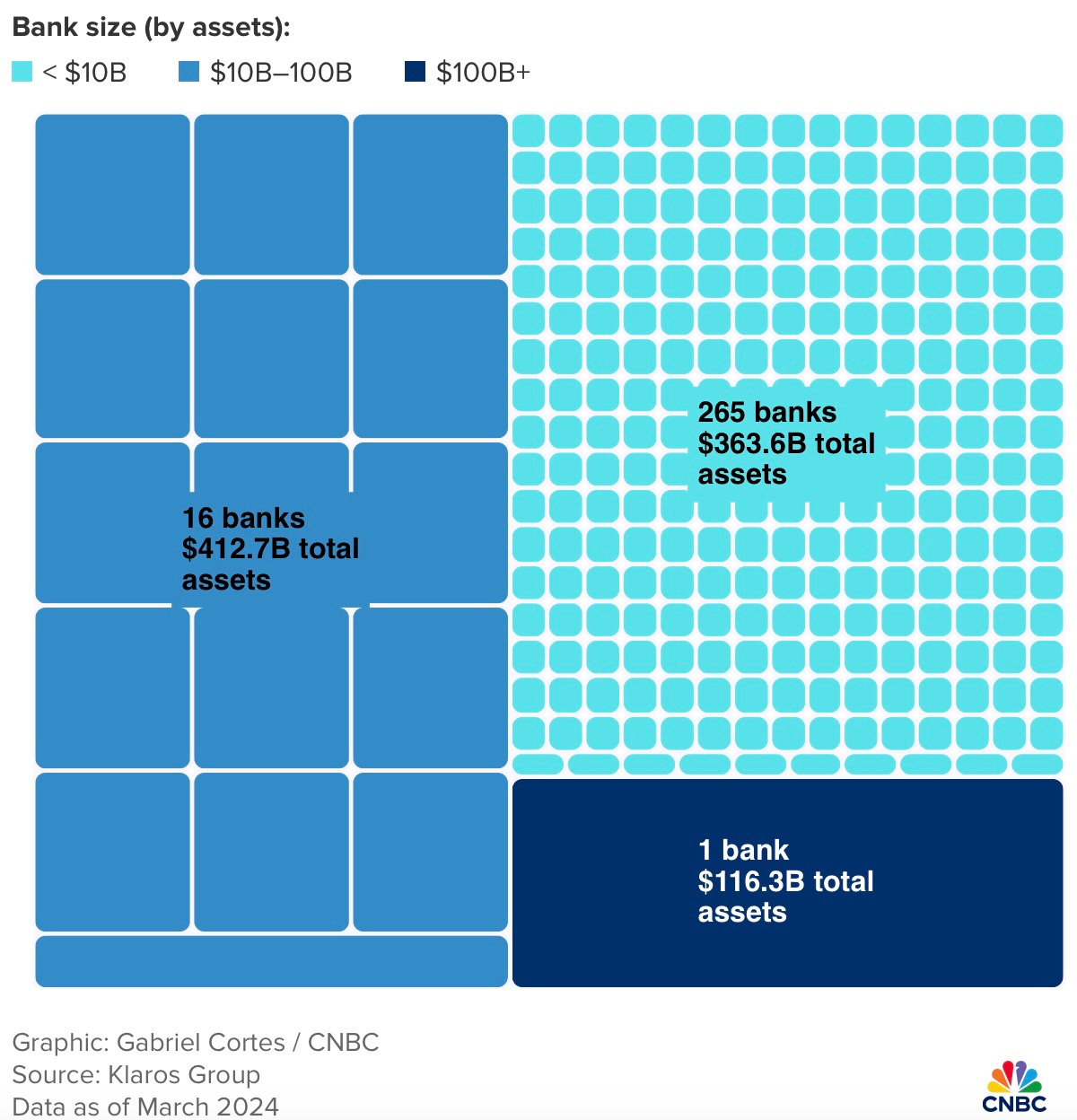

Apparently, banks have done very little to change the makeup of their reserves, while CRE defaults have gotten worse for an entire year to where banks are holding more rotten CRE debt. The banks poised for problems now total nearly a trillion dollars in assets and graph out like this in terms of small, medium and large-sized banks:

Those that were identified as potential trouble banks in this study were banks that held, at least, 300% of their total capital in outstanding CRE loans and where unrealized losses on Treasuries in reserve and losses on loan defaults amounted to, at least, 4% of total capital. (No banks were identified by name in this study, though New York Community Bank is certainly the big one based on its assets.)

As for the regulators who are supposed to be watching this, they are just as much letting this slide as they did going into March of 2023 where they said they knew about the problems and wrote to the banks that eventually failed to tell them they needed to do something about it. They sent a letter. Believe it or not, they’re using the same approach still, which I don’t find at all reassuring:

Behind the scenes, regulators have been prodding banks with confidential orders to improve capital levels and staffing, according to Klaros co-founder Brian Graham.

“If there were just 10 banks that were in trouble, they would have all been taken down and dealt with,” Graham said. “When you’ve got hundreds of banks facing these challenges, the regulators have to walk a bit of a tightrope.”

Bank stocks still have not fully recovered either, even after the latest moonshot stock rally, leaving banks in a position of needing to raise capital as New York Community Bank just did with Steven Mnuchin and his pals.

Powell putters

This is all why Chairman Powell warned congress in his last testimony that “there will be bank failures.” OK, of course, there are always some banks that are going to fail somewhere, but he said this as the result we can expect due to the CRE crisis.

“This is a problem we’ll be working on for years more, I’m sure. There will be bank failures,” Powell told lawmakers. “We’re working with them … I think it’s manageable, is the word I would use.”

“I think it’s manageable” is also not something I find reassuring, especially after the guy in charge says that there will be bank failures coming out of the massive CRE problems all over this country. How many bank failures. Five? Fifty? Does he have any idea. At least, we know it MIGHT be manageable.

So, as liquidity has continued to tighten up from more Fed QT, while continued high Fed interest rates has kept bonds held in reserve down in value (which could get worse if the Fed has to raise rates because of a resurgence in inflation, taking those bonds down even more), and just the stashed cash in the reverse repos drains … expect trouble. In fact, the list of potential problem banks, rather than resolving somewhat as banks have had some time to try to “manage” their problems like Powell describes, has grown by a lucky 13 since this time last year, according to the FDIC.

Banks canibalizing banks

After the implosion of SVB last March, the second-largest U.S. bank failure at the time, followed by Signature’s failure days later and that of First Republic in May, many in the industry predicted a wave of consolidation that could help banks deal with higher funding and compliance costs.

But that didn’t happen.

Besides that, one problem bank devouring another nearly dead bank doesn’t necessarily make for a healthy bank. New York Community Bank did exactly that during the 2023 go-around, eating up an arm of failing SVB, and look at where that got it. Indigestion.

On top of all that, banking is a little less profitable now due to regulation. (Not that the greedy banksters aren’t making bank, but the lesser bankers are in a tighter spot.) And it is the regulators who are making those mergers that might normally be lifelines a lot harder by rejecting a lot of them. Maybe they should. Maybe they are all like NYCB’s consumption of SVB body parts—not such a good idea. Eating the supposedly cleaner meat off a rotting corpse doesn’t necessarily guarantee new high-protein muscle building for the eater. One would think these things would be obvious, but sometimes the desire to pick up something cheap in a firesafe, even if it might be a bit tainted is too strong, I guess.

One deterrent to mergers is that bond and loan markdowns have been too deep, which would erode capital for the combined entity in a deal because losses on some portfolios have to be realized in a transaction.

In other words, banks don’t have to mark many of their bonds down to market value if they plan to hold them to term, but in a merger, they do have to market those bonds down to market, making their problems worse on paper.

This was a problem we saw in the Great Financial Crisis, too, where banks that consumed other banks wound up needing massive bailouts because they got so sick from what they ate. Eating a piece of Bear Stearns meant its consumer, JPMorgan, needed a huge bailout to wash the Bear down (just so that JPM could become all the more “too big to fail”). Fatten them up then bail them out and make them bigger seemed to be the plan, as I wrote about at the time with dashes of humor (I hope) here.

Well, technically, the bailout of Bear happened as part of the deal that stuffed the dying Bear into the belly of JPM:

Federal Reserve Chairman Ben Bernanke defended the bailout by stating that a bankruptcy of Bear Stearns would have affected the real economy and could have caused a “chaotic unwinding” of investments across US markets.

But, hey, at least, the Federal Reserve has lots of experience managing these kinds of things, so maybe that is what Powell meant by saying he thought the Fed could manage this kind of stuff … like they did last time.

And, surprise, surprise,

The merger restrictions on the industry have been the equivalent of the Jamie Dimon Protection Act.

No doubt. Maybe Powell is even hoping “there will be bank failures.” That’s how he serves his friend up some nice snacks to make JPM bigger and fatter all the time.

How big of a bank-busting feast will JPM get to enjoy

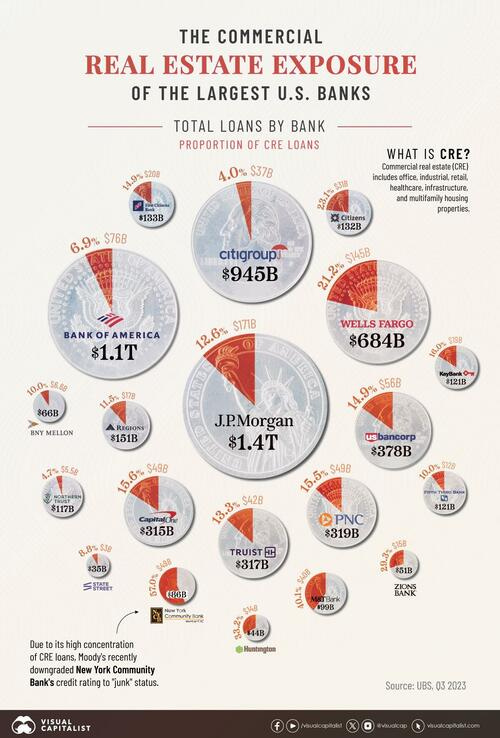

Here’s a picture that does identify the largest banks with the most exposure, which puts JPM in the middle as the biggest bank by loans, which also shows JPM as a bank with fairly large exposure to the CRE crisis based on percentage of its loans.

The six largest U.S. banks saw delinquent commercial property loans nearly triple to $9.3 billion in 2023 amid high vacancy rates and increasing borrowing costs…. In fact, for almost half of all U.S. banks, commercial real estate debt is the largest loan category overall.

Keep in mind, though, the banks with the most exposure as a percentage of total loans or percentage of total assets are the smaller community banks, which is where most of those real-estate loans are made, not the behemoths shown above; so the problem is worse at the mom-and-pop stops of the banking world.

To make it all worse, do you remember the term mortgage-backed securities? A big thing in the Great Recession, right? Well, these banks have been at it again and bundled these loans into packages much like those MBS. Except, to make that better, they created a new kind of instrument that is only for loans that are considered too “speculative for conventional mortgage-backed securities.” Sort of like MBS for the worst of the worst.

So, what could go wrong when some unnumbered bunch of banks do fail as Powell manages the known problem after his regulators failed to force corrective action?