In a distressing reality check, the average American is in the throes of an unprecedented financial crisis, and the situation demands swift and decisive action. The stark numbers tell a harrowing tale: a staggering sixty percent of American families are on the brink, navigating the precarious path of living paycheck to paycheck. A record number are forced to take on second or even third jobs merely to stay afloat.

The hidden tax of inflation is hitting hard, with the average American worker now burdened with an extra $4.97 per hour—effectively doubling their federal income tax. This is not a mere statistic; it’s a wake-up call, urging all Americans to take their personal finances seriously, to stop sleepwalking through these turbulent times.

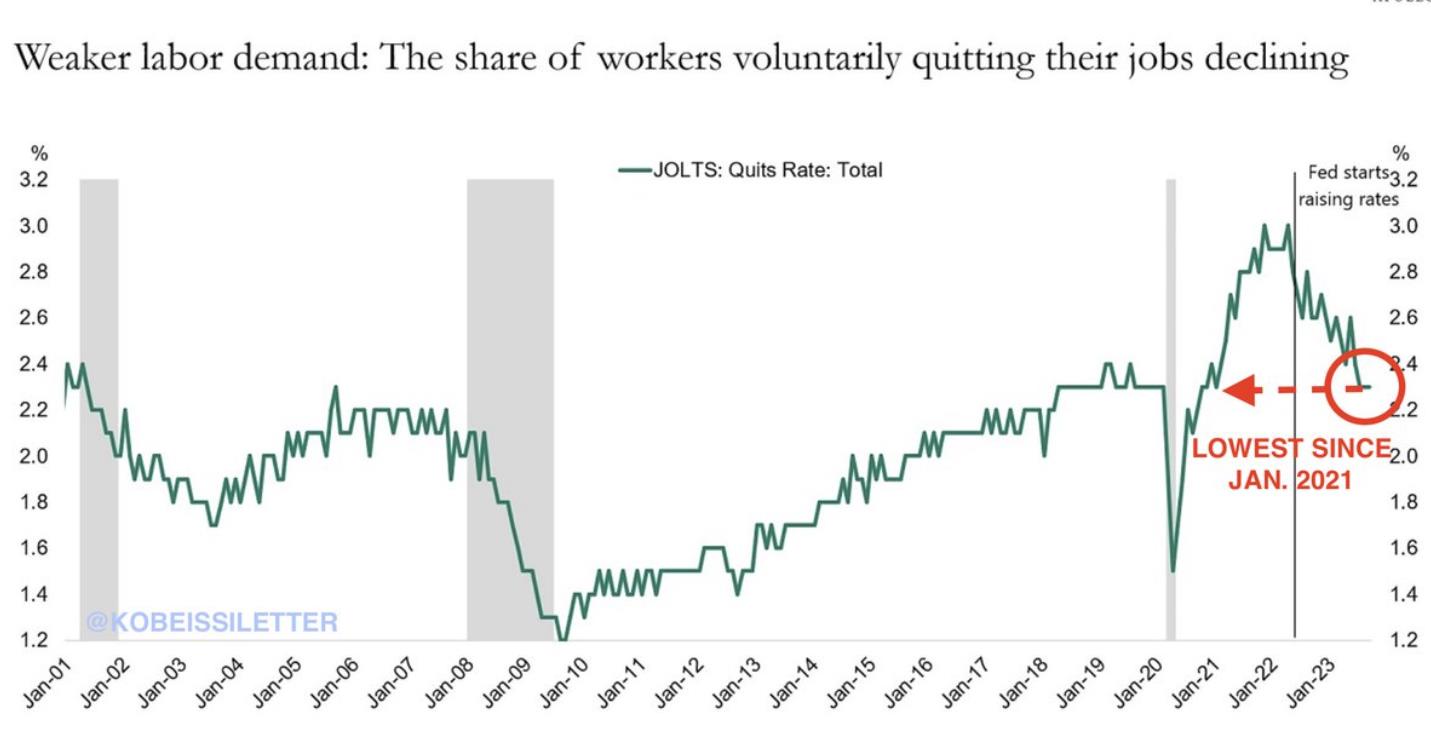

Recent developments underscore the urgency. Hasbro’s announcement of cutting 1,100 jobs is a stark reminder that no one is immune. The labor market landscape is shifting, with the share of workers voluntarily quitting their jobs dropping to a concerning low of 2.3%. This decline is a red flag, signaling weaker labor demand in 2024, coupled with a slowdown in job growth and persistently high interest rates.

As the economy grapples with the aftermath of the pandemic, the reversal of labor market conditions is apparent. Consumers, now depleted of excess savings, are at the mercy of employment, exacerbated by record-high interest rates on credit cards reaching an alarming 25%.

The housing market, once a beacon of stability, is showing signs of strain. Over 3% of U.S. homes sold at a loss between August and October 2023—a significant increase from the previous year, with the median loss averaging around $40,000. Divorced couples are resorting to cohabitation due to the formidable challenges of securing alternative housing in this tough market.

In conclusion, urgent action is the need of the hour. The financial struggles faced by the average American demand immediate attention and bold solutions. Whether through personal financial prudence or swift, comprehensive economic policies, the time for action is now. America cannot afford to wait.

Sources:

Article:https://t.co/AzjbT1JSIR

— E.J. Antoni, Ph.D. (@RealEJAntoni) December 11, 2023

Hasbro laying off 1,100 workers as weak toy sales persist into holiday season

Everything the Biden regime says is a lie. https://t.co/Y6n3liI9p2

— Catturd ™ (@catturd2) December 12, 2023

The share of workers voluntarily quitting their jobs is down to 2.3%.

This is the lowest since January 2023 and down from 3.1% prior to the Fed started rate hikes.

Weaker labor demand will be the theme of 2024 as job growth slows and rates stay higher for longer.

Furthermore,… pic.twitter.com/jdMGyASvl5

— The Kobeissi Letter (@KobeissiLetter) December 11, 2023

More than 3% of U.S. homes sold at a loss August–October 2023 — up from 2.4% a year ago, per Redfin.

The median loss was around $40,000.

— unusual_whales (@unusual_whales) December 11, 2023

The housing market is so tough that divorced couples are still living together, per WSJ.

— unusual_whales (@unusual_whales) December 11, 2023

2008-09 was the worst recession I forecasted in real time. Again, cries of “What recession?” until it was well underway. As late as June 2008, most of the FOMC thought the economy would “skirt recession” even though it had started 6 months before. Go figure. pic.twitter.com/x0hm0nJC96

— Arturo Estrella (@intheyield) December 11, 2023