by nobjos

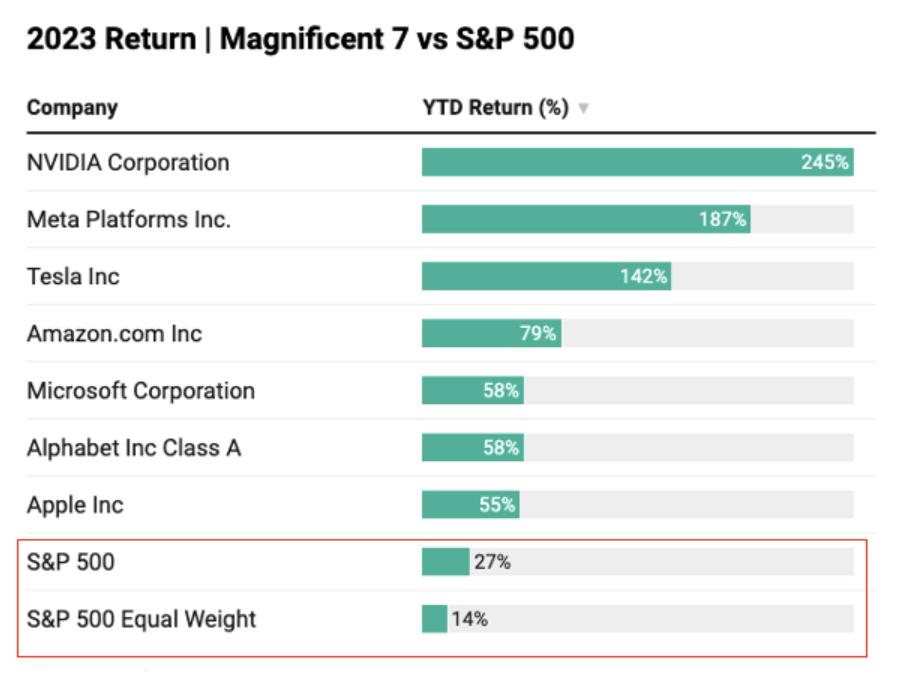

This chart has nothing to do with the weights of the stocks in the index. It’s highly unusual for the biggest companies to outperform the index (aka size effect).

The latest research from Dimensional shows that once a stock joins the top 10 largest U.S. stocks, its subsequent returns tend to lag the market.

Based on the last 95 years of data, these stocks had an average annualized return of 20% in excess of the market 5 years before joining the top 10 list. But once they joined, they underperformed the market by 0.9% in the next 5 years.

So this year was an outlier.