Everyone in the US is a an Apple shareholder through index funds, 401ks, etc.

It’s a horrible use of capital.

BREAKING: Apple stock, $AAPL, surges after the company announces a $110 BILLION share buyback, the largest in history.

Apple reported quarterly revenue of $90.8 billion and EPS of $1.53, both of which were above expectations.

However, revenue in Greater China was down by 8.1%… pic.twitter.com/6RLmzX7YHa

— The Kobeissi Letter (@KobeissiLetter) May 2, 2024

Apple has no tricks left. They can't innovate, their product sales are tanking, they are blowing their cash on share buybacks.

— Financelot (@FinanceLancelot) May 2, 2024

Apple’s $110 Billion Stock Buyback Plan is Largest in US History

(Bloomberg) — In a move fitting for one of the largest companies in the world, Apple Inc. just announced the biggest US buyback ever, saying its board approved an additional $110 billion in share repurchases.

With the announcement, the maker of iPhones tops its own record for largest buyback value announced in the US. In 2018, the tech giant authorized $100 billion in share repurchases, according to data compiled by market research firm Birinyi Associates that goes back to 1999.

“An astonishing number,” said Steve Sosnick, chief strategist at Interactive Brokers LLC. “Apple may be acknowledging that they are becoming a value stock that returns money to shareholders rather than a high powered growth stock that needs its cash for R&D or expansion.”

https://finance.yahoo.com/news/apple-110-billion-stock-buyback-220603961.html?.tsrc=rss

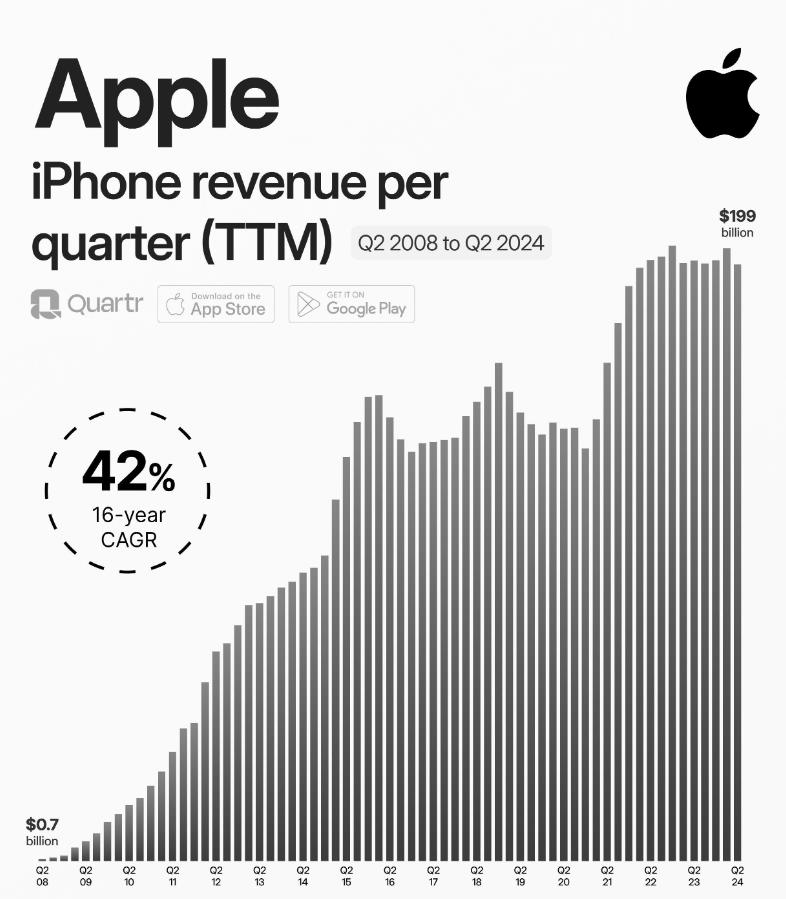

Apple’s iPhone revenue per quarter:

h/t Southwestern