How is the 2023 housing market DIFFERENT from 2008?

There’s a new player: PRIVATE EQUITY

In the wake of the 08 crisis, private equity started buying up foreclosed residential homes in bulk

What does this mean for the housing market?

1/3

— Amy Nixon (@texasrunnerDFW) June 28, 2023

We’re in uncharted territory with US housing

In 2007, our housing market had NEVER seen big National home price declines

In 2023, we’ve never seen what happens in a high rate environment when institutions own swaths of residential properties

We’re about to find out

3/3

— Amy Nixon (@texasrunnerDFW) June 28, 2023

“We’re in uncharted territory with US housing

In 2007, our housing market had NEVER seen big National home price declines

In 2023, we’ve never seen what happens in a high rate environment when institutions own swaths of residential properties

We’re about to find out ”

Beware: Bank lending standards at historically high levels point to a sharp rise in the default rate pic.twitter.com/GhgM35Dfzv

— Game of Trades (@GameofTrades_) June 28, 2023

Beware: Bank lending standards at historically high levels point to a sharp rise in the default rate pic.twitter.com/GhgM35Dfzv

— Game of Trades (@GameofTrades_) June 28, 2023

Despite a close positive correlation since 2022, the market has significantly diverged from this liquidity index

The last time this happened, S&P 500 had a sharp drawdown pic.twitter.com/4pE2u6QJmu

— Game of Trades (@GameofTrades_) June 28, 2023

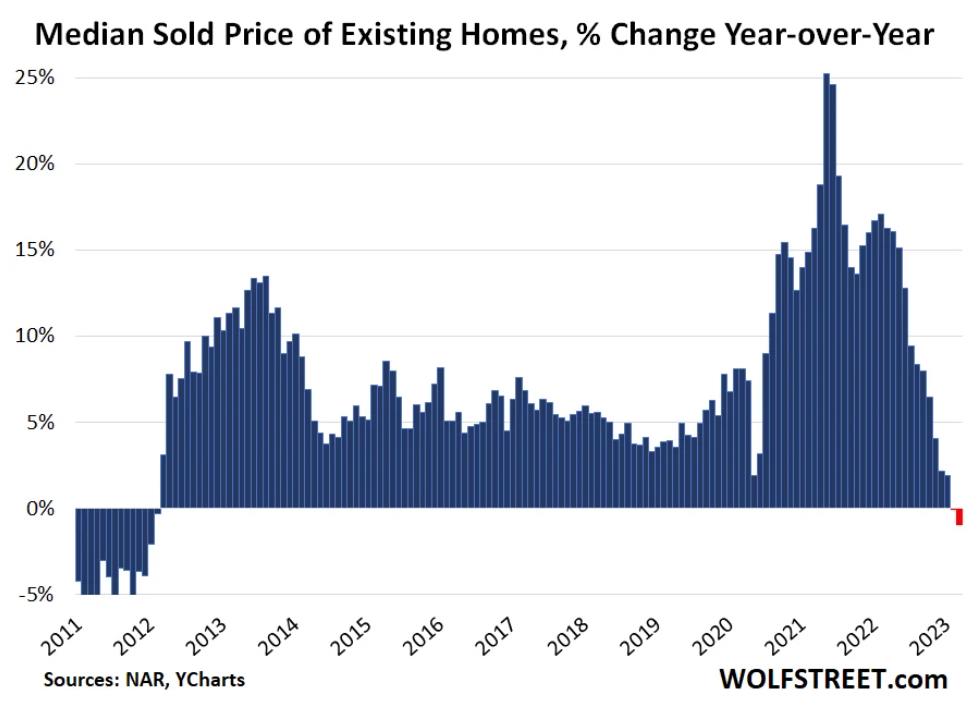

Home prices in the US declined for the first time in 11 years:

Housing Prices Are Falling As Reality Sinks In

Apartment renters in Las Vegas are currently enjoying the upper hand, with landlords offering enticing perks such as free rent, event hosting, and reduced rents. The city has seen a decrease of 2.2% in rental rates during the first quarter of this year. Similar trends are observed in Sunbelt cities like Phoenix and Atlanta. The surge in multifamily construction, fueled by low interest rates and high rental demand, is now facing a downfall as interest rates rise and economic viability diminishes. The government’s intervention during the pandemic, including shutdowns, zero interest rate policies, and fiscal stimulus, has contributed to the current state of the apartment market. The Austrian business cycle theory suggests that government intervention and subsequent market adjustments are to blame for the ongoing apartment sector depression.

Largest Ever 6-Month Decline in Price Explains the New Home Buying Surge

The median price of new homes experienced the steepest six-month decline ever in April, but saw a slight increase in May. This decline reflects builders’ response to affordability concerns caused by high prices, rising mortgage rates, and inflation. Existing home sales, on the other hand, have mostly stabilized at a low level.

US Purchase Mortgage Demand DOWN -45.3%, Refi Demand DOWN -91%, Mortgage Rate UP 128%

Mortgage applications rose by 3.0 percent, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey. The Market Composite Index, which measures loan application volume, also increased by 3.0 percent. However, mortgage purchase demand is down by 45.3 percent, refinance demand is down by 91 percent, and mortgage rates have increased by 128 percent under the current economic conditions.

Views: 365