The economy is completely bifurcated.

If you own assets you’re doing well, if you don’t own assets you’re living in the Great Depression 2.0

The question is how much longer can the US economy be propped up by asset prices?

My answer: not long pic.twitter.com/TUrv8sRl2w

— George Gammon (@GeorgeGammon) August 29, 2024

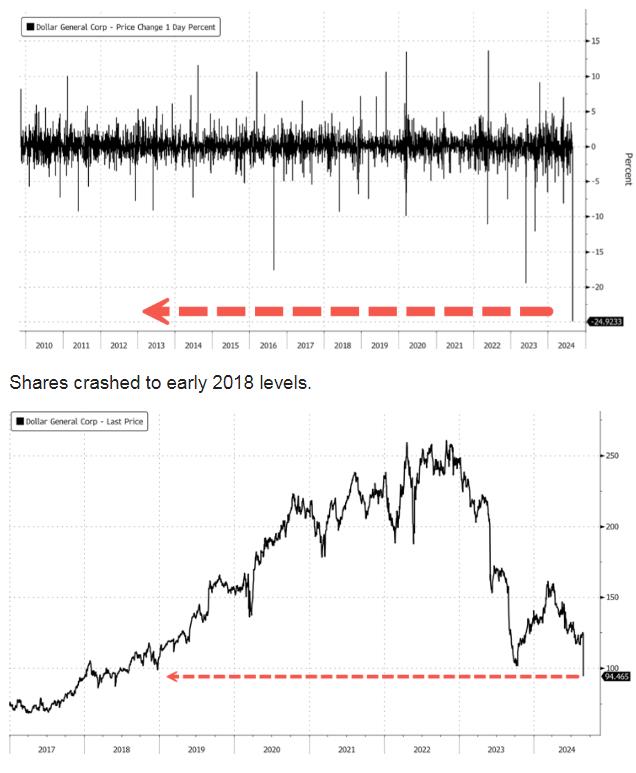

The recent collapse of Dollar General shares is a glaring indicator of this economic facade. The nation’s largest discount retailer saw its stock crash 23.5%, plunging to levels not seen since 2018, following a disastrous second-quarter earnings report. Wall Street’s expectations were missed, and the retailer slashed its full-year outlook, citing the grim reality that its core customers are “financially constrained.” The ripple effect was immediate, with competitor Dollar Tree also taking a hit, dropping over 9% in early trading.

Source: Zerohedge

What are we actually producing in this so-called strong economy? Certainly not housing, as residential investment was the weakest sector in Q2 GDP, and revisions only made it worse. The American economy seems to be a hollow shell, propped up by the spending habits of the wealthy and the desperation of the poor.

And while this financial turmoil unfolds, the Biden administration’s PR machine was quick to tout a surge in personal consumption—a move that feels increasingly detached from the economic pain felt by everyday Americans. According to the Chicago Fed’s NFCI, credit conditions are the loosest since January 2022, yet it’s clear that access to credit isn’t solving the underlying issue of financial strain for the average consumer.

The collapse of Dollar General’s shares serves as a stark reminder that America’s economic foundation is anything but stable. When even the most budget-conscious consumers are forced to tighten their belts, it’s a clear sign that the system is failing. The stock market may react to earnings misses, but the real crisis lies in the growing disconnect between GDP figures and the lived reality of millions of Americans struggling to make ends meet.

America’s GDP is basically just rich people buying things, poor people opening credit cards to buy things, and a bunch of money thrown at AI

What are we producing?

Building?

Not housing, because Residential investment was the weakest sector in Q2 GDP, and revised down pic.twitter.com/QPAILKNTwj

— Amy Nixon (@texasrunnerDFW) August 29, 2024

US pending home sales are lower than when

*checks notes*

The entire country was shut down and we had 20% unemployment and everyone thought they were going to die https://t.co/YenqGguNn1

— Amy Nixon (@texasrunnerDFW) August 29, 2024

#recession … #GFC2 US #Consumer edition https://t.co/EcEAZFgZyH pic.twitter.com/0LfYo9nnYk

— Invariant Perspective (@InvariantPersp1) August 29, 2024

Bulls are rotating out of Tech stocks while praying for rate cuts. It's a dangerous game to play with no safety net other than imaginary Fed bailout.

The only thing keeping GDP from imploding is a 6% budget deficit.

"The consumer is strong" pic.twitter.com/Sqz30BzGw6

— Mac10 (@SuburbanDrone) August 29, 2024

At the Dollar General on Tuesday, two miles from our farm. I want to take a video camera and interview all the parties. This would be hilarious. 🤣 pic.twitter.com/0pLcoazVuL

— David C. Baker (@davidcbaker) August 23, 2024

Sources:

The prices are crazy at the grocery store these days.

Which prices jump out at you the most?

Steaks? pic.twitter.com/RP00l63sc4— Wall Street Silver (@WallStreetSilv) August 28, 2024