Credit Scores Abruptly Plunge As Americans Stop Paying Down Debt; Synchrony Financial Warns

Over the past few years, tens of millions of consumers witnessed a remarkable increase in their credit scores, primarily due to helicopter money dished out by the federal government, rock-bottom interest rates, and a pause on student-loan payments. However, the party has come to an abrupt end as credit scores plunge.

Bloomberg reports Synchrony Financial is closing inactive accounts and capping card limits for a number of clients as macroeconomic headwinds mount.

“What we are seeing is people who are doing significant score migration — a 680 or a 690 going to a 620,” Synchrony Financial CFO Brian Wenzel said in an interview.

Wenzel said, “Folks who had paid down debt, their scores had gone up, and now they’re reverting back to more normal performance.”

Credit Scores Abruptly Plunge As Americans Stop Paying Down Debt; Synchrony Financial Warns https://t.co/T3qibkDfwM

— zerohedge (@zerohedge) July 20, 2023

Here are the latest signs that Americans are running out of savings

Americans are running out of savings.

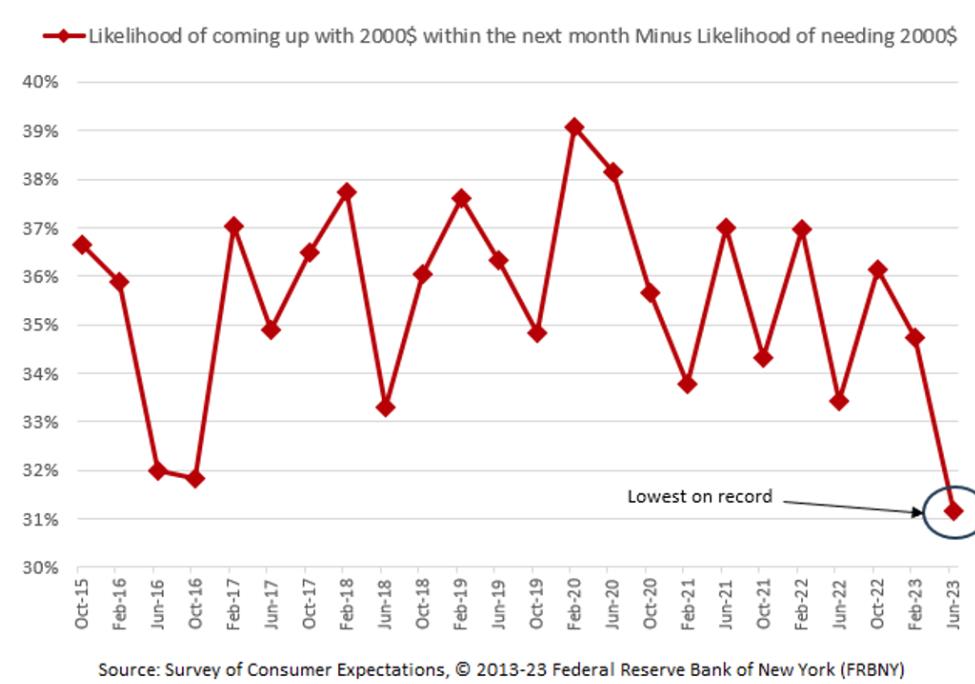

Christophe Barraud, chief economist and strategist of Market Securities and someone who regularly appears among the ranks of the top economic forecasters, pointed to a New York Fed survey which found that the average likelihood of a credit applicant needing $2,000 within the next month rose to the highest level since Feb. 2021, while the average likelihood of being able to come up with $2,000 fell to the lowest level since Feb. 2022.

— Win Smart, CFA (@WinfieldSmart) July 20, 2023

261 views