by TonyLiberty

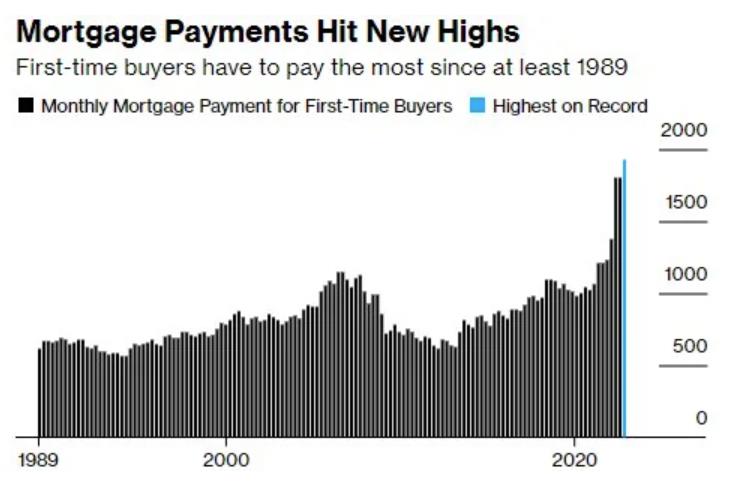

The housing market is in a difficult state, with low inventory, high mortgage rates, and high prices making it difficult for buyers to afford homes.

Despite aggressive interest rate hikes by the Federal Reserve, home prices have remained high. First-time homebuyers are having difficulty competing with investors, who are able to make all-cash offers on homes.

Many homeowners are sitting on low mortgage rates, which makes it less appealing for them to sell their homes and take on a new mortgage with a higher interest rate.

The housing market may start to slow down the economy. This is because the housing market is a major driver of economic growth. When the housing market is struggling, it can lead to a decrease in consumer spending, investment, and employment.