TL;DR:

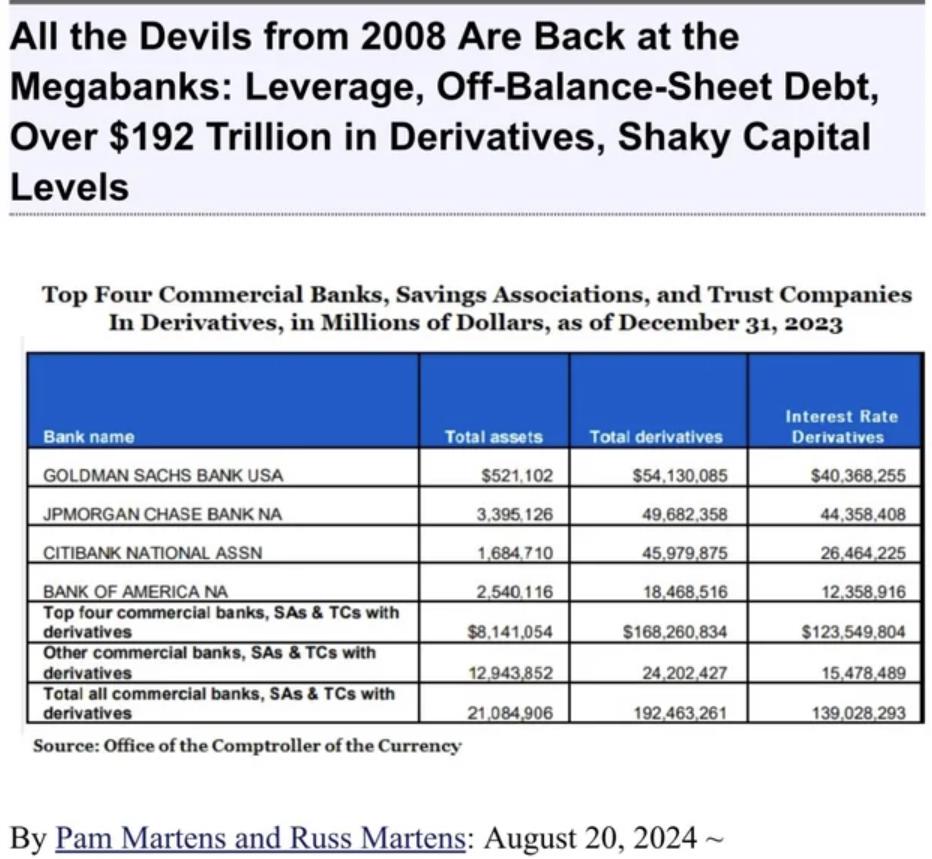

- Derivatives Danger: Four major U.S. banks hold 87% of all derivatives, totaling $168.26 trillion.

- Dodd-Frank Failure: The 2010 law failed to prevent the return of risky derivatives practices.

- Leverage and Off-Balance Sheet Debt: Megabanks have excessive leverage and hide debt off their balance sheets.

- Financial Crisis Repeat: The current situation resembles the 2008 crisis, with risks like those that led to Citigroup’s collapse.

- Need for Reform: Congress should restore the Glass-Steagall Act to separate federally-insured banks from risky trading activities.

h/t F-uPayMe

86 views