by elProtagonist

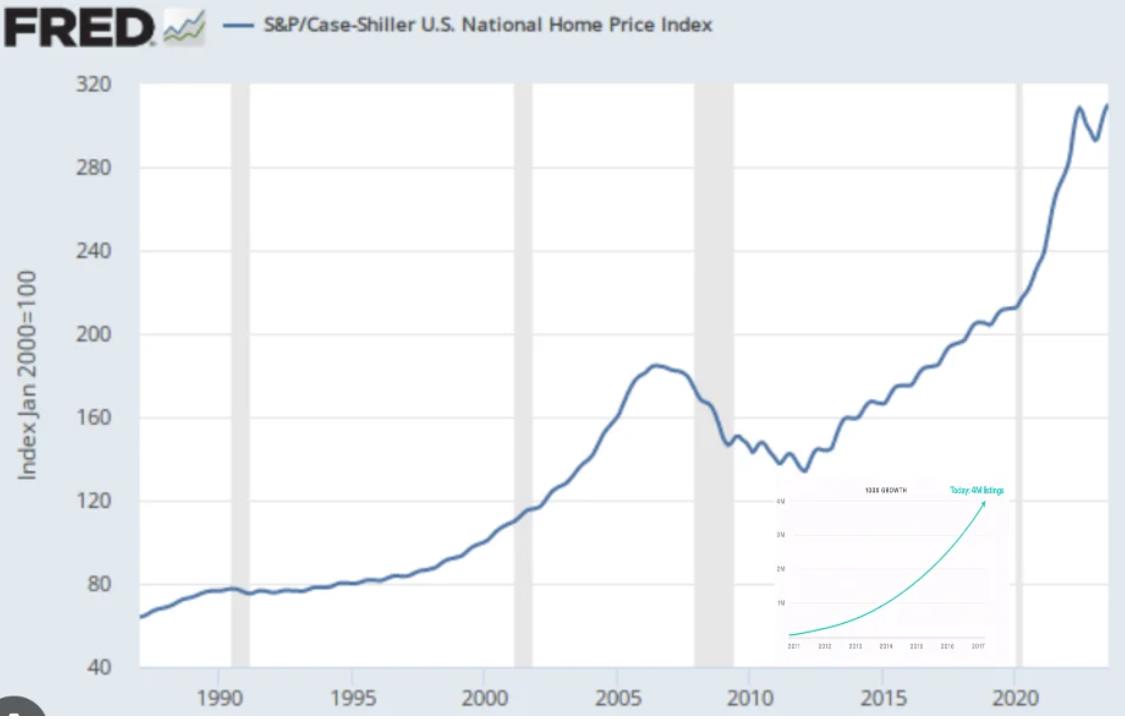

As you can see from the graph, there is a direct link between the growth of AirBNB listings and housing prices.

The economists have been looking at the housing market the wrong way. The problem is that RESIDENTIAL properties are being used for COMMERCIAL purposes. People are buying secondary homes as investment properties. This creates more scarcity and therefore higher housing prices.

I’ve seen firsthand people buying homes will all cash and then list them as AirBNBs. Once the buyer generates enough income, this cycle continues over and over again.

The only way to stop this is to crack down on AirBNBs. The fed can either tax them or as Canada and NYC has started doing, restricting short-term rentals. If we don’t do something soon, this problem is going to get a whole hell of a lot worse.

139 views