via Egon von Greyerz:

The health of the world economy is clearly linked to the health of global leaders. That clearly raises the question if unhealthy leaders create a diseased economy or if an ailing economy creates sick leaders.

It doesn’t really matter what came first since the Western world economy is now as close to being terminally ill as it has ever been and its population is continuously getting unhealthier.

And weak Western leaders focus on peripheral political issues, whether it is climate, ESG, Covid vaccines, gender and other woke topics.

Nothing new in that. Arranging the deck chairs on a sinking world economy clearly seems meaningful to hapless leaders rather than preventing the ship from sinking.

Gargantua in the picture above/below personifies, gluttony, greed and a self-indulgent world. But we don’t need to turn to a 500 year old story book by the French author Rabelais to study the vices of mankind.

The health of a nation is clearly also reflected in the health of its leaders.

Recent health leaders in the USA, Belgium, Canada and Britain certainly don’t give a signal of “mens sana in corpore sano” or “a healthy mind in a healthy body” as the Roman poet Juvenal wrote 2000 years ago.

Or as the Greek philosopher Thales said 2600 years ago: “What man is happy? He who has a healthy body, a resourceful mind and a docile nature.”

We must also ask if the poor health of the global financial system is linked to the choice of the chief of the Bank of International Settlement (BIS, the central bank of central banks).

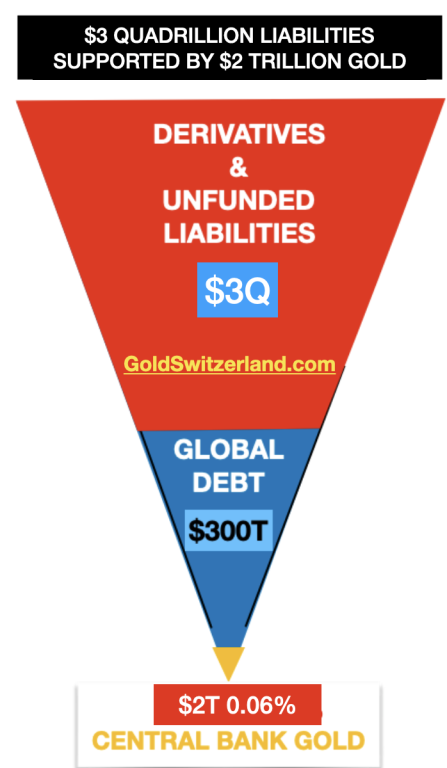

The latest BIS quarterly review refers to the opaque off balance sheet derivatives market. I am still of the opinion that total derivatives including the shadow market could easily be $2-3 quadrillion. $2 QUADRILLION DEBT PRECARIOUSLY RESTING ON $2 TRILLION GOLD

Well, it certainly seems like Gargantua was a role model for many of these leaders. But unhealthy living is not just the privilege of leaders. Only 10% of adult US population was obese 50 years ago and today 45% are obese. So the trend is clear and within the next 10 years, over 50% of the US population will be obese. And Western Europe will of course follow the US example as they always do.

So why am I talking about obesity in a financial newsletter? Well because as I said above, it comes from self-indulgence and greed which is the current state of the Western world economy.

As I have discussed many times, we are coming to an end of a major economic and cultural cycle.

Only future historians will know if this is a 100, 300 or 2000 year cycle. If I ventured a guess, I would have thought that it could be a very long cycle like 2000 years.

There are many similarities with the ending of the Roman Empire like, debts, deficits, taxes, decadence, self-indulgence, wokeness etc.

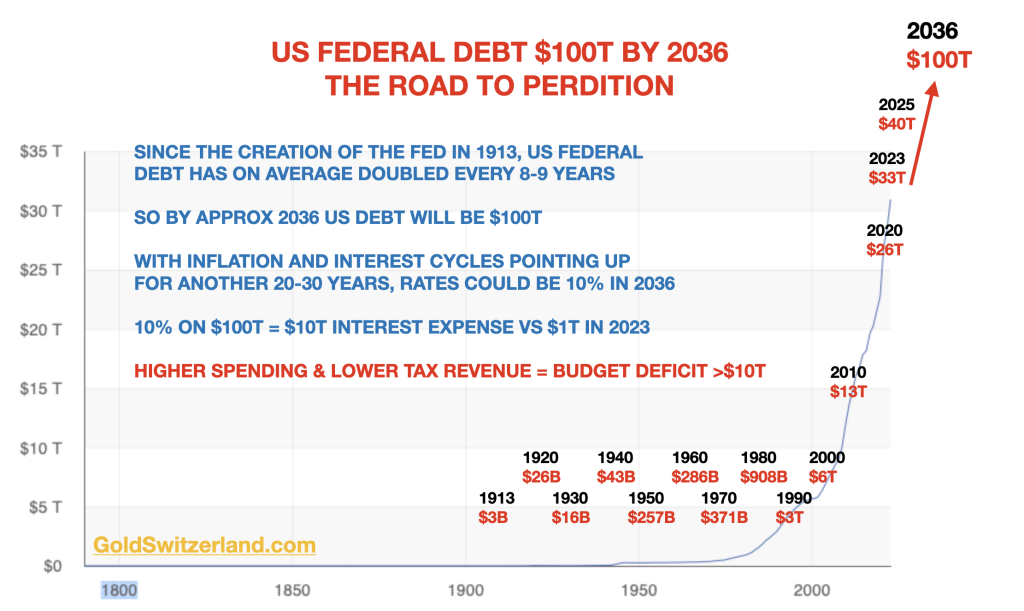

Empires don’t disappear overnight. It is a long outdrawn process. If we take a starting date for the beginning of the decline of the current Western Empire, dominated by the USA, it would probably be the creation of the FED in 1913. This private central bank was the great enabler for bankers and industrialists to control the system. As Mayer Amschel Rothschild said in the late 1700s: “Give me control of a nations’s money and I care not who makes the laws.”

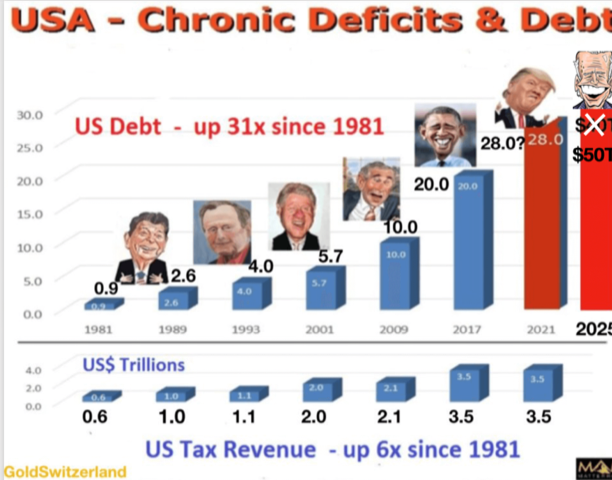

The mighty US economy emerged after WWI as a major economic power whilst the European continent was suffering from the effects of the war. In spite of superior economic performance, the US already started to accumulate budget deficits in the early 1930s. And since then buying the people’s votes was the number one criterion rather than a balanced budget.

So far, in the last 110 years there have been less than 10 years with a real surplus in the US. As I often point out, the Clinton years produced fake surpluses since the debt continued to rise. But plus ça change – things never change.

As long as there has been any form of money, governments have always found ways to destroy its value.

There are many ways to debase a currency, like less gold or silver in a coin or using a cheaper metal. Paper money has obviously been the perfect tool for corrupt governments. This is “the Finger Snapping Method” as a Swedish central banker explained when asked how money is created. Just snap your fingers and the money arrives. Or as my colleague Matt Piepenburg calls it “Mouse Click Money”.

EMPIRE OF DEBT AND MEDIOCRITY

Having driven through Corsica this summer, you realise that wherever you go in these parts of the world, you are in the midst of history, a history which was so much more glorious than the current Empire of Debt and mediocrity.

Corsica was ruled by the Republic of Genoa from 1284 to 1768 when it was ceded to France. Napoleon was from an Italian noble family and was born in Corsica in 1769 a year after the island became French. So by just one year, history could have looked very different with Napoleon as an Italian General and leader.

Napoleon wasn’t the only famous Corsican, Christopher Columbus was born there 3 centuries earlier and became famous for having led the way to the colonisation of the Americas when he in 1492 sailed across the Atlantic believing that he would reach Asia.

But sadly, those glorious periods of history are long gone. Today there are no heroes and few statesman or explorers who make history.

Not a single one of today’s “glorious leaders” will be remembered by history, whether we talk about Biden, Sunak, Macron, Scholz, or Meloni.

Sadly the world has a motley crew of aspiring statesmen who will be forgotten the day after they have left office.

But they will all have left a memorable legacy – a debt burden of $340 trillion plus derivatives and a shadow banking system of $2 quadrillion at least.

And it is this debt and the irresponsible deficit spending that leaders should focus on if they intend to cure their economies.

But sadly no one has the courage to rein in unlimited deficit spending. Because buying the favour and votes of the people is the only way to conclusively hang on to power.

So what will happen next is self-evident:

MORE DEFICITS & RUN AWAY DEBT

As the graph below shows, US debt will at least be $40 trillion at the beginning of the next presidential period. I forecast this already 7 years ago when Trump was elected president. No genius required for this forecast just pure extrapolation of the trend. On average US debt has doubled every 8 years.

But $40 trillion debt by 2025 is just the beginning. Just look at the next graph.

With the same extrapolation of debt doubling every 8 years which has been very accurate, debt will be $100 trillion in 2036.

As the interest rate cycle continues to rise, we will at a minimum see 10% by 2036. Personally I think it can be a lot higher.

Still at 10% on $100 trillion debt, just the interest cost will be $10T against $1T currently.

I would be surprised if the budget deficit in 2036 will be less than $10T!!

So there we have it, the road to perdition for the US seems very clear.

Sure, tit could be argued that this is all speculation. Of course it is, but it is more than that since all it does is to extrapolate historical trends. So dismiss it at your peril.

HIGHER INTEREST RATES AND INFLATION, COLLAPSING BOND MARKETS,

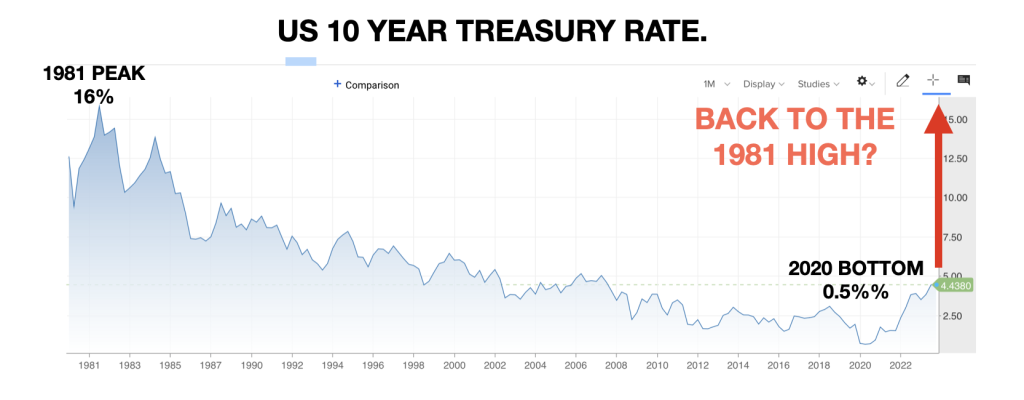

Interest rates peaked in 1981 with the 10 year treasury at 16%. We saw the cycle bottom in 2020 at 0.5%. Rates are now going up for probably decades but with the normal violent volatility.

Long term inflation has just started an uptrend. No one should be fooled by the temporary correction of the rising trend.

HIGHER COMMODITY PRICES, ESPECIALLY OIL

As fracking returns now have peaked, the world has seen peak oil. Add to that the increased cost of producing energy as I have written about in previous articles and we will have the perfect energy storm.

LOWER ASSET PRICES

The Everything Bubble will now turn to the Everything Collapse as I have outlined in previous articles.

HIGHER GOLD PRICE

As gold buying continues to move from West to East with gold most probably becoming the new Reserve Asset for central banks instead of the dollar, there will be a total repricing of gold as I have covered in previous articles, such as A DISORDERLY RESET WITH GOLD REVALUED BY MULTIPLES. Gold demand will increase substantially. Since gold production cannot be increased, an increase in demand can only be satisfied with higher price, not more gold.

IT IS NOT ABOUT BEING RIGHT BUT ALL ABOUT NOT BEING WRONG

As I often say, forecasting is a mug’s game. So it is easy for critical voices to reject my predictions above.

However, no one should focus on if my predictions are inaccurate.

Instead, everyone should consider the massive risk cloud that is hanging over the world currently. And I haven’t even discussed geopolitical risk.

The key is to protect yourself, your family and your investors.

Wealth Preservation is absolutely critical and physical gold is historically one of the best investments for protecting your assets.

Everyone is going to lose out in coming years. The ones who lose the least will be the winners.