Ever since the U.S. abandoned the Gold Standard in 1971, U.S. debt, also called Treasuries have become the bedrock of our financial system.

Put in the very simplest of terms, Treasuries are the senior most asset class, with their yields representing the “risk free” rate of return against which all risk assets (stocks, real estate, commodities, etc.) are priced.

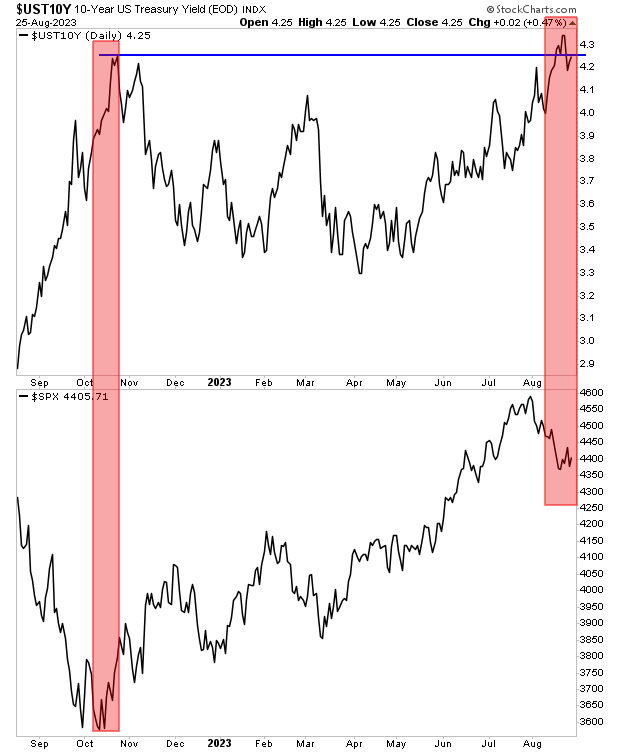

Treasury yields are the reason stocks exploded higher from the April 2020 lows. They are also the reason stocks peaked and began a bear market in March 2022. And they are the reason stocks bottomed in October 2022, igniting one of the best bull runs in recent history.

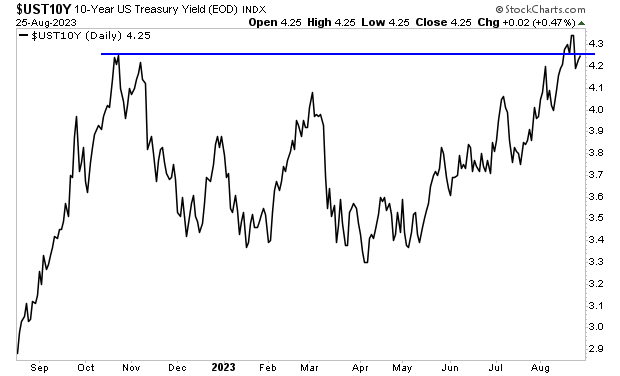

I mention all of this because the yield on the 10-Year U.S. Treasury, which is the single most important bond in the world, has recently hit new highs. And if it doesn’t stop right here and now, stocks are primed for a major collapse.

How major?

The last time the yield on the 10-Year U.S. Treasury was at its current level, the S&P 500 was trading at 3,600. Today it’s at 4,400.

See for yourself.

Sure, stocks might hold up with Treasury yields at these levels for a time. But the clock is ticking. And it’s only a matter of time before we get a NASTY risk off move.

132 views