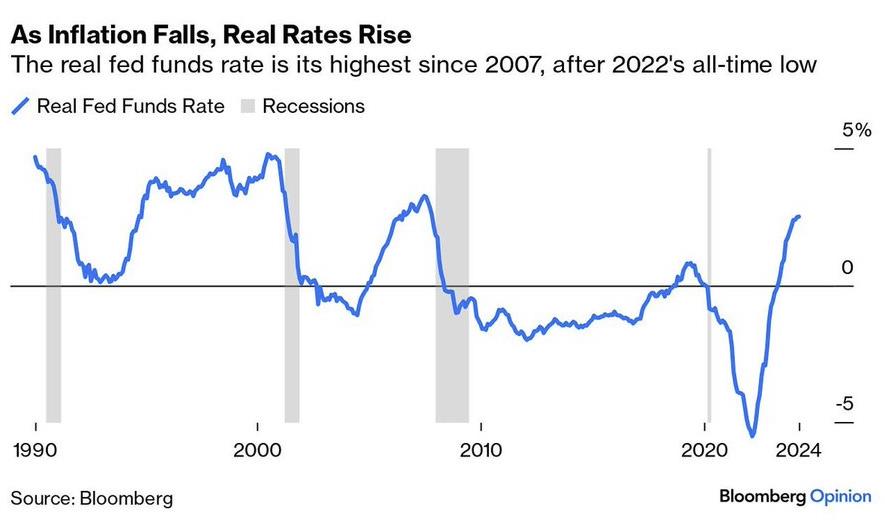

The Federal Funds Rate, which is the interest rate at which depository institutions lend balances to each other overnight, has indeed reached its highest level since 2007. As of May 2024, the rate was reported at 5.33%, which is a significant increase from the historic low of 0.08% in 2022.

Retail spending in freefall

Total card spending was down 0.4% y/y in the week ending Jun 1, according to BAC aggregated credit & debit card data. Retail ex auto spending per HH came in at -1.9% y/y. pic.twitter.com/PAog5iPXPT

— zerohedge (@zerohedge) June 7, 2024

When considering the impact of inflation on retail spending, it’s important to look at real spending, which is adjusted for inflation. If nominal retail spending is down, but inflation is high, then real spending could indeed be in decline, which might be described as a “freefall” in purchasing power.

For example, if total card spending was down 0.4% year-over-year in the week ending June 1, but inflation was at 5% during the same period, then the real spending would have decreased by approximately 4.6% when adjusted for inflation. This would indicate a significant reduction in the actual amount of goods and services purchased by consumers.

Similarly, if retail ex auto spending per household came in at -1.9% year-over-year, and inflation was at 5%, then the real spending would have decreased by about 6.9% when adjusted for inflation.

These adjustments provide a clearer picture of consumer behavior and economic health by accounting for the changing value of money over time. It’s a crucial factor for economists and policymakers when analyzing economic trends and making decisions.

Views: 118