It’s never a good sign when an old dormant volcano starts showing numerous new cracks.

A huge crack just busted open in the US financial world. It reeks of the sulpherous fumes of the old financial crisis:

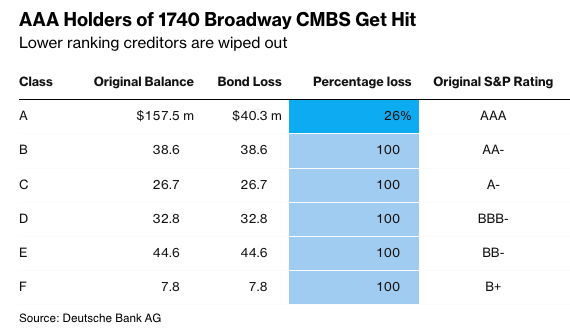

First Time Since GFC: Holders Of AAA ‘CRE-Backed’ Debt Hit With Losses

Uh, oh. That’s not good. Remember all the old Great-Recession talk about tranches and how the top tranche of mortgage-backed securities was suppose to merit a AAA rating because all the lower tranches had to be destroyed before any damage happened to the top? Then lower tranches suddenly got wiped out everywhere and top-rated tranches, held by major banks that only invest in secure stuff, went down in droves? Well, look what finally just happened for the first time since the Great Financial Crisis:

That’s not good!

Investors holding a tranche of top-rated debt backed by commercial real estate have suffered losses for the first time since the housing meltdown collapsed the economy 16 years ago. This alarming development signals a worsening multi-year downturn in the CRE space, fueled by the Federal Reserve’s interest rate hiking cycle and plummeting office tower values nationwide.

Everyone holding the lower tranches of this “derivative” instrument (remember that old familiar and stinking term?) got completely wiped out, and the holders of the top AAA tier now get 74 cents on the dollar.

“Now that we’ve seen the first commercial mortgage-backed securities get hit, other AAA bonds are bound to see losses,” Lea Overby, a CMBS strategist at Barclays, wrote in a note, adding, “These losses may be a sign that the commercial real estate market is starting to hit rock bottom.”

I’ve predicted that crash as a certainty under Fed tightening for several years here and on my former site, The Great Recession Blog. It’s simple cause-and-effect: As the Fed tightens, I’ve pointed out in my articles for paying subscribers (now called Deeper Dives), the Fed would not be able to avoid crashing the the totally dependent Everything Bubble that it inflated with all of its financial loosening. When you take the hot air out that inflated the balloon, the balloon has to deflate and fall out of the sky. Bubbles never stay inflation when you suck the cheap money back out of them. Part of that, I’ve warned, would include a huge real-estate implosion in mortgage-backed securities again, except that this time it would happen first and foremost in commercial real-estate, rather than housing.

Getting back to my volcano metaphor, it was all a matter of waiting long enough for Fed tightening to keep upping the pressure beneath the surface. This may well be the first major crack in the CRE arena that I’ve been warning about here for all readers.

“With about $700 billion of non-agency CMBS outstanding and another $3 trillion of commercial mortgages on bank balance sheets, even a modest uptick in losses could weigh on the financial system for years,” Bloomberg journos said. They were quick to note, “To be clear, no one is predicting a repeat of 2008, when bad mortgages, mostly residential, nearly brought down the financial system.”

Well, except that you kinda just did, but you’re afraid of sounding like Chicken Little to your colleagues.

On Wednesday, the latest FOMC minutes showed a “deterioration in conditions in domestic CRE markets or a sharp tightening in financial conditions.”

Crack!

A little tip like that from the Fed, which sounds almost sanguine, can have volumes hidden behind it. That is how the Great Recession came about. First nothing, then one bank, then a second, then many all over the place.

As a reminder, I showed last year how this is the first year that would see major roll-overs of commercial real-estate bonds and suggested that would be when we see the trouble begin.

Mortgage Bankers Association notes that $929 billion—20% of the $4.7 trillion total—in commercial mortgages held by lenders and investors are coming due this year. The figure is up 28% from 2023 and inflated by amendments and extensions from prior years. Nevertheless, borrowers are now having to bite the bullet and pay up or default.

US debt explosion

This one is a super volcano, long building up pressure but slow to blow. The US Treasury, however, is showing some cracks in the caldera and cluster mini quakes:

Rising US debt burden spooks some bond investors

Investors are bracing for a flood of U.S. government debt issuance that over time could dwarf an expected rally in bonds, as they see no end in sight for large fiscal deficits ahead of this year’s presidential election.

While bond markets so far this year have been driven mostly by bets on how deeply the Federal Reserve will be able to cut interest rates, fiscal concerns are expected to become more prominent as the Nov. 5 election nears. Analysts and investors say a reduction in deficit spending does not appear to be a policy priority for President Joe Biden and Republican challenger Donald Trump. Both candidates’ teams dispute this notion.

Some investors have already started to allocate funds in ways that would avoid losses if Treasury yields, which move inversely to prices, start surging because of supply and demand imbalances. Others are concerned that uncertainty over just how much debt will be needed for deficit spending could end up destabilizing the $27 trillion Treasury market, the bedrock of the global financial system.

Those are just hairline fractures in the bedrock of the caldera for now, but the fact that they are showing up and breathing out sulfurous gases, speaks of troubles beneath that are likely to emerge at the surface. What is keeping rates down right now, according to the article, is the suppression of concern due to the hopes of imminent rate cuts by the Fed—a bizarre bias at a time when inflation has gone back to rising for months on end. Those always-imminent cuts are continually getting pushed further and further away because they are a mirage in the first place, having retreated from a first cut anticipated in March, all the way to November now.

“If we take a step back away from the Fed and away from the next six months where we could still get substantial rate cuts, supply numbers are not healthy,” said Ella Hoxha, head of fixed income at Newton Investment Management, who favors short-term maturities in Treasuries.

And, of course, those rate cut hopes that keep suppressing the government’s cost of credit are exactly what Powell has been enticing with his own soft words for months now, undermining his own fight against inflation. That’s because, while trying to look like he’s fighting inflation hard, he has to be wary of this:

Benchmark 10-year Treasury yields, now at around 4.4%, could go up to 8%-10% over the next several years, she said. “Longer term, it’s not sustainable.”

Powell got nervous as soon as the bond market started doing the Fed’s heavy lifting for it and priced Treasuries up to 5% yields.

So-called bond vigilantes – investors who punish profligate governments by selling their bonds – made a comeback last year, pushing 10-year Treasury yields to 5% for the first time in 16 years….

Powell kicked that in the teeth by talking the tightening back down. Yellen helped:

Concerns over growing U.S. debt issuance subsided after the Treasury Department in November slowed down the pace of increases….

Larger auctions for long-dated debt are expected already next year, analysts have said.

The fact that the US is rapidly peeling off foreign investors isn’t going to help close those cracks either:

“An environment where you have a reduced buyer base and more supply definitely makes me think that over time you will see more term premium,” he said, referring to a measure of the extra compensation investors demand for lending to the government over the long term.

Ah, but listen to the government pros try to sound like they’re actually doing something about it:

“After the prior administration increased the debt by a record $8 trillion and didn’t sign a single law to reduce the deficit, President Biden has signed $1 trillion of deficit reduction into law and has a plan to lower the deficit by $3 trillion more,” White House spokesperson Jeremy Edwards said….

Meanwhile, the U.S. Treasury 10-year term premium briefly moved back into positive territory.

Ever notice how ALL deficit reduction by all administrations since Reagan is always scheduled to actually happen years down the road? Then, for some reason, the people who actually hold the reins of power in those years don’t do as the people of the past assured us all they would do, so the promised reductions never occur. Instead, the next congress, for some reason, thinks it has the right an ability (because it does, even if its a bad idea) to ignore old promised deficit reductions and simply approve bigger ones!

Notice, also, how Biden’s spokesperson conveniently ignored the trillions in deficits that Biden has already amassed and just mentioned the reductions he has promised to accomplish when he is no longer around to make them happen.

Housing data just cracked up

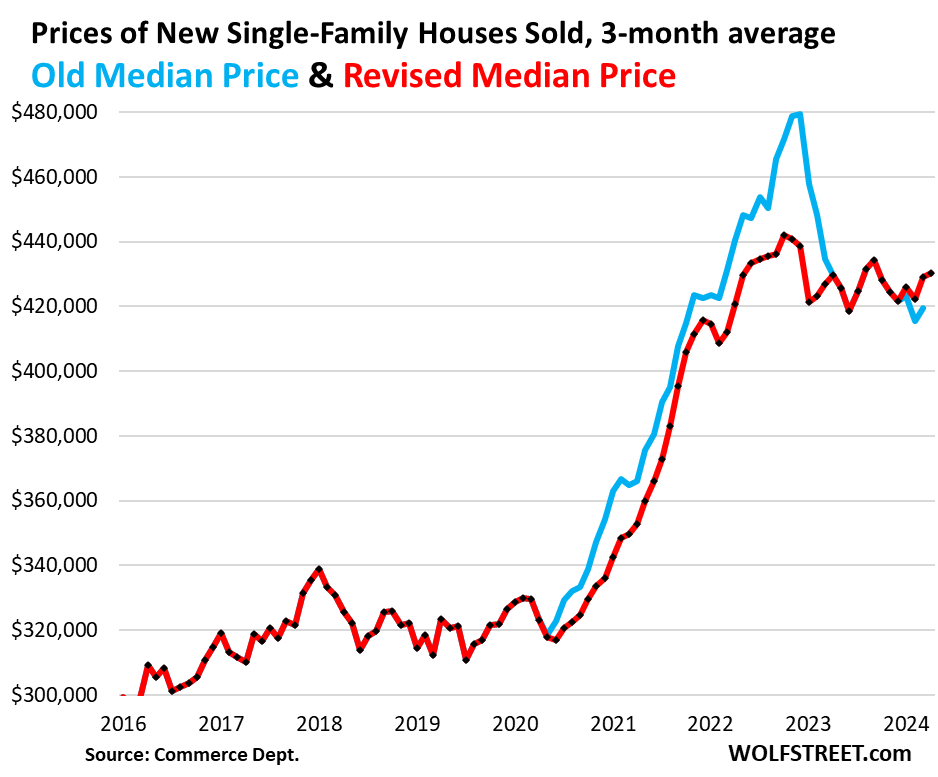

Speaking of economic cracks, here’s a newly discovered fault line in critical economic data. The Census Bureau and the Department of Housing and Urban Development (HUD) got their heads together and just discovered that they grossly erred in how they reported housing inflation during the Covidcrisis. (Another revision? Go figure!) It turns out, their data placed median home prices way too high during the crisis. Here is how they have corrected the data:

Assuming they know anything more about true housing prices than the did back then, the new data show that the drop in housing prices in late 2022/2023 (actual deflation) was a lot less of a decline from the price peak than had been reported. It also shows prices now rising again, with the current median price being much closer to the peak median price than the current price was under the old data. (Meaning less headway made against inflation and showing a little more of a current rise.)

Yipes on Yellen!

Speaking of getting heads together, it appears Janet Yellen has finally gotten hers together and has just realized that inflation is hurting the average person. Good job, Janet, but try to keep up, will you? With that, we move from economic cracks to an economic crackpot.

She actually admitted that living costs are a “problem to a lot of people” following “substantial increases” in prices for goods.

In an interview with the Financial Times on Thursday, Yellen acknowledged that housing and everyday goods prices were still very high for many consumers despite solid wage growth in recent months.

So observant about price impact the caviar eaters are!

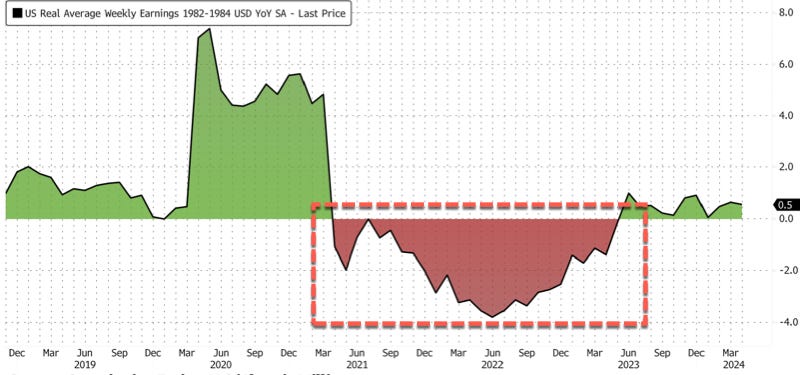

That solid wage growth Yellen speaks of during the Biden administration and her term as Treasury head looks like this when adjusted for inflation:

Adjusted for real inflation based on real data, instead of the kind kept by the Biden Census Bureau, it would, of course, be an even thinner green ribbon at the end because housing prices are a major factor in CPI, and they’ve gone back up in today’s new data more than in the old stuff Yellen was going by, leaving more to subtract out of weekly wages when computing real gains or losses.

Yellen continued, “The cost of living is a problem to a lot of people,” adding, “So I think this is a concern that people legitimately have.”

Thank you, Janet, for giving it legitimacy for us. We recognize that understanding the impact of inflation on those who “shouldn’t be complaining about the economy,” as the Biden admin recently complained, is a step up for the caviar crowd. It’s a good thing we have a Treasurer now capable of explaining the basic concepts.

Zimbabwe is smarter now than the US crackpots

With Janet managing the United States’ actual money printing (The Bureau of Engraving and Printing being a department of the US Treasury) and her pal Powell managing the nation’s digital creation of money, I wonder if we will be able to do as well as Zimbabwe now is.

According to today’s news, Zimbabwe, the king of fiat inflation, now has actual gold-backed currency, and the International Monetary Fund has just praised the new currency as “a pivotal policy development.” (Maybe the US should try that since it is apparently cutting-edge thinking.) Of course, gold-backed is only as good as the nation’s eventual willingness (and ability in inventory) during a run on its money to turn over the gold it has promised, but apparently the people of Zimbabwe have finally found something they trust more than all their former failed money because its value has held stable and is actually rising up toward the dollar.

The central bank’s strategy this time hinges on a commitment to only issue ZiG notes backed by reserves, coupled with a firm promise to avoid financing government expenditure through currency printing—an approach that had previously undermined the local currency and necessitated a shift towards transacting in US dollars.

There’s a novel concept. If they can live up to that, it sounds like the former crackpots of currency have gotten some cents and are gaining ground on the establishment crackpots here in the US, given that Papa Powell seems to be getting soft on inflation in order to help Yamma Yellen with financing government expenditures because Treasury interest was getting to be more than the federales could afford.

When the Fed raises rates, as it now clearly needs to do another notch to send inflation back down, that only works if it drives up Treasury interest rates because those impact almost all interest rates. That’s partially why inflation was falling when Treasuries were hovering around 5% but hasn’t fallen since petrified Powell jawboned interest down while holding actual policy steady.

On Thursday, the ZiG reached its highest level against the US dollar, trading at 13.21 per dollar—a 2.6% increase from its initial trading value on April 8. This consistent performance underscores the central bank’s strategy to foster market-driven valuation.

It’s amazing what a switch to real money backed by something can do. Zimbabwe finally figured out that printing money to fund your government ends in disaster. Janet and Jerome, on the other hand, are just discovering the possibilities together of helping the government out with its debt. So much for Yellen’s ostensible concern about how inflation is impacting the people who can barely afford eggs from chickens, much less from fancy fish.

Views: 160