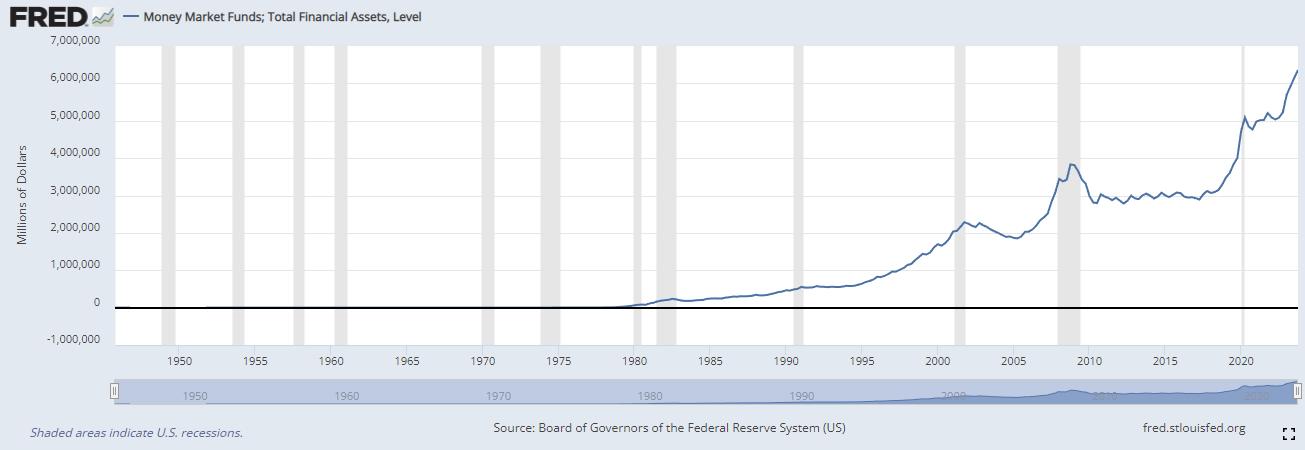

A record $6.4 Trillion in money market funds and another $2.870 Trillion in Certificates of Deposit (CD) balances reported…

Source: fred.stlouisfed.org/series/MMMFFAQ027S

Certificate of deposit balances at US banks jumped by more than a trillion in 2023, with concentration reaching its highest level in about 10 years amid growing rates in the market.

In aggregate, certificate of deposit (CD) balances at US banks climbed to $2.870 trillion in the fourth quarter of 2023, up 6.9% from the previous quarter and 68.0% year over year, S&P Global Market Intelligence data shows. While the CD balances continued to rise, the rate of growth has slowed since increasing 24.8% in the first quarter of 2023.

The CD concentration rose to 15.3% at the end of 2023, the highest level since the second quarter of 2013, with total deposits increasing 1.4% during the period after declining for six consecutive quarters.

The CD concentration dropped to 6.3% at the end of the first quarter of 2022 as deposits from the pandemic stimulus pushed the noninterest-bearing deposits concentration to 28.9% at the end of 2021 when the rates were low. The Federal Reserve’s rapid increase in rates to curb inflation helped bring the noninterest-bearing deposits concentration down to 21.8% as of Dec. 31, 2023, the lowest in the last decade, as customers began moving their money more aggressively into higher interest paying accounts.

h/t SnortingElk

Views: 339