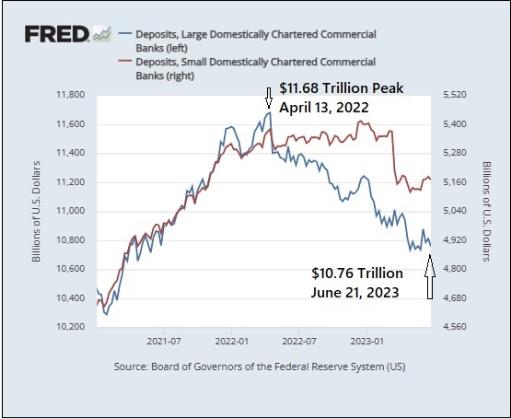

Large Banks Experience Record $921B Deposit Drain in 40 Years, Outpacing Small Banks’ Decline

Data from the Federal Reserve reveals that large banks in the U.S. are experiencing the fastest decline in deposits in four decades. Since April 2022, deposits at the 25 largest commercial banks have plummeted by $921 billion, a decline of 7.88 percent. In contrast, small banks saw a decline of 4.5 percent, shedding only $243.37 billion. This data puts into perspective the misleading narrative that depositors were flocking to larger banks during the banking crisis earlier this year. The decline in deposits raises concerns about the overall health of the banking industry.

Views: 50