by DesmondMilesDant

Caption: Fed paper

–

Caption: Link to article :

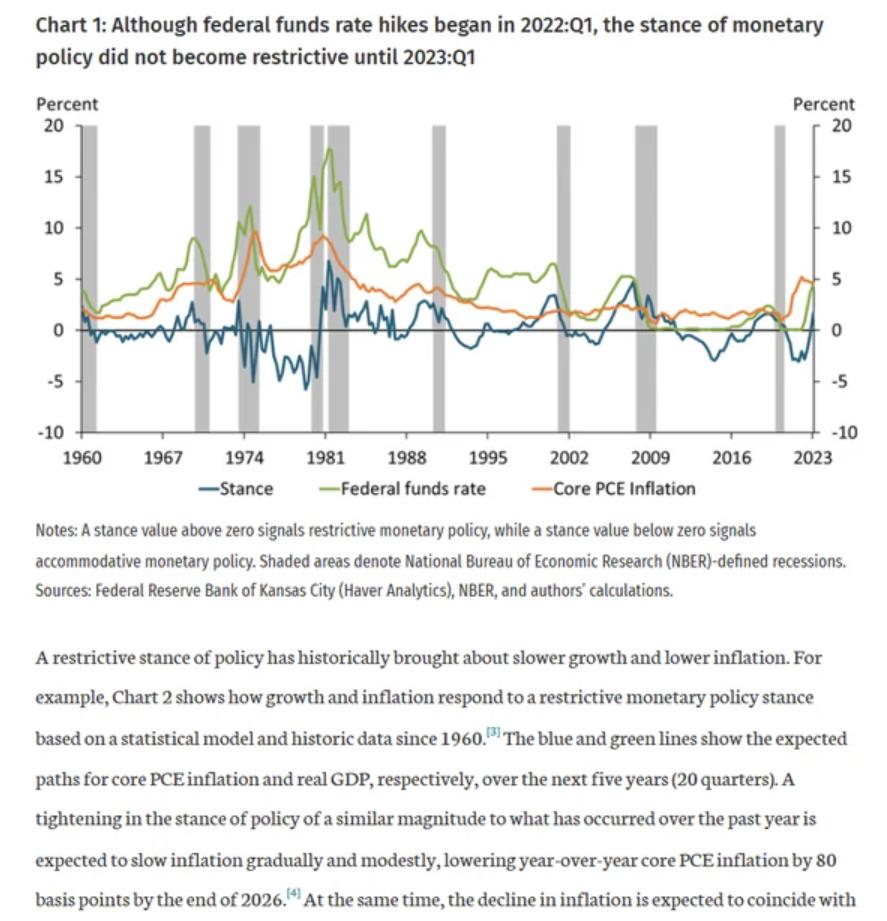

The Fed’s decision to keep rates low for longer than markets are currently pricing in could have major implications for stocks. If inflation does not begin to pick up until 2026, as the new paper suggests, it could mean that the U.S. economy is in for a period of slower growth and lower stock prices.

Views: 108