by Junior_Wrangler8341

Source: @SuburbanDrone

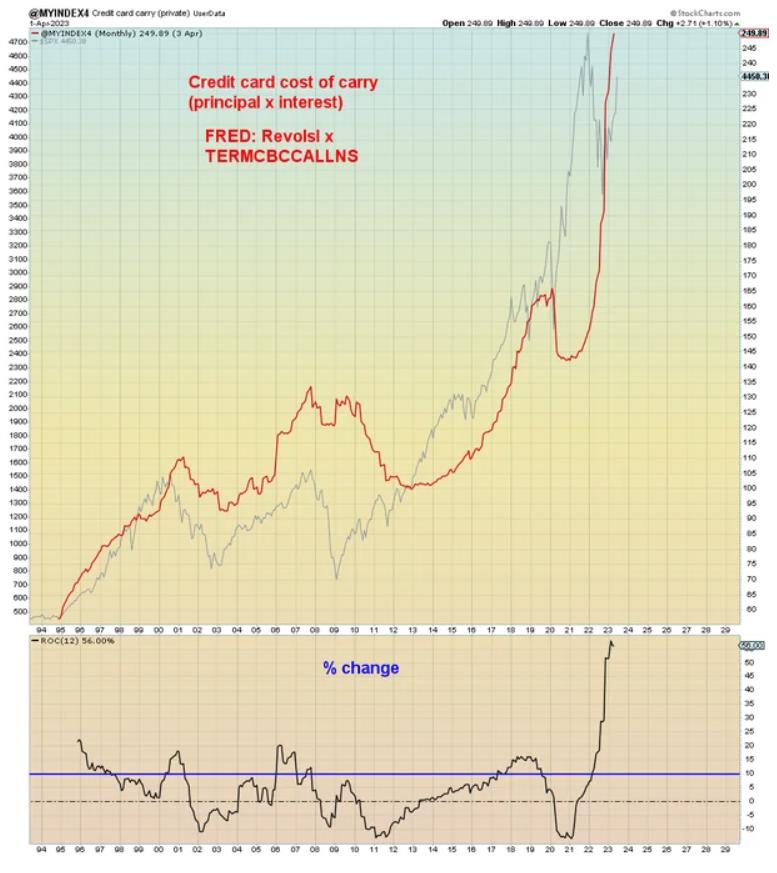

$1.7 Trillion in Americans’ Savings Burned Since 2020 As Credit Card Debt Hits All-Time High

Americans have squandered $1.76 trillion in savings since 2020, leaving a meager $533 billion. Personal savings are at a dismal 4.6% of income, well below the 8.9% average. A staggering $986 billion credit card debt adds to their vulnerability. Wells Fargo predicts a looming recession as the labor market weakens. The financial future looks bleak for American households.

Meanwhile in UK

Sky is the limit pic.twitter.com/c0cCwKlMgk

— 🅰🅻🅴🆂🆂🅸🅾 (@AlessioUrban) July 5, 2023

You know it's bad when …

I have never seen that on a restaurant bill.

— Wall Street Silver (@WallStreetSilv) July 5, 2023

New month, new record 😳

$1,000 monthly payments aren't going anywhere.

Nearly 1 in 5 consumers who financed a new vehicle in Q2 2023 committed to a monthly payment of $1,000 or more — an all-time high.

Absolutely wild. (via Edmunds) pic.twitter.com/C6Um4vowIa

— CarDealershipGuy (@GuyDealership) July 4, 2023

US 10-yr rates are on the cusp of breaking out and revisiting 4.25%, IMO pic.twitter.com/NoUfG2d5LT

— Michael J. Kramer (@MichaelMOTTCM) July 5, 2023

⚠️ Canadian factory activity slows further in June

"Reports of subdued market demand, both at home and abroad, were widespread, with clients reportedly hanging back from committing to new business given the uncertain economic outlook,"

Full Story → t.co/z2eKC4SnE3

🇨🇦… pic.twitter.com/wUHxBhV6tv

— PiQ (@PriapusIQ) July 4, 2023

SOFR rates already rising exponentially.

Banks lose a lot of their ability to set LIBOR rates(in simplest terms banks get together and set rates that are extremely favorable to them to borrow basically cheap money. Now in comes SOFR, banks are no longer agile to set their cheap favorable rates because they are given the rate by an outside committee

For the longest time they haven’t wanted to swap off LIBOR but it’s hot af for us because shorting activity is becoming more and more expensive and so are any swaps/margin calls due to risk calculations.

Fed Economists Warn Large Economic Shockwave, With ‘High Share’ of Companies in Financial Distress

The Federal Reserve has issued a fresh warning about the state of the US economy. According to a research note by two Federal Reserve economists, the number of non-financial firms facing financial distress has reached historic levels. The economists highlight that the recent tightening of US monetary policy, coupled with the high percentage of distressed firms, could have significant effects on investment, employment, and overall economic activity. The economists estimate that the impact may be particularly noticeable in 2023 and 2024. The Fed also cautions that its own policies may push distressed companies closer to default, potentially leading to a wave of unforeseen layoffs. The analysis suggests that the effects on employment could be even more significant than estimated, as bankruptcies and associated layoffs may not be fully captured by the data.

Four US Banking Giants Now Have $205,000,000,000 in Unrealized Losses Sitting on Balance Sheets

The four largest banks in the US, Bank of America, Wells Fargo, JPMorgan Chase, and Citigroup, are facing a total of $205 billion in unrealized losses on their balance sheets. These losses are a result of bad bets in the bond market. Bank of America is in the worst position, with $100 billion in unrealized losses. Wells Fargo and JPMorgan Chase each have $40 billion in losses, while Citigroup has $25 billion. The failure of Silicon Valley Bank in March serves as a cautionary example of the risks associated with unrealized losses. Despite these losses, the Federal Reserve claims that Bank of America and other major banks performed well in a recent stress test. However, the test also projected total losses of $541 billion in a hypothetical recession.

US Bank Credit Growth Approaches Stall Speed – M2 Money Growth Reverses Course, But Still Negative

The economic approach of the Biden administration involves significant federal spending and monetary stimulus from the Federal Reserve. However, as with any stimulus, its effects can diminish over time. This is evident in the stagnation of US bank credit growth at a mere 0.7% year-over-year, while M2 Money growth sees a slight increase at -4%. These are factual figures. Some critics argue that the Federal Reserve, which operates independently, manipulates interest rates, while President Biden and Congress pursue expansive spending measures, resembling reckless behavior to drive economic growth.

‘The Global Economy Is Due for a Reality Check,’ Warns the Central Banks’ Bank

The global economy faces a bleak future. High inflation and financial risks loom large. Purchasing power has declined, and there’s a risk of a vicious cycle of rising prices. Financial stability is threatened by excessive debt and asset prices, putting weak banks and non-bank institutions at risk. Shaky government finances worsen the situation. Policymakers must prioritize price stability and implement regulations to ensure financial institution safety. Fiscal consolidation and long-term structural reforms are essential. Without change, trust in policymaking and economic prosperity will be lost.

Views: 1,064