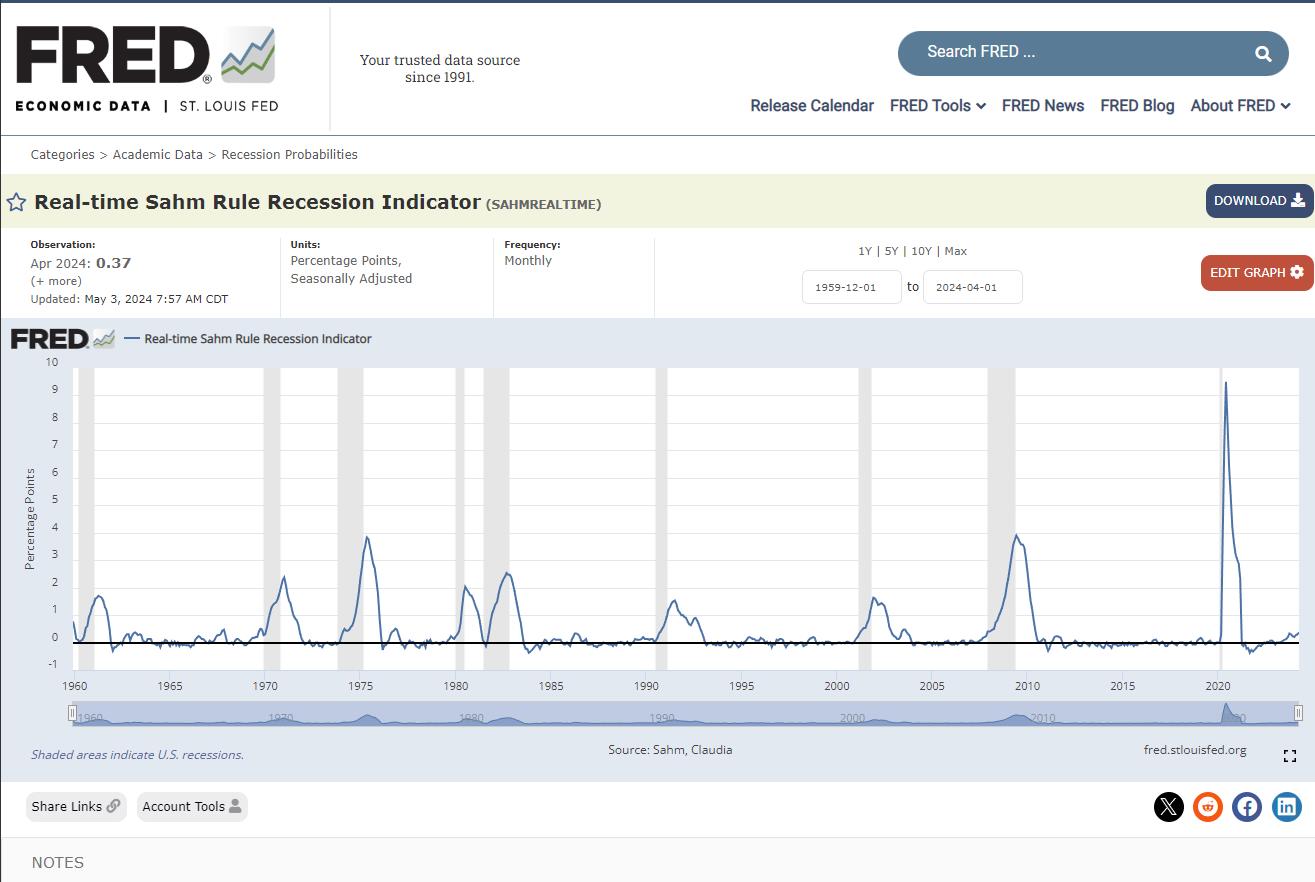

fred.stlouisfed.org/series/SAHMREALTIME

The Sahm rule indicates that we are in recession if it breaches 0.5%. It currently sits at 0.37% which is the highest it has been since 2003 when the economy is not in a recessionary environment.

The rule has been in a clear uptrend since January. Another minor rise in unemployment may tip the indicator over it’s 0.5% threshold which would indicate that the U.S. is actively in recession.

Would like to hear everyone’s thoughts. Interest rates are now starting to bite and it is slowly reflecting in the jobs data. May and June’s jobs data will be crucial to watch.

The latest the calculation of the "Sahm rule" recession indicator shows the three-month average of the (unrevised) unemployment rate is now 0.36 pp above the lowest such reading for the previous 12 months

This is the highest reading of the current cycle pic.twitter.com/QMzt3DEn6G

— Nick Timiraos (@NickTimiraos) May 3, 2024

Views: 370