And Fed Chair Powell is joining them because suddenly nothing is going right for his soft-landing plans!

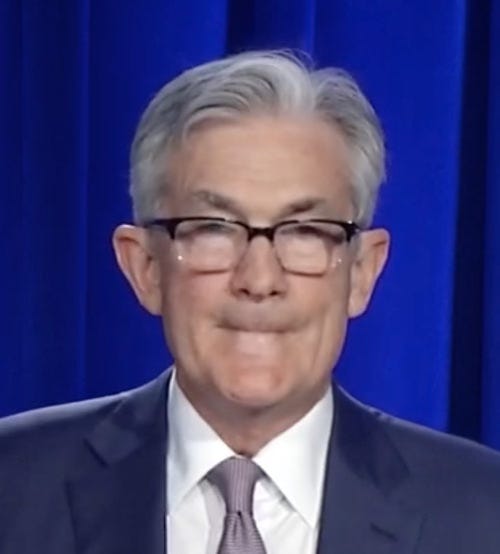

Rising Middle-East tensions are driving up the price of crude oil and driving down the price of stocks and value of bonds. Analysts are saying oil could go to $100/bbl if the conflict between Israel and Iran goes any further. If Israel responds to the recent attack by Iran, some think Iran is likely to fight back with the West in a variation of what it has already done via its proxies. In the worst-case scenario for oil, Iran will block the Strait of Hormuz to tanker traffic, using its proxies to do there as they have already done on the other side of the Arabian Peninsula (or doing that directly, themselves, from Iran). That could raise oil to $130/bbl, which would blow the doors off inflation. Societe Generale puts the risk at $140/bbl if the US gets involved. For now, however, the oil market is just biting its lips … like this:

Well, that’s Fed Chair Jerome Powell, but he is biting his, too, as everything turns against his flight plans for a soft landing at the end of his own war … with inflation.

That’s because the Fed pumped so much money into the economy during the Covid lockdown fiasco that he can’t get the surplus money out quickly enough. As noted yesterday, and caught in the news again today, Powell has clearly pushed rate cuts back once again. In fact, Bank of America is now resetting its calendar for the first cut to March of next year (going for a different March than the one most analysts originally thought they would get. Oh well, only off by a year.) A number of banks are going, at least, as far as wondering if the Fed will cut at all this year, while the best-case scenarios for rate cuts are rapidly sliding from June to into September; but that, in my opinion, is a dream that comes from breathing too many gas fumes off that oil, given just the probable oil risks alone, let alone the numerous other factors that have been lifting inflation higher already.

As a result, stock prices are continuing to drop; the S&P is on pace for its third straight week of decline with all of the last four sessions from this week having gone underwater; momentum in stocks has fallen off precipitously; and the stock market’s volatility gauge is rapidly rising from its long slumber as are all other volatility gauges:

Implied volatility measures for stocks, bonds and currencies have all hit notable highs over the past week…. Wall Street’s “fear gauge” has surged to its highest level since Halloween. The Cboe Volatility Index VIX, known as Wall Street’s “fear gauge,” traded as high as 19.56 on Tuesday, its highest intraday level since Oct. 31…. The ICE BofAML MOVE Index, a measure of implied volatility of Treasurys, had reached a two-year low as recently as March 27. But the index has risen more than 40% since then to close at 121.15 on Monday…. The dollar’s advance has sent the JPMorgan G-7 Volatility Index, which measures the cost of hedging swings in major currency pairs, to its highest level since January

So, things are getting churned up as markets of all kinds are making up lost time taking back the rewards they errantly gave under their gas-sniffing high that developed after soft-talking Powell enabled them to believe in a Fed-fantasy March rate cut this year. Some of the ever-high, petrol-snorting stock optimists who just can’t give it up are now saying the market is just taking a needed breather after all the good news of the first two months of the year. Good luck with that! I’m sure they need a breather, all right, after asphyxiating on the off-gassed aromas of long-dead dinosaurs since last Halloween, probably topped off with a deep breath of burning glue. What they are really getting is a wake up to the reality that has been slowly building around their blind eyes since the middle of last summer.

They just cannot admit they were in denial about inflation and more lately about the ways in which the Middle East is going critical. We still have Gaza. We still have the Houthis stopping traffic on the Red Sea, and now we have direct war between Iran and Israel and the West. Of course, all those concerns from the Middle East plus Ukraine along with the rise of inflation that has been slowly burning its way up the Fed’s backside for months aren’t helped any by the poor earnings reports that have just come in this week at the start of reporting season. These give Powell a new reason to bite his lip because the former head of the FDIC said today that she expects to see some of Powell’s “banks-will-fail” financial institutions start to identify themselves in the details as the tide runs out and we now see what they have been wearing for swimming suits (or not) during the long outflow of commercial real estate.

Investors had pinned their hopes for stocks on strong earnings growth, strategists said. But even this has come into question, as earnings season has gotten off to a rocky start.

Having to hold longer through current interest rates, even it the Fed doesn’t take the step it loathes of raising rates a notch, as I’ve said I think it will likely have to do, still raises the likelihood that something(s) big and bad will snap before the Fed is able to cut. (Of course, there I am, being out of step with everyone again, thinking what nearly everyone else thinks is unthinkable.)

An analyst at Moody’s is practically begging the Fed to cave in now on the basis (get this!) that they have achieved their employment mandate! How on earth does that thinking work? The Fed has achieved its mandate of a strong, tight labor market; therefore, it should start dropping interest rates immediately in order to stimulate the economy and tightening labor up even more? The guy works for Moody’s, and he can’t even see how knotted his logic is. If the Fed has achieved its labor mandate, why would it switch to stimulus policy on that basis? The truth is the guy is just that afraid the Fed is breaking bad. So, he’s grasping for reasons the Fed should back off.

Fact is, things are not looking like a soft landing for Powell anymore. I’m guessing he’s flying a Boeing 787 Dreamliner, and the fuselage is pulling apart in mid-air.

Jim Reid, a research strategist at Deutsche Bank, wrote in a note on Tuesday that he believes it will be “incredibly difficult” to achieve a soft landing for the US economy because it’s moved from the largest jump in the money supply since the World War II to the largest contraction since 1930.

Extremely rapid, long dives from high altitude don’t easily make for soft landings; but I’m out of touch with everyone on that dream, too. Almost all articles this year have been talking about the likelihood of a soft landing. My problem? I just don’t fly Dreamliners. Don’t trust ‘em anymore. In the meantime, welcome to the new “transitory” where it seems the one thing most transitory about the Fed’s home-brewed inflation was its decline into a soft landing. It’s starting to look a lot more like we’re flying into a cyclonic updraft. So, turbulence and chaos ahead as Powell tries to bring the dream home.