On Saturday, Zero Hedge published an article by Jeffrey Tucker that laid out just how far off the media has been in all of its soothing spin that attempts to cool your perception of inflation:

For months and even years, the mainstream news has sought to spin terrible inflation news. It’s not so bad, it’s just transitional, it’s getting better, it’s not really a problem, and all your gloom about the value of the dollar is in your head. Truly, in the past fortnight, we have been inundated with articles suggesting that the public is dumb as rocks for thinking that inflation is still a problem.

And then all of a sudden months of denial left them in a place where, BOOM! it was bad overnight. Still, some have tried their best to splash a little quenching water on these flames, but it’s not working anymore. Others threw in the towel on the subterfuge and finally called the heat as it is:

It was so bad that not even the two most influential venues could deny it. The New York Times reported, “Inflation Stronger Than Expected.” The Wall Street Journal reported, “Hot Inflation Report Weakens Case for Fed’s June Rate Cut.” The accompanying editorial is even better: “The Inflation Thief Rises Again.”

Now that some venues, trusted beyond their merits, have stopped parroting the Fed’s new “it’s just a bump in the road” transitory inflation narrative, even the Fed has had to start admitting—in what appears to be getting close to unanimous consent—that it is losing the inflation fight so far this year. Today Papa Powell finally said the fight is not going well, allowing that there has been “a lack of further progress” this year, and he even confirmed this pushes rate cuts further off:

Federal Reserve Chair Jerome Powell said Tuesday that the U.S. economy … has not seen inflation come back to the central bank’s goal, pointing to the further unlikelihood that interest rate cuts are in the offing anytime soon….

Powell said that while inflation continues to make its way lower, it hasn’t moved quickly enough, and the current state of policy should remain intact.

“More recent data shows solid growth and continued strength in the labor market, but also a lack of further progress so far this year on returning to our 2% inflation goal,” the Fed chief said during a panel talk.

Echoing recent statements by central bank officials, Powell indicated the current level of policy likely will stay in place until inflation gets closer to target….

“The recent data have clearly not given us greater confidence, and instead indicate that it’s likely to take longer than expected to achieve that confidence,” he said….

Powell added that until inflation shows more progress, “We can maintain the current level of restriction for as long as needed….”

Treasury yields rose as Powell spoke. The benchmark 2-year note, which is especially sensitive to Fed rate moves, briefly topped 5%, while the benchmark 10-year yield rose 3 basis points. The S&P 500 wavered after Powell’s remarks, briefly turning negative on the day before recovering.

Some of the other central-bank officials who made similar statements today were …

Federal Reserve Vice Chair Philip Jefferson …

who suggested Tuesday that the central bank’s key rate may have to remain at its peak for a while to bring down persistently elevated inflation…. He said his outlook is that inflation will cool even with the Fed’s key rate “held steady at its current level….”

Jefferson’s remarks appeared to open the door to the prospect that the Fed will dial back its forecast, issued at its most recent policy meeting in March, that it would carry out three quarter-point cuts this year to its benchmark rate, which stands at about 5.3%….

In his speech Tuesday, Jefferson said the Fed estimates that its preferred inflation gauge, which will be reported next week, rose in March, to 2.7% from a year earlier, up from 2.5% in February. Such an increase would echo a rise in the more widely followed consumer price index, which rose to 3.5% in March, from 3.2%.

and …

The Fed’s Daly who noted today …

The economy growing at a solid rate, the labor market is still strong, and inflation is above target.. Worst thing to do is act urgently when urgency isn’t necessary.

The spinners’ gotta spin

As, in don’t act to lower rates at all when you don’t need to. The credit rating service, Moody’s, even chimed in today to say that current data clouds the rate-cut picture that markets have in mind. They now see the June cut that the stock market has switched to betting on as unlikely.

U.S. inflation is expected to retreat eventually, but the recent upside surprise in U.S. inflation data could delay monetary policy easing, says Moody’s Investors Service….

The latest robust reading adds to the uncertainty surrounding the timing of U.S. rate cuts. The rating agency said there is unlikely to be be enough evidence of declining inflation before the U.S. Federal Reserve Board’s mid-June meeting to enable it to begin reducing rates.

Let me say it more plainly for them: “The June rate cut is also now as good as long gone.”

Markets had previously targeted mid-year as the likely starting point for U.S. rate cuts.

That was, of course, after they had previously targeted March as their solid position for the starting point of US rate cuts. So, they don’t know much.

“Disinflationary progress has slowed since the start of the year, but it is too early to conclude that it has stalled or reversed,” Moody’s said.

Really? Not according to Papa Powell, who seems to have found several ways of saying it has stalled. (See the many elements from his comments in boldface above.) I don’t know how anyone, especially Moody’s, can say with a straight face that the Fed’s fight hasn’t stalled? Seriously? Look at the FACTS (even as presented by the Fed);

You don’t get much more stalled than that! Good grief, people are thick when it comes to admitting the more-than-obvious truth. And notice the stall goes right back to the first uptick in July where I notified my readers that inflation had just put in a turn that would last (when the media was NOWHERE near saying such a thing). From that date on, I tracked the stall throughout those months, pointing out “still stalling.” Even “rising.” To this day, some like Moody’s, even when they are writing about disinflation slowing down, cannot bring themselves to admit that it isn’t just slowing down. It’ has STOPPED! ZERO PROGRESS FOR NINE MONTHS!

Yet, the picture is actually far worse than a mere stall, as I’ll lay out below, due to how the numbers have been manipulated.

While Moody’s expressed irrational belief that inflation will eventually start to cool again this year, I don’t see it that way any more than I see ANY way of saying, based on the clear facts above (and below), that inflation hasn’t stalled. Oil is certainly rising, which will continue to contribute a lot to inflation’s rise directly and over time a lot more indirectly. Even if Israel doesn’t make a harsh reprisal to Iran’s first-ever direct attack from its own borders into Israel’s (far from a sure bet), Iran may very well respond to whatever Israel does do, as Iran has stated it will do in the news today much more quickly than it last response and using “weapons it has never used before,” which will press Israel to do a lot more. (See headlines below.)

It seems an obviously terrible bet to lay against those odds the claim that inflation will cool! I don’t think either Iran or Israel is going to cool off under the collar anytime soon. So, how is inflation going to cool with Middle East oil on fire and shipping routes closed by terrorists, driven, funded, and weaponized by super-heated Iran? If Iran doesn’t directly attack Israel again out of fear of a much harsher response from Israel and its allies, it will certainly find ways to attack more fiercely through its multiple proxy wars, such has hitting the Red Sea harder to hurt the West and pushing the Hezbollah and Syrian gangs to do more. There is almost zero chance at present of the Middle East cooling down. It’s only a question of how much hotter that hell gets.

Inflation much hotter than reported!

There are a few things I should note from the earlier inflation reports that I was going to highlight in my last Deeper Dive, which I’ll lay out now as they are way to important to let them slide by, even as a Middle-Eastern raging war has taken over the news:

One is that, as hot as inflation was in the last PPI report, it would have been worse if not for massive “seasonal adjustments.” The devil is in details, and I would question how much the details were seasonally adjusted to look a lot less bad than the raw numbers. The details were adjusted far more than they were in other March’s, so why was this March so unseasonably seasonable when compared to other reports from the same season (going off the five years before the pandemic as the days when things were normal)? How convenient for Biden that there was so much unstated justification for adjusting the degrees of inflation down so much more than in other Marches! It seems he’s getting a little extra mileage out of Covid. Maybe the economy has long Covid.

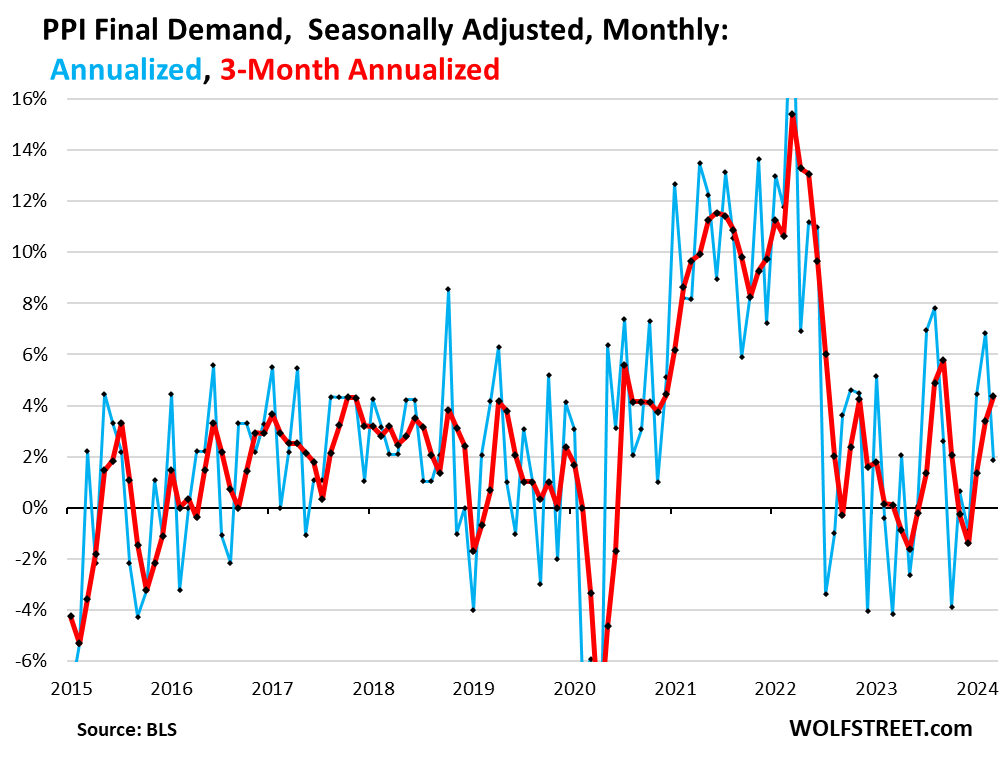

In fact, if you smooth things out over three months, the smoothened numbers look worse than the raw numbers:

And, if you take out the seasonal adjustments, they look worse still:

Second, the ALL of the three-month rates (to smooth out the “bumpiness” Powell originally used as his new “transitory” non-starter) jumped higher, meaning the smoothed January report and the smoothened February report and the smoothened March report, all jumped higher. So, you can’t even smoothen out those bumps when you try by spreading them across three month averages.

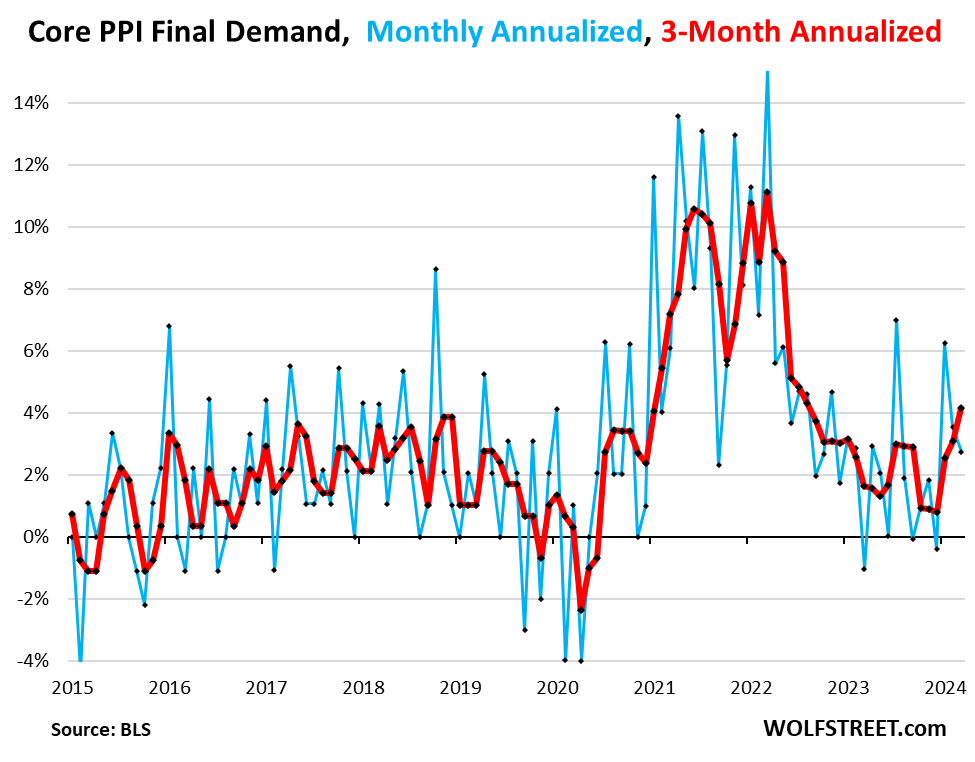

Core CPI, which the Fed prefers, also looked much worse, even with the adjustments:

There is no way to make that pig look good with a little more lipstick because the pig is roasting on a spit in hell! Even seasonal fashion lipstick can’t do the trick because it melts off faster than you can apply it. And both services and goods were way back up over the first three months of this year. UP, not just stalled! So, all elements of inflation are doing worse, and the Middle East heat assures a greater inferno to come. You can believe in Moody’s fact-free, fantasy cooling period if you want to; or you can believe in the obvious reality raging as an inferno all around us. Who has steered you right so far?

So, welcome to Fed hell, prepared in advance for us all!